Dear colleagues.

For the EUR / USD pair, the continued development of the downward structure from September 20 is expected after the breakdown of 1.1740. The upward movement is considered as a correction. For the GBP / USD pair, the level of 1.3380 is the key support for the top. For the USD / CHF pair, the continuation of the upward movement is expected after the breakdown of 0.9725. For the USD / JPY pair, we expect to reach the level of 112.79. For the EUR / JPY pair, the price is still in the zone of initial conditions for the downward cycle. For the GBP / JPY pair, the continuation of the upward movement is expected after the breakdown of 152.84. At the moment, the price is still in correction.

Forecast for September 27:

Analytical review of currency pairs in the scale of H1:

For the EUR / USD pair, the key levels on the scale of H1 are: 1.1866, 1.1829, 1.1801, 1.1762, 1.1742, 1.1700 and 1.1642. Here, the continuation of the movement downwards is expected after passing the price of the noise range of 1.1762 - 1.1742. In this case, the target is 1.1700. Near this level is the consolidation of the price. The potential value for the bottom is the level of 1.1642, upon reaching which we expect a rollback to the top.

Short-term upward movement is possible in the area of 1.1801 - 1.1829. The breakdown of the last value will lead to a deeper movement. Here, the target is 1.1866. Up to this level, we expect the initial conditions for the upward cycle to be formalized.

The main trend is a local downward structure from September 20.

Trading recommendations:

Buy: 1.1801 Take profit: 1.1827

Buy: 1.1832 Take profit: 1.1864

Sell: 1.1740 Take profit: 1.1705

Sell: 1.1768 Take profit: 1.1645

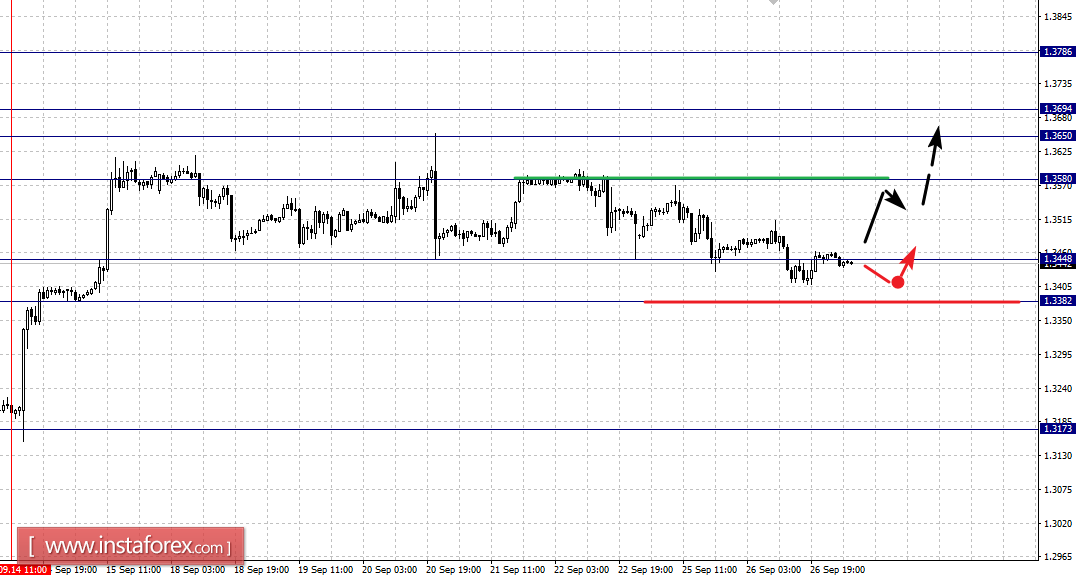

For the GBP / USD pair, the key levels on the scale of H1 are: 1.3786, 1.3694, 1.3650, 1.3580, 1.3448 and 1.3382. Here, we continue to follow the upward cycle of September 14. At the moment, the price is still in correction. Continued upward movement is expected after the breakdown of 1.3580. Here, the first target is 1.3650. Short-term uptrend is possible in the area of 1.3650 - 1.3694. The breakdown of the last value will lead to a movement towards the potential target of 1.3786, upon reaching which we expect a pullback downwards.

