Today, like yesterday, the macroeconomic calendar is almost empty. And although in the usual situation, this is an excellent reason for correction, which is clearly overdue for the dollar. It has strengthened the dollar well against the single European currency and the pound. It is hardly worth waiting for today. The only noteworthy news that comes out today can help strengthen the dollar. It is predicted that the sales of housing in the primary market in the US after a decline of 9.4% will show an increase of 3.3%. Such a significant revival in the housing market contributes to higher inflation and increases the likelihood of an increase in the refinancing rate in December. Before the release of these data, there will be a weak tendency to weaken the dollar.

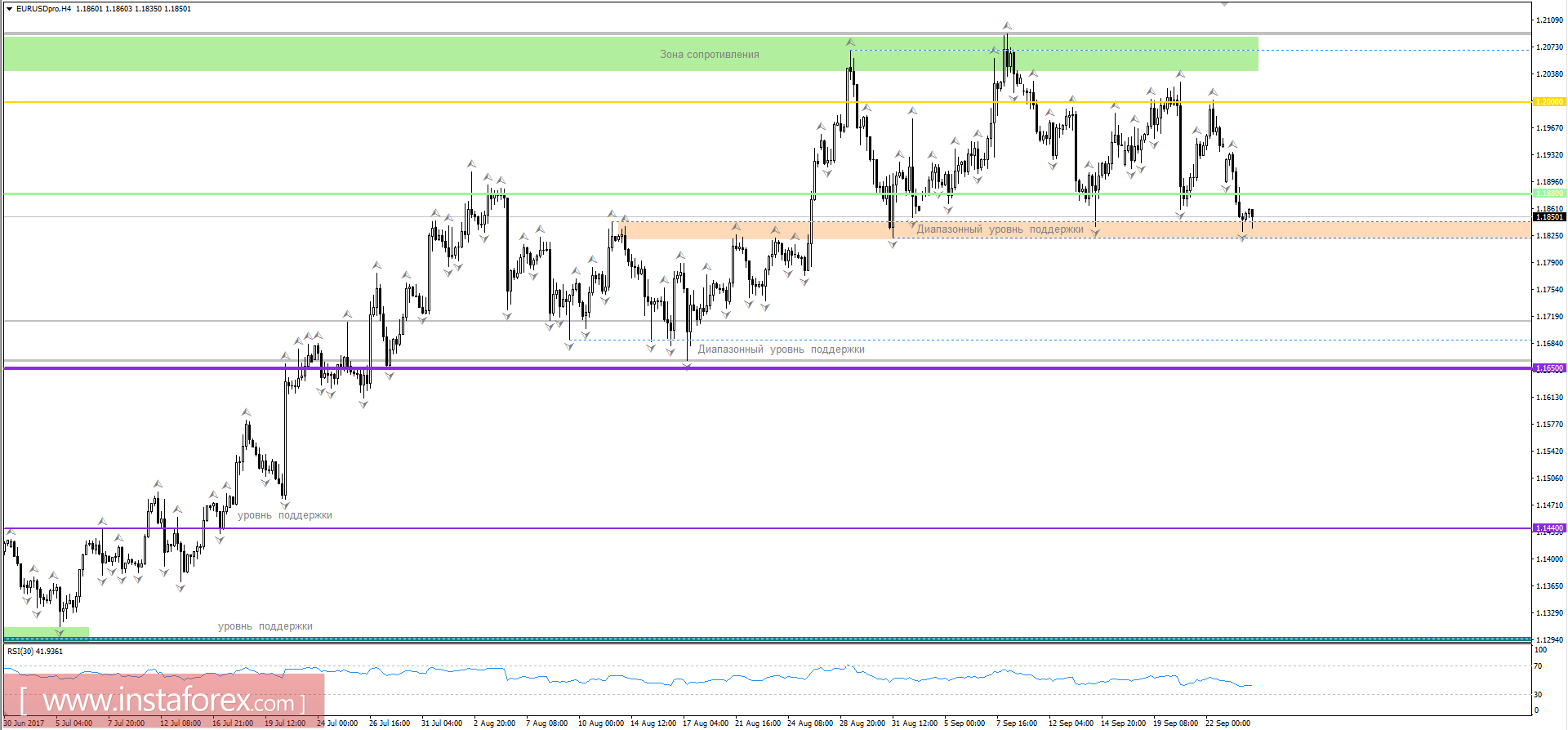

The euro / dollar currency pair entered the range support level of 1.1820 / 1.1845, where it felt a periodic support before it. Probably assume a temporary fluctuation within the level where the bulls will try to return to the market, playing out the values and directing us to 1.1880 / 1.1920.

