The US dollar recently traded recently according to the decision of U.S President Donald Trump relative to the future head of the Federal Reserve, which will be replaced after Janet Yellen's resignation effective in February.

Donald Trump trimmed down to five candidates the number of applicants for the position as the Fed Reserve head, including Janet Yellen, Jerome Powell, Kevin Warsh, John Taylor and Gary Cohn. Both J.Yellen and J.Powell are regarded to be the representatives of the supporters of soft monetary policy, while the rest are considered as supporters of the hard monetary policy. It is not yet clear on whose side the president is inclined to. Today, he will hold a meeting with the current head of the Central Bank, Janet Yellen. It is projected that in case there are no positive comments on her candidature after the meeting, this indicates support the US dollar, as it shows the balance leans toward the side of the hard monetary supporters, which is three out of five. These include K. Warsh, J. Taylor, and G. Cohn.

The dollar itself paused on Wednesday due to the anticipation of new economic statistics. Yesterday, the dollar ignored the release of negative data on the number of issued permits for new-home construction, as it fell by 4.7% in September versus -0.2% in August. This decline is attributed to the impact of consecutive hurricanes that hit the southern coast of the United States last month.

Today, the market will focus on the publication of extensive statistical data from the Federal Reserve Bank of Philadelphia. Along with the publication of data on applications for unemployment benefits in the United States which is assumed to drop by 3,000 last week to 240,000 from 243,000 in the previous week.

Yesterday, the Fed representatives, William Dudley and Robert Kaplan, have their respective speech. Kaplan did not address the prospects of interest rate hike. But Dudley, whose opinion is perceived by investors as median, said that "the biggest source of uncertainty for the economy is (the) Washington's policy." He also added that "it still expects inflation to rise." And "the impact of the dollar perceives as quite neutral for inflation." And the last thing that relates to the prospects for raising rates in his speech is "the Fed is on the way to raise rates in 2017 in accordance with its forecast."

Based on the market, it can be assumed that he is almost completely confident that the rates in December will raised by 0.25%, in general.

Forecast of the day:

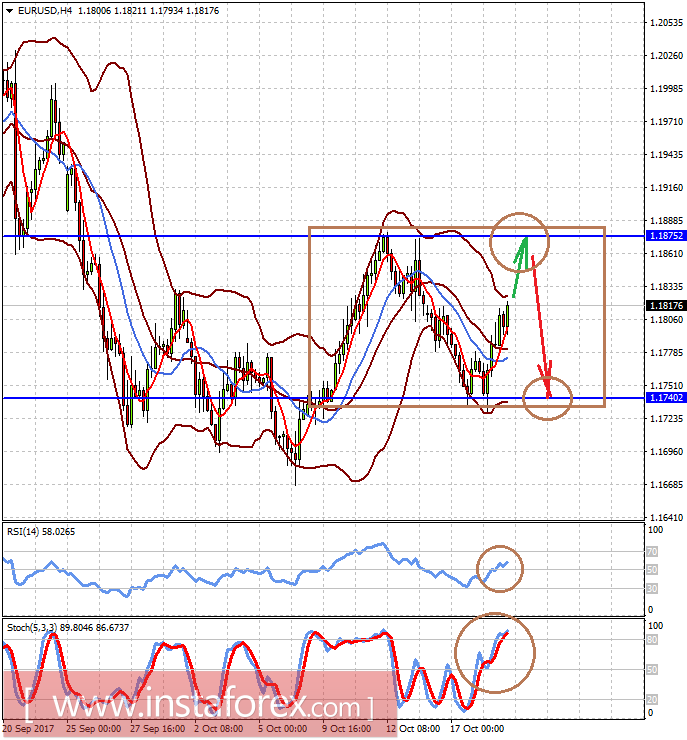

The EUR/USD pair would likely remain in the range of 1.1740-1.1875 for today, its growth or decline is constrained by the risk factor relative the ECB meeting scheduled next week. In general, the assessment for the pair remains negative.

The GBP/USD pair would likely trade in the range of 1.3140-1.3325, but a break of the 1.3140 level may be the reason of its fall towards 1.3030 mark.