Short-term downward movement is possible in the area of 1.3448 - 1.3382. The breakdown of the latter value will lead to the development of a downward structure. In this case, the potential target is 1.3173.

The main trend is the local structure from September 14, the correction stage.

Trading recommendations:

Buy: 1.3580 Take profit: 1.3648

Buy: 1.3650 Take profit: 1.3692

Sell: 1.3445 Take profit: 1.3384

Sell: 1.3380 Take profit: 1.3275

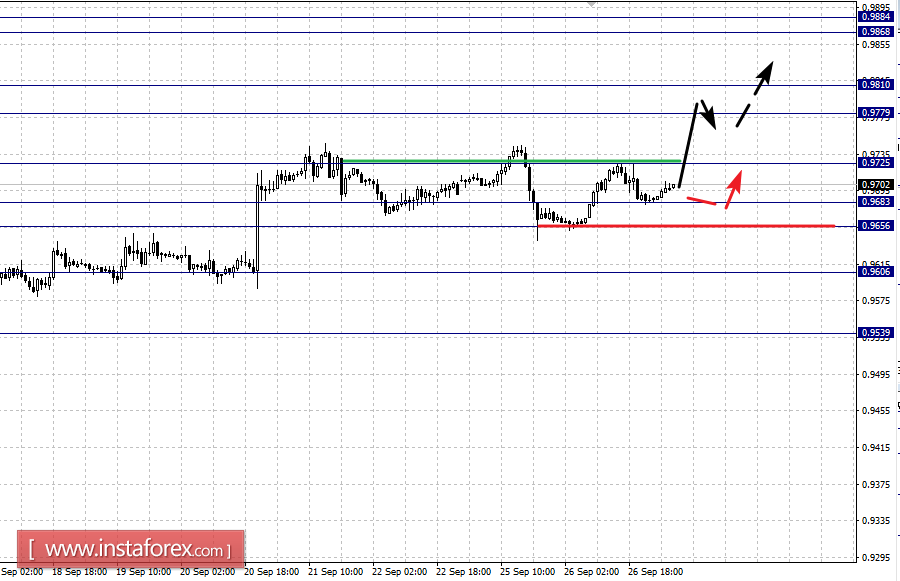

For the USD / CHF pair, the key levels on the scale of H1 are: 0.9868, 0.9810, 0.9779, 0.9725, 0.9683, 0.9656 and 0.9606. Here, we continue to follow the upward structure of September 8. Continued upward movement is expected after the breakdown of 0.9725. Here, the first target is 0.9779. In the area of 0.9779 - 0.9810 is short-term upward movement, as well as consolidation. The potential value for the top is the level of 0.9868, from which we expect a pullback downwards.

The consolidated downside is possible in the range of 0.9683 - 0.9656. The breakdown of the last value will lead to in-depth correction. Here, the target is 0.9606. This level is the key support for the top on the scale of H1. Its breakdown will allow us to count on the movement towards the potential target of 0.9539.

The main trend is the upward structure of September 8.

Trading recommendations:

