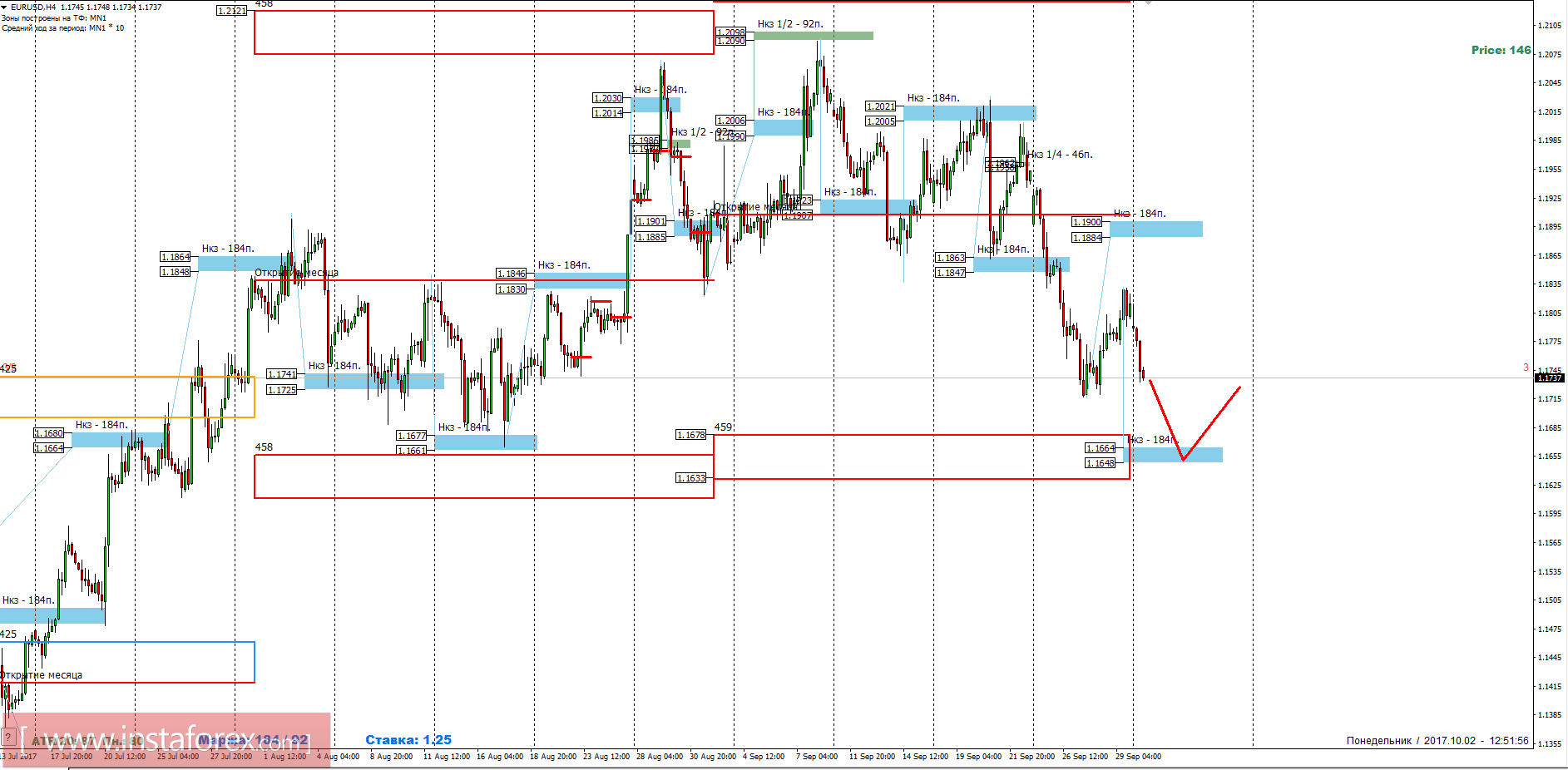

The medium-term momentum remains in a downward motion so the probability of a retest of the September low is over 70%. This allows you to keep the medium-term short positions.

Medium-term plan.

During the first week of the month it is difficult to determine the monthly control zones in October, so the nearest reference point is the MKZ 1.1678-1.1633 for September. Aiming to reach this zone remains the priority since the downward movement is a medium-term impulse. It is important to note that within a monthly short-term range there is a weekly short-term limit between 1.1664 and 1.1648. A test in this area will record the majority of sales. The emergence of large demand in this zone can lead to the formation of both a medium-term correctional movement and a reversal formation.

There will be a large demand immediately after the last week's low to form an alternative model. This will allow consideration of the continuation of the downward movement for today and the formation of a reversal pattern on the younger timeframe.