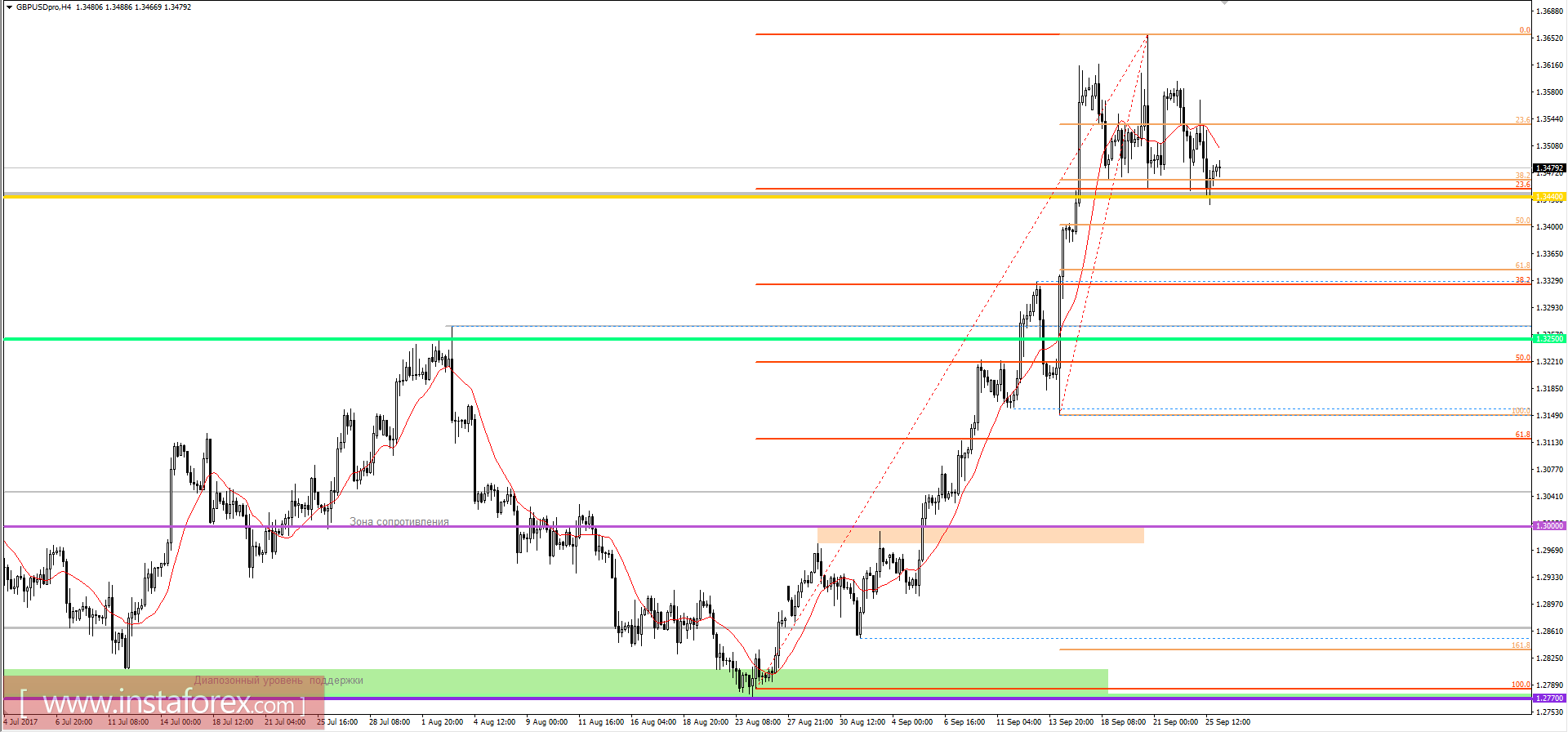

The pound / dollar currency pair once again found support in the support level of 1.3440, where it slowed down and rolled back. Probably assume a temporary fluctuation within 1.3440 / 1.3480, where the bulls will try to work out the level, directing us to 1.3535 / 1.3570.