Buy: 0.9725 Take profit: 0.9778

Buy: 0.9810 Take profit: 0.9865

Sell: 0.9654 Take profit: 0.9608

Sell: 0.9603 Take profit: 0.9540

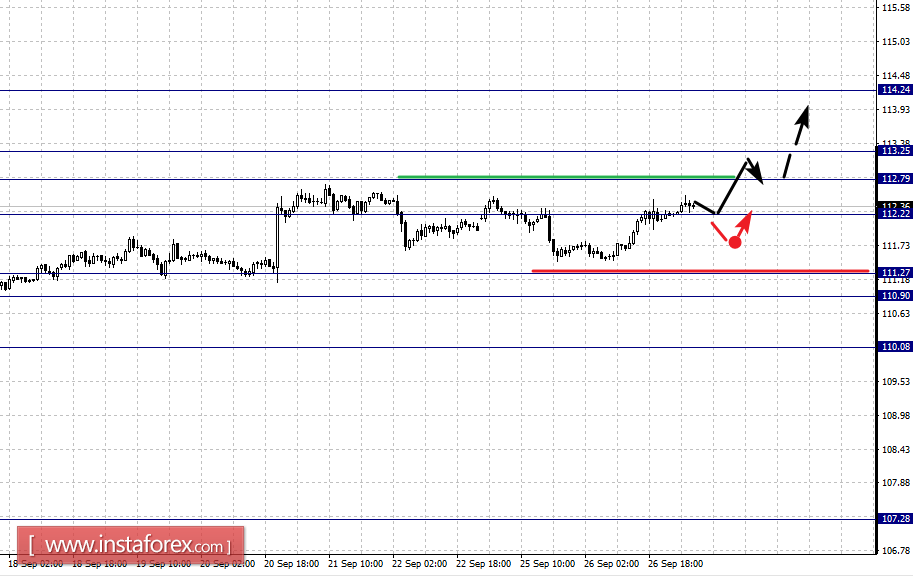

For the USD / JPY pair, the key levels on a scale are: 114.24, 113.25, 112.79, 112.22, 111.27, 110.90, 110.08 and 109.01. Here, we continue to follow the upward structure of September 8. Continued upward movement is expected after the breakdown of 112.22. In this case, the first target is 112.79. Short-term upward movement is possible in the area of 112.79 - 113.25. The breakdown of the last value will allow us to count on the movement towards the potential target of 114.24, from which we expect a pullback downwards.

Short-term downward movement is possible in the area of 111.27 - 110.90, which is the key support for the top. Passing this price will lead to the development of a downward structure. In this case, the target is 110.08.

The main trend is the upward structure of September 8.

Trading recommendations:

Buy: 112.22 Take profit: 112.77

Buy: 113.27 Take profit: 114.20

Sell: 111.25 Take profit: 110.92

Sell: 110.88 Take profit: 110.10

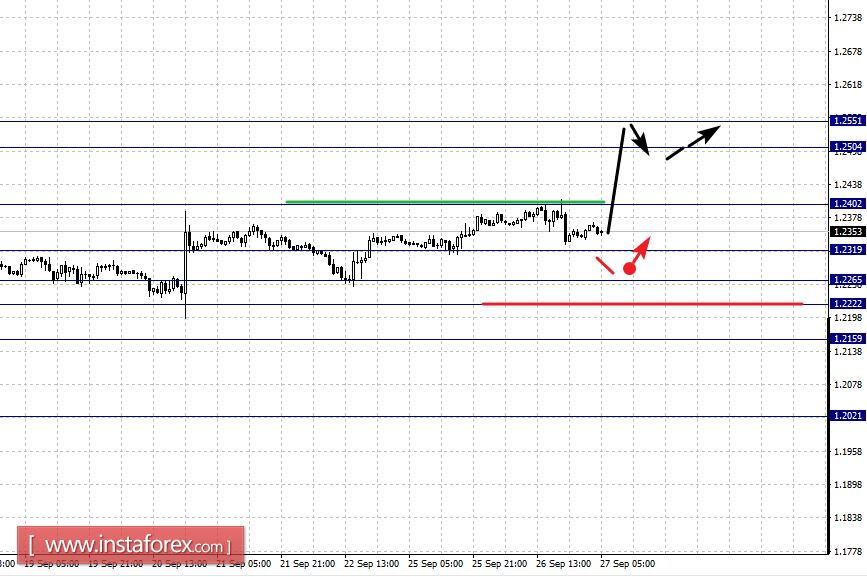

For the CAD / USD pair, the key levels on the H1 scale are: 1.2551, 1.2504, 1.2402, 1.2319, 1.2265, 1.2222, 1.2159 and 1.2021. Here, we follow the development of the upward structure of September 8. Continued upward movement is expected after the breakdown of 1.2402. In this case, the target is 1.2551. Upon reaching this level, we expect consolidation in the area of 1.2504 - 1.2551. Hence, the rollback into correction.

Leaving the correction zone is possible after the breakdown of 1.2319. Here, the target is 1.2265. In the area of 1.2265 - 1.2222 is short-term downward movement. The breakdown of the last value will lead to in-depth correction. Here, the target is 1.2159. This level is the key support for the top. Its breakdown will lead to the development of a downward structure. In this case, the potential target is 1.2021.

The main trend is the upward structure of September 8.

