Released in the first half of the day, data on Germany and the eurozone as a whole disappointed investors. This led to a fall in the euro and US dollar pair. Good data from the UK did not lead to an increase in demand for the British pound. Instead, the pound and US dollar pair declined to new weekly lows.

According to the report of the Institute of Research ZEW, economic sentiment in Germany for the month of August this year significantly deteriorated. However, as noted in the report, the prospects for the largest European economy remain stable.

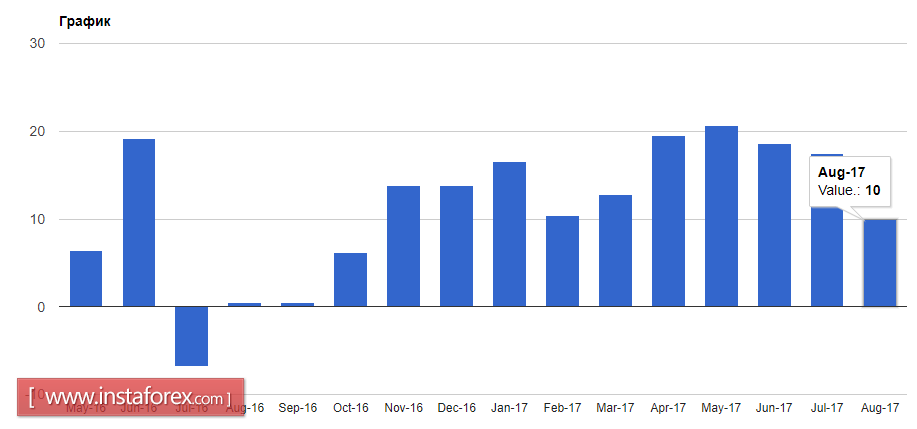

Thus, the ZEW preliminary index of economic expectations for the month of August 2017 dropped to 10 points from 17.5 points in July. The long-term average for this indicator was 23.8 points. Economists predicted a drop to 14 points.

Despite the weak data coming in the second quarter of this year on the German economy, many experts are confident that the good growth rate will continue.

Today, it also became known that the export of equipment from Germany in the first half of this year has grown significantly. This happened due to the high demand from China.

According to the VDMA industrial group, equipment exports increased by 5.9% compared to the same period last year. From China, demand grew by 22.6%. Exports to Russia increased by 21%. The export of equipment from Germany to the US increased by 7.3%. Export to the EU also added 2%.

Weak data on the mood in the business environment of the eurozone pressured the euro. Despite the data being a preliminary reading, it is still quite significant. According to the ZEW Institute report, the sentiment index in the business environment of the eurozone for the month of August this year fell to 29.3 points from 35.6 points in July. Economists had expected the index to fall to 34.2 points only.

As for the technical picture of the EURUSD pair, the potential for both growth and falling of the euro is limited due to tomorrow's speech by ECB President Mario Draghi at the Fed symposium where it is expected that the head of the Central Bank will shed light on the future fate of the bond redemption program.

The British pound ignored the good data on the state budget surplus of Great Britain, which was caused by a strong growth in production, income, and tax collections on wealth.

There was also growth in the borrowing of the public sector. According to a report by the National Bureau of Statistics, the net borrowing of the public sector in the first four months of this year was at 22.8 billion pounds, which is 1.9 billion pounds more than in the same period last year.

As noted in the report, the growth was entirely due to the increase in the cost of servicing the public debt. This was for the period of April to July which amounted to 21.6 billion pounds, which is 4 billion pounds more than the same period last year.