Yesterday's speeches by a number of Federal Reserve representatives did not lead to a larger than expected growth in the US dollar. Slowing down the rate of inflation, as well as more serious financial losses due to hurricanes, could significantly affect the economic growth of the US in the third quarter of this year.

Fed representative Rosengren said yesterday that the Fed should take safety measures against overheating of the economy. In his view, the main driver of inflation should serve the labor market. Rosengren also noted that the weakness of inflation is a temporary factor and the current Fed policy should outpace the inevitable rise in inflation.

Another representative of the Fed, Bullard also drew attention to the fact that inflation in recent months was weaker than expected but low unemployment is not likely to become an indicator of inflation in the near future.

According to Bullard, the current interest rate is likely to be appropriate in the short term, which should lead to an accelerated economic growth, which slowed due to hurricanes. The representative of the Federal Reserve expects to accelerate economic growth in the fourth quarter of this year.

Similar statements by FRS members indicate that current interest rates are unlikely to change. Expect to increase the cost of borrowing will be possible only in December this year.

As for the technical picture of the EUR/USD pair, a small pause in the 1.1720 support area may take a couple of days. The breakthrough of this range will continue the downward movement of the trading instrument, which will lead to the renewal of larger lows around 1.1660 and 1.1560 in the short term.

The New Zealand dollar almost did not react to the decision and statements of the Reserve Bank of New Zealand.

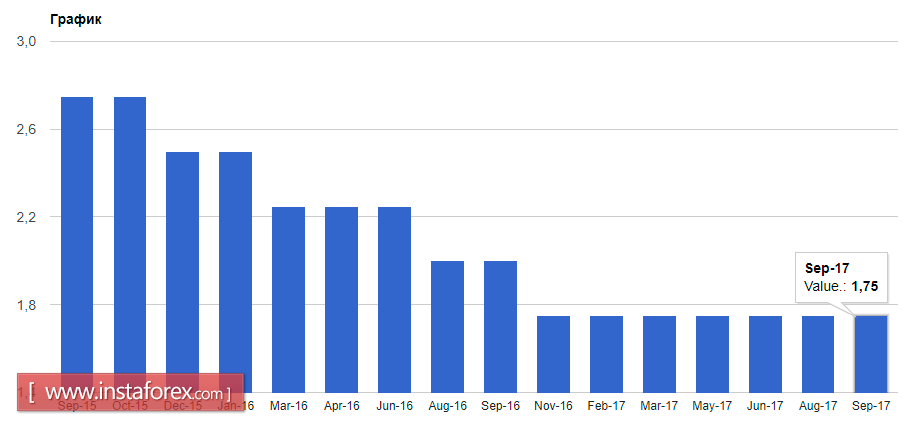

Today, it became known that the Reserve Bank of New Zealand left the official interest rate unchanged at 1.75%. The bank said that the lower rate of the New Zealand dollar will help increase inflation of prices for traded goods and contribute to a more balanced growth. It is also expected that GDP growth will continue at current rates and house prices will become more moderate.

The RBNZ is also expected to see overall inflation likely to decline in the coming quarters.

As for the technical picture of the NZD/USD pair, it is possible to maintain pressure on the New Zealand dollar, at least until major support levels update in the range of 0.7130-0.7150.