Trading recommendations:

Buy: 1.2406 Take profit: 1.2500

Buy: 1.2506 Take profit: 1.2550

Sell: 1.2319 Take profit: 1.2267

Sell: 1.2220 Take profit: 1.2160

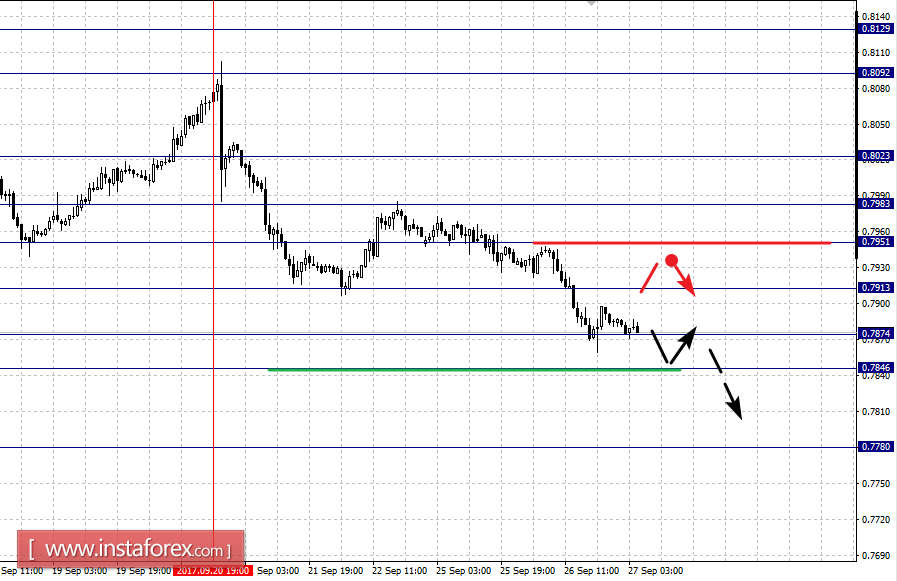

For the AUD / USD pair, the key levels on the scale of H1 are: 0.8023, 0.7983, 0.7951, 0.7913, 0.7874, 0.7846 and 0.7780. Here, we continue to follow the downward structure of September 20. Short-term downward movement is expected in the area of 0.7874 - 0.7846. The potential value for the downward movement is still the level of 0.7780. Movement towards this level is expected after the breakdown of 0.7844.

Correction is possible after the breakdown of 0.7913. Here, the first target is 0.7951. Short-term upward movement is possible in the area of 0.7951 - 0.7980. The breakdown of the last value will lead to the development of an upward structure. Here, the target is 0.8023. Up until this level, we expect the formation of pronounced initial conditions for the top.

The main trend is the downward structure of September 20.

Trading recommendations:

