A new week in the financial markets began quite calmly. After last weekend, as a result of statements by the North Korean and American sides, geopolitical tensions have somewhat subsided. The markets have actually frozen up with their attention now on the important event of the week - the speech of US Federal Reserve's Chairman, J. Yellen at the economic conference in Jackson Hole.

As a result of last week, it should be noted that there have not been actual changes in the markets. The overall trend is still a side trend. The decline in geopolitical tension stopped the growth of demand for defensive assets. Despite this, they did not turn their prices down and still remain at local highs.

The publication last week of the protocol of the Fed's July meeting did not bring anything new. As expected, the Fed concentrated its attention on the beginning of the reduction of the balance sheet and expressed concern about the stabilization of inflation and the lack of its further growth.

The only bright event of the past week was the unexpected strong growth on Friday in the American trading session of crude oil quotes. The trigger for it was the news of a fire at an oil refinery in Texas. Against this backdrop, crude oil prices rose by more than 3.5%. This upward trend was also supported by a message from the service company Baker Hughes about the reduction in the number of operating drilling rigs by 5 pieces to 763. However, despite these locally positive news for oil prices, we do not expect a change in the overall lateral trend in the oil market. Most likely, the "outset" will continue until it becomes clear who is winning: the increase in oil production or its decline in the OPEC + pact.

Today, there is no important economic data, so the markets will closely monitor geopolitical events on the Korean peninsula and prepare for the speech of J. Yellen in Jackson Hole. The market expects a comment on the rates and details of the process of balance sheet reduction.

Forecast of the day:

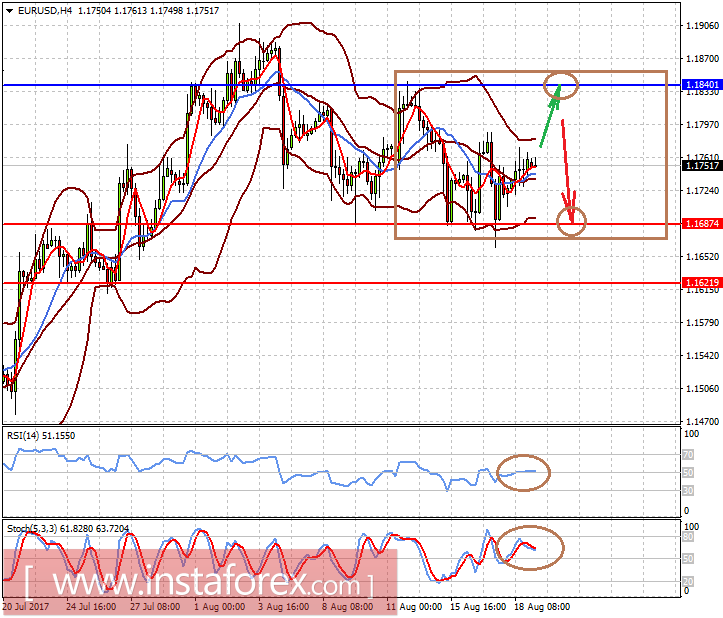

The EURUSD remains in the range of 1.1685-1.1840. It is likely that today, the overall lateral trend will continue. Given this, we believe that the pair should be sold on growth with a local target of 1.1685, as the ECB is unlikely to go to drastic measures in aiming for reducing incentive measures due to inflation stabilization and a strong decline in Germany's GDP growth rate.

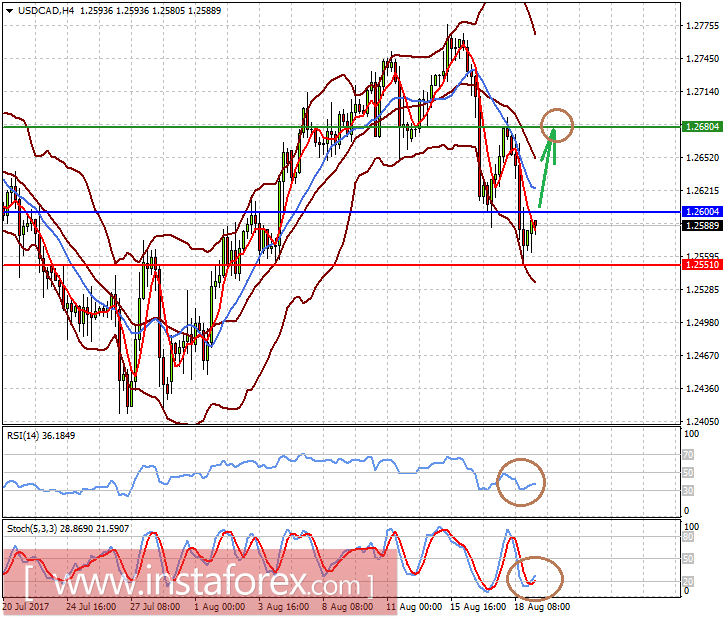

The pair USDCAD has reached a local minimum of 1.2550. If it overcomes the 1.2600 mark on the wave of correction of crude oil prices, there is a probability of its growth to 1.2680.