EUR / USD, GBP / USD

As shown in the review yesterday, the corrective growth of the euro and the pound is expected on Friday but it started prior that day, despite the upward revision of US GDP for the 2nd quarter from 3.0% to 3.1%. The US commodity trade balance in August improved from -63.9 billion dollars to -62.9 billion. Also, wholesale stocks increased in August by 1.0% against expectations of 0.4%. The growth of markets is attributed with the lack of plans to fill the budget presented by the White House and the tax reduction resulted in a "hole" of $ 2.2 trillion created for ten years. As a matter of fact, we do not see any danger in the increase of public debt, as the US will be able to increase its debt by $220 billion a year without any issues. This will be three times lower compared with the previous administration and twice lower under the leadership of George W. Bush.

The next round of EU-UK talks is assessed by the observers from a positive standpoint. But on contrary, negatives are higher than positives. Michel Barnier, an EU negotiator, believes that any arrangements are very unsteady since it leads to mutual losses, and the trade agreement (or agreements) is, in fact, the main issue in Brexit, but is still not yet to happen. Also, Mark Carney said that the Central Bank has extremely limited opportunities to amortize the consequences of Brexit.

The Germany GfK Consumer Climate for October dropped to 10.8 instead of the expected growth from 10.9 to 11.0, while Spain's consumer price index for September showed an expected growth from 1.6% YoY to 1.8% YoY.Today, British investors are preparing to fulfill GDP data and other important indicators. The issue is about the steady growth of the majority of indicators, and the reaction towards the data above or below the forecast can be exacerbated. The final estimate of GDP for the 2nd quarter is expected to be unchanged at 0.3% (1.7% YoY), while mortgage lending in August came in at 3.6 billion pounds. In July, business investment is expected with zero change. The balance of payments for the second quarter is expected to improve from -16.9 billion pounds to -15.8 billion pounds.

In the euro area, the consumer price index for the current month is expected to increase from 1.5% YoY to 1.6% YoY, and the base CPI is forecasted to remain unchanged at 1.2% YoY. At 3:00 PM London time, the meeting of Mark Carney and Mario Draghi in London begins, intended for the 20th anniversary of the Bank of England's independence. And, the argument regarding the monetary regulation might be affected.

In the United States, forecasts seem weak. Personal income of consumers last month is expected to increase by 0.2%, growth in personal spending is 0.1%. The price index of basic expenses can grow by 0.2%. The business activity index in the manufacturing sector of the Chicago region for September may fall from 58.9 to 58.6 points.

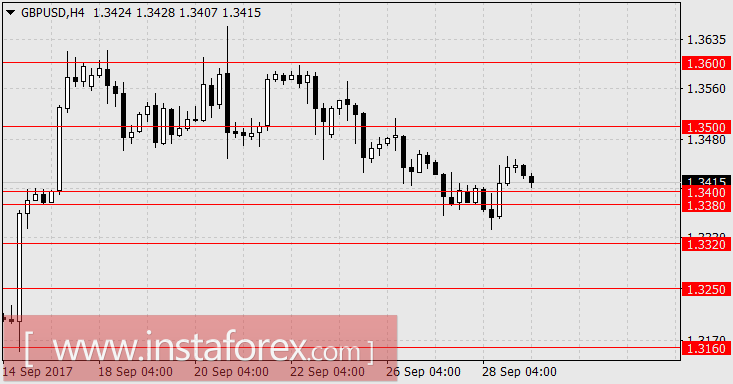

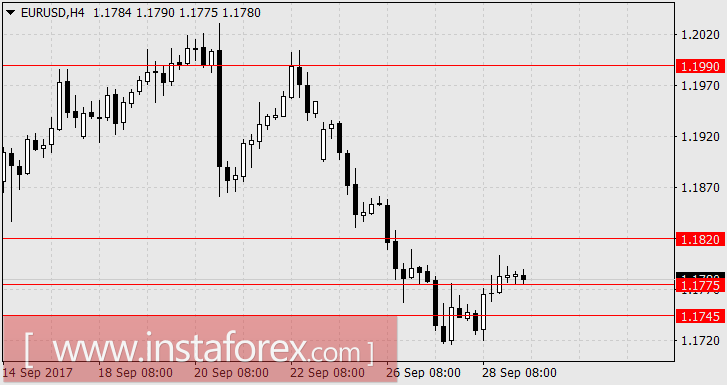

Eventually, we are anticipating for the resumption of the pound correction within the range of 1.3400-1.3500. For the euro, we anticipate for a consolidation in the range 1.1775-1.1820.

AUD / USD

The Australian dollar continues to depict the movements of the US dollar and seems that there is nothing unusual about it. Today, the data on private sector lending for August came out which was according to the expected and neutral increase of 0.5%. The growth of mortgage lending amounted to 0.5%. Generally, the crediting of Australian citizens raise fears, as the aggregate debt grows twice as fast as the revenue growth. The issue about the rising prices for real estate is also threatening because the main buyers of houses in Australia are Chinese people, and the demand from their side pushes the prices up.

Despite the correction of the US dollar, oil lost about 1% in value, iron ore about 2%, and coal by 0.2%. Copper and other non-ferrous metals are more expensive.

On Tuesday, next week, the RBA will have a meeting and it is possible that we will hear statements about the intention to adjust monetary policy. The Central Bank has long been concerned about the strong increase in house prices. We are expecting for the completion of the AUD/USD correction within the range of 0.7830 / 70.