The European currency rose significantly in tandem with the US dollar on Monday trading, after investors' expectations for a further increase in interest rates in the US declined. Weak data on economic activity in the US also did not benefit the US dollar.

According to the CME Group, federal funds futures yesterday indicated only a 40% chance that the Fed will raise rates this December. While a month ago such a probability was 43%. This is taking place against the backdrop of weak fundamental data for the second quarter of this year, as well as amid political tensions that call into question the ability of the Donald Trump administration to fulfill its promises during the campaign.

Yesterday it also became known that economic activity in the US in July this year fell. According to the statistics agency, the index of national activity of the Fed-Chicago in July 2017 rose to -0.01 from -0.16 in June, while a year ago the index was 0.07. The indicators of production in the manufacturing industry have suffered most.

As for the technical picture of the EURUSD pair, the large growth that was observed yesterday against the backdrop of low trading volume is not yet a reason to talk about the resumption of the upward movement in the European currency, which will be aimed at updating the monthly highs.

Most likely, all the attention of investors will continue to be focused on the speech of Mario Draghi at the symposium of the Fed. It is from his statements that will determine the future direction of the pair in the short term, and all the current speculative movements are unlikely to be important.

A return to support level 1.1790 could increase pressure on the euro, which will lead to the renewal of weekly lows in the area of 1.1740 with the main target of the closing at 1.1680. In case of a return to the highs of today, one can count on buying euros in order to update to 1.1850 and 1.1870.

The Australian dollar ignored data indicating that consumer confidence in Australia continued to decline. According to the report of ANZ-Roy Morgan, for the week from August 14 to August 2, the consumer confidence index fell by 2.2% compared to the previous week, which indicates a decline in consumer sentiment. The sub-index of households' assessment of current conditions fell by 2.1%, the subindex of future conditions fell by 5.3%.

The Canadian dollar continued to strengthen against the US dollar, despite a strong decline in oil prices, as well as weak data on wholesale trade.

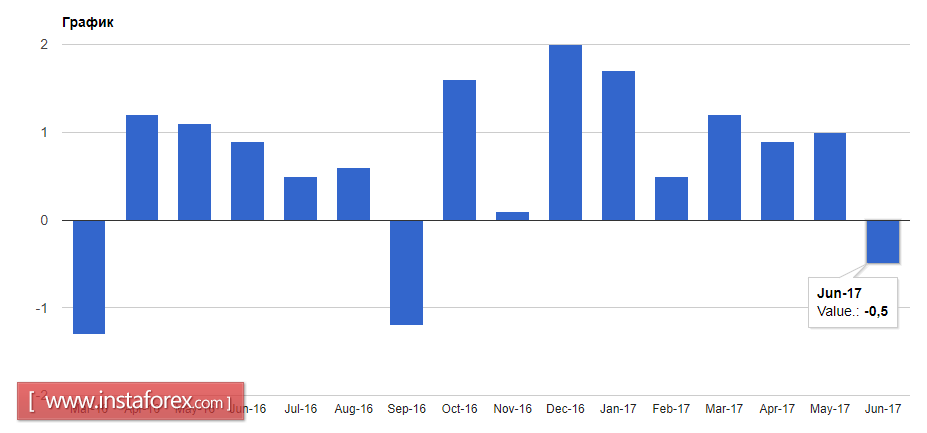

According to the report of the National Bureau of Statistics of Canada, the volume of wholesale trade in June this year decreased by 0.5% compared to the previous month and amounted to 61.4 billion Canadian dollars. Economists had expected sales to fall 0.2%.

The fall was due to a reduction in sales of tobacco products and food.