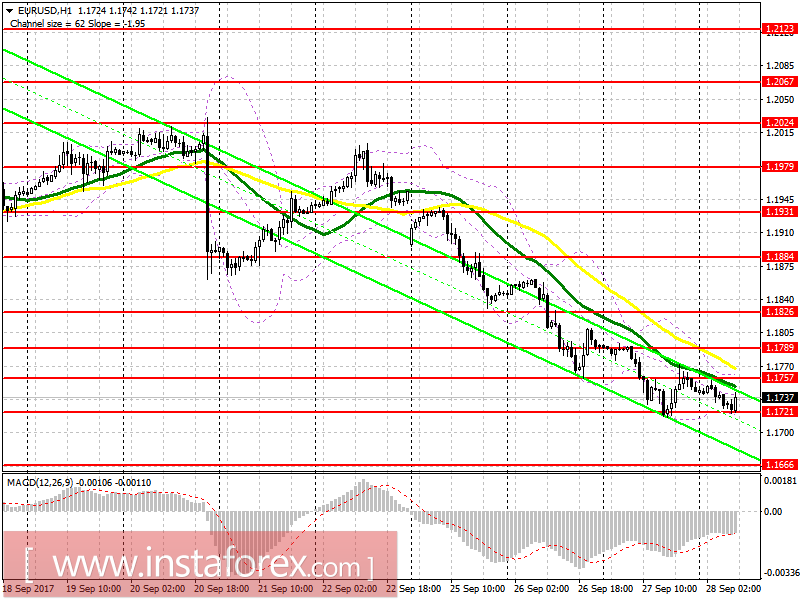

EUR / USD

To open long positions for EUR/USD, it is required:

Euro purchases are best considered after a false breakout and return to the level of 1.1721, or after consolidation above 1.1757, with a mandatory test of this level from top to bottom on a good volume. In this case, one can expect a larger upward trend in the area of 1.1789 and 1.1826. In the case of further fall of the euro below 1.1721, returning to long positions is best for a rebound from 1.1666.

To open short positions for EUR/USD, it is required:

Sellers will try to form a false breakdown at 1.1757, but the whole thing is to postpone sales until an update to 1.1789. The return and consolidation below 1.1721 will also be an additional signal to increase short positions with the main weekly target of an update to 1.1666, where I recommend fixing the profit. In the case of a larger euro growth in the morning, you can immediately sell at a rebound level of 1.1826.

GBP / USD

To open long positions for GBP/USD, it is required:

The pound movement will be tied for the performances of Mark Carney and Theresa May. A break above 1.3423 could lead to the demolition of a number of stop orders and a larger uptrend in the area of 1.3463 and 1.3509, where I recommend fixing profits. In the case of a pound drop below 1.3365, I recommend that you return to purchases only after updating to 1.3309 and 1.3271.

To open short positions for GBP/USD, the following is required:

GBP / USD movement at the level of 1.3365 and consolidation there will be a good signal to increase short positions with the expectation of renewing weekly lows around 1.3309 and 1.3271, where I recommend fixing profit. If the pound is rising in the morning, it's best to go back to sales after updating to 1.3463 or to a rebound from 1.3509.

Indicators

MA (average sliding) 50 days - yellow

MA (middle sliding) 30 days - green

MACD: fast EMA 12, slow EMA 26, SMA 9

Bollinger Bands 20