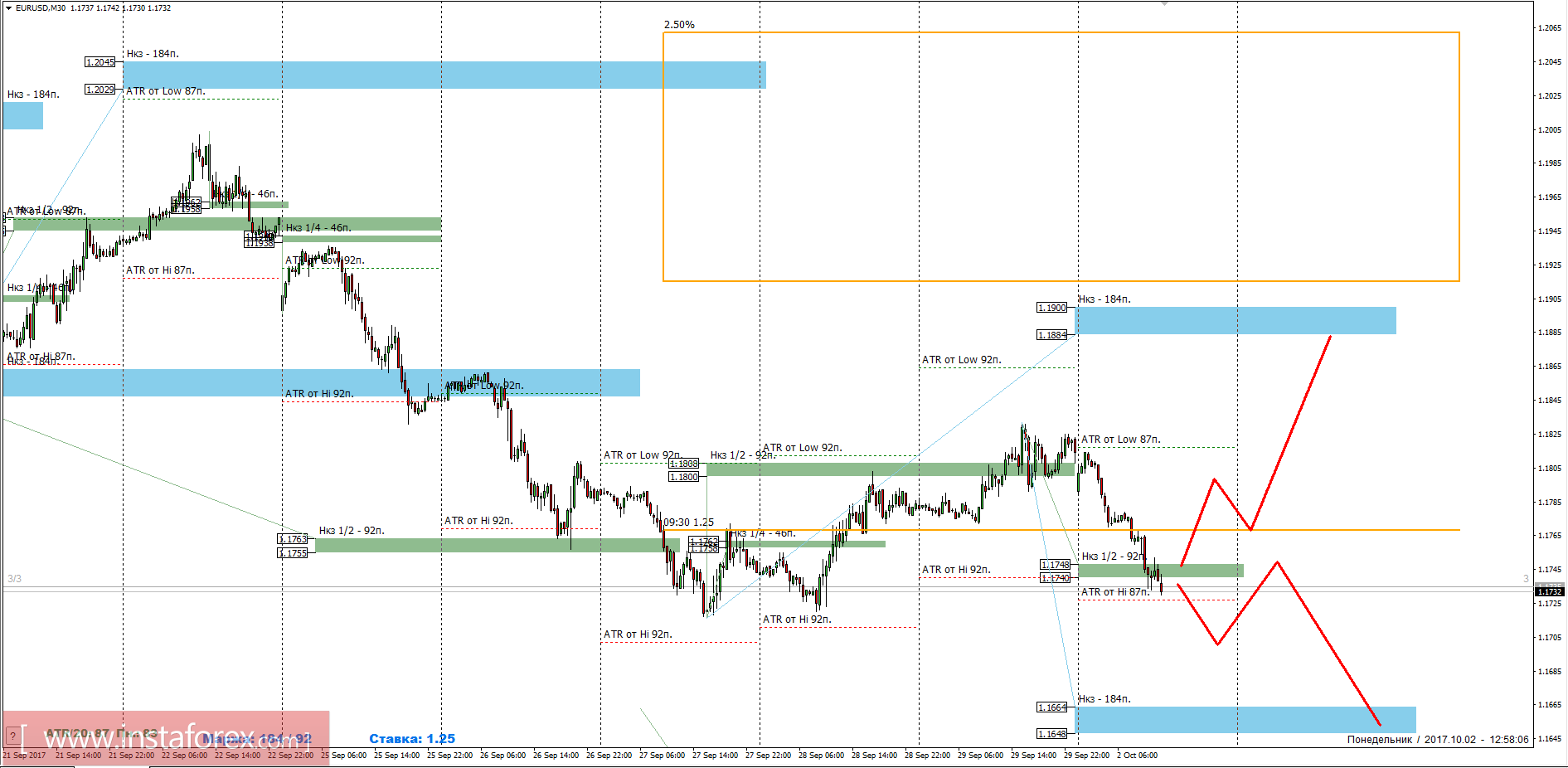

Intraday plan.

Last week's trades closed above NKZ 1/2 1.1888-1.1800, which allowed the possibility for a decline as an opportunity to search for profitable purchase prices. Despite this, there is a test NKZ 1/2 at 1.1748-1.1740 as of the moment. In case of today's US session closing below the level of 1.1740, the ascending model will be canceled, with the target of the fall at a weekly KZ of 1.1664-1.1648. If the closing of the American session occurs above the NKZ 1/2, then it will be necessary to look for a pattern for the purchase of the instrument. Both models will provide a profitable risk-to-profit ratio.

The daytime CP is the daytime control zone. The zone formed by important data from the futures market that change several times a year.

The weekly CP is the weekly control zone. The zone is formed by marks from important futures market which change several times a year.

The monthly CP is the monthly control zone. The zone is a reflection of the average volatility over the past year.