Buy: 0.7914 Take profit: 0.7950

Buy: 0.7953 Take profit: 0.7980

Sell: 0.7872 Take profit: 0.7848

Sell: 0.7844 Take profit: 0.7785

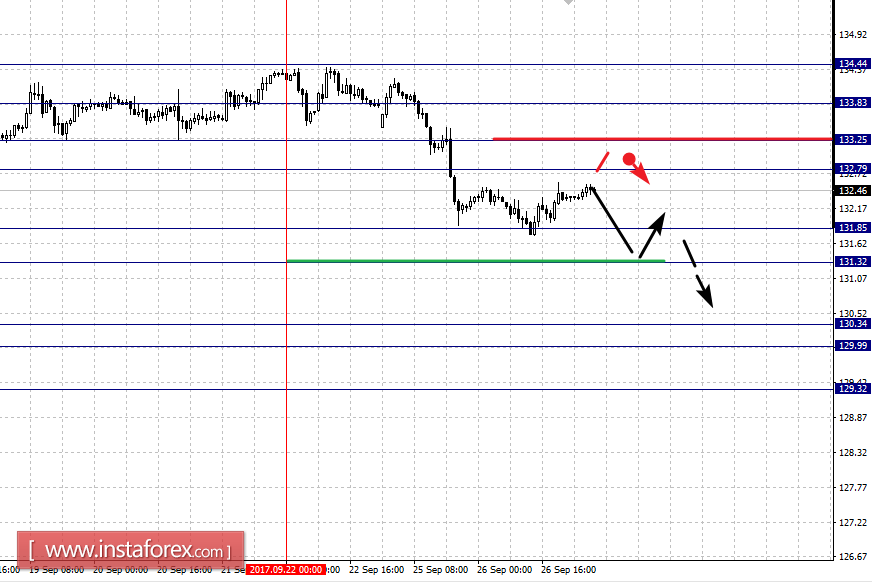

For the EUR / JPY pair, the key levels on the scale of H1 are: 133.83, 133.25, 132.79, 131.85, 131.32, 130.34, 129.99 and 129.32. Here, we continue to monitor the formation of a downward structure from September 22. Continued downward movement is expected after the breakdown of 131.85. Here, the target is 131.32. Near this level is the consolidation of the price. The breakdown at 131.30 should be accompanied by a pronounced downward movement towards 130.34. In the area of 130.34 - 129.99 is consolidation. We consider the potential value for the downward movement to be 129.32, from which we expect a pullback upward.

Short-term upward movement is possible in the area of 132.79 - 133.25. The breakdown of the last value will lead to in-depth correction. Here, the target is 133.83. This level is the key support for the downward structure from September 22.

The main trend is the formation of a downward structure from September 22.

Trading recommendations:

Buy: 132.80 Take profit: 133.20

Buy: 133.27 Take profit: 133.80

Sell: 131.85 Take profit: 131.35

Sell: 131.28 Take profit: 130.40

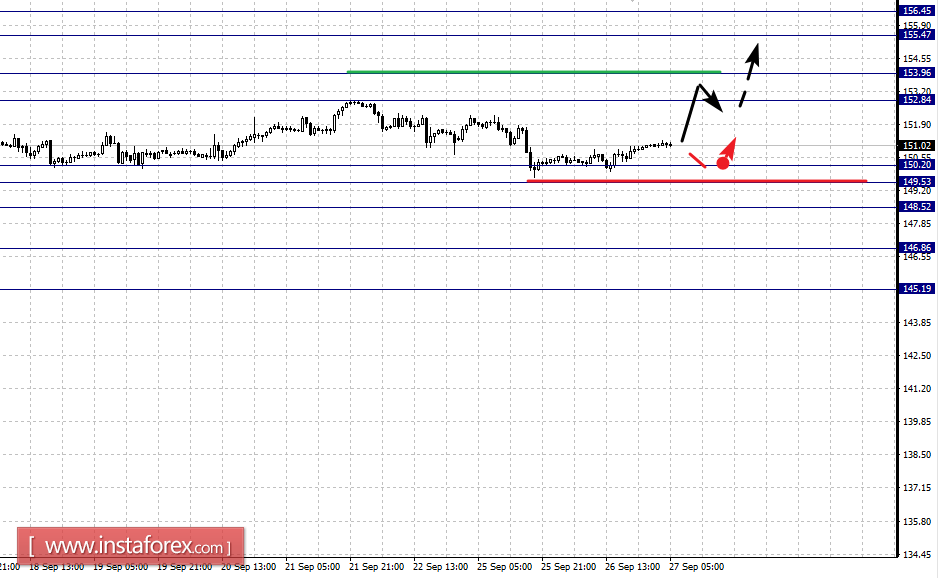

For the GBP / JPY pair, the key levels on the scale of H1 are: 156.45, 155.47, 153.96, 152.84, 150.20, 149.53, 148.52 and 146.86. Here, we continue to follow the upward structure of September 14. At the moment, we expect the movement to reach 152.84, after which we expect consolidation in the area of 152.84 - 153.96. The breakdown at 154.00 should be accompanied by a pronounced movement to the level of 155.47. The potential value for the top is the level 156.45.

Short-term downward movement is possible in the area of 150.20 - 149.53. The breakdown of the last value will lead to in-depth correction. Here, the target is 148.52. This level is the key support for the top. Its breakdown will lead to the development of the downward structure.

The main trend is the local cycle of September 14.

Trading recommendations:

Buy: 152.84 Take profit: 153.92

Buy: 154.00 Take profit: 155.45

Sell: 150.20 Take profit: 149.55

Sell: 149.48 Take profit: 148.60