The US dollar fell against the euro and a number of other currencies on Wednesday, October 18, after the release of a number of fundamental statistics.

Earlier this week, the US dollar received support after improving the prospects for implementing tax reform in the United States. However, the enthusiasm subsided and in place of excitement came the sharper question of who would US President Donald Trump appoint as chairman of the Federal Reserve System. It is expected that the new chosen chairman of the Fed will be a supporter of higher interest rates.

However, until this point, the uncertainty in this issue will exert pressure on the US dollar, and much will depend on how the meeting of the US President with the current chairman of the Federal Reserve, Janet Yellen, will take place.

If there are more serious changes in the progress of the implementation of the tax reform in the US, it will be possible to count on the strengthening of the US dollar.

The report of the Fed's Beige Book yesterday had a negative impact on the quotations of the US dollar. It says that the US economy grew at a modest pace in September and early October of this year. The price pressure is still moderate, which could adversely affect the Fed's plans for interest rates.

As for the technical picture of the EURUSD pair, the bulls need to get beyond the limits of the large resistance at 1.1815, which blocked the road today towards continued growth. Breaking through this level opens real prospects for further upward correction in risky assets in expectation of renewing the monthly highs of 1.1850 and 1.1890.

The commodity currencies reacted differently to the data on the Chinese economy.

According to the National Bureau of Statistics, China's economy slowed in the third quarter of this year. Thus, China's GDP in the third quarter of this year grew by only 6.8% compared to the same period of the previous year after the growth of 6.9% in the second quarter. The data fully coincided with the forecasts of economists.

However, industrial production in China for September 2017 grew at a faster pace after a sharp slowdown in the previous two months.

According to the same National Bureau of Statistics, industrial production in China for September grew by 6.6% compared to the same period last year after rising by 6.0% in August. Economists expected a more modest growth of 6.5%. Compared to the previous month, industrial production grew by 0.56% for September.

Good data on the Australian labor market supported the Australian dollar in the Asian session.

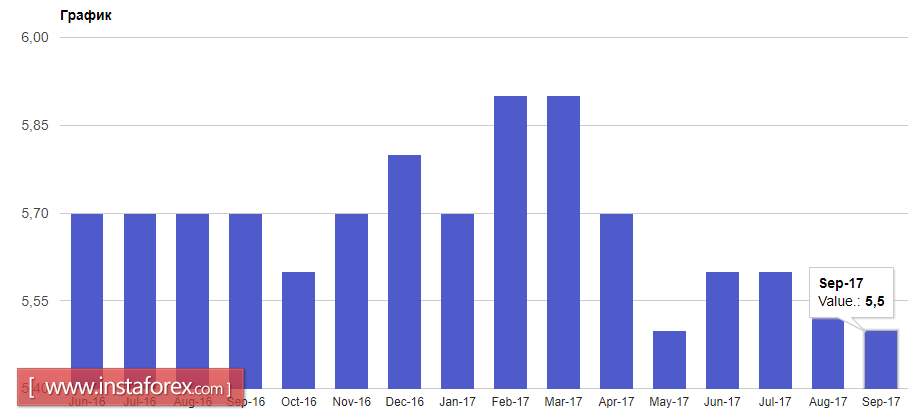

According to the report, the unemployment rate dropped to 5.5%, while the rate of creation of new jobs increased significantly. Compared to August, the number of jobs in September increased by 19.8 thousand, while economists had expected only a growth of 14.1 thousand.