EUR / USD, GBP / USD

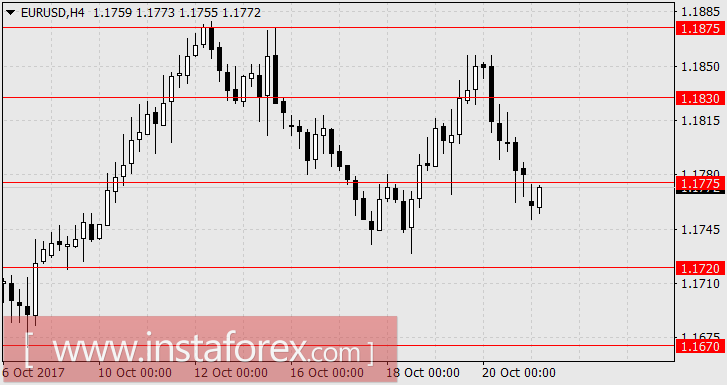

The good indicators of the Euro area balance of payments came out on Friday, as the balance in August was 33.3 billion euros against the forecast of 26.2 billion. The July data were revised upwards from 25.1 billion to 31.5 billion euros. Also, the German producer price index in September grew by 0.3% against the expectations of 0.1%. However, the euro resulted in a downfall due to the draft budget approval by the US Senate next year, as it turned out to have better than expected data on housing sales and budget. Sales of houses in the real estate secondary market in September amounted to 5.39 million against the forecast of 5.30 million and 5.35 million in August. This indicates that the negative expectations in this sector caused by hurricanes "Harvey" and "Irma" have not been confirmed. While sales fell only in Florida and Texas. The federal budget ended the month of September with a surplus worth 8.0 billion dollars against the forecast of -0.9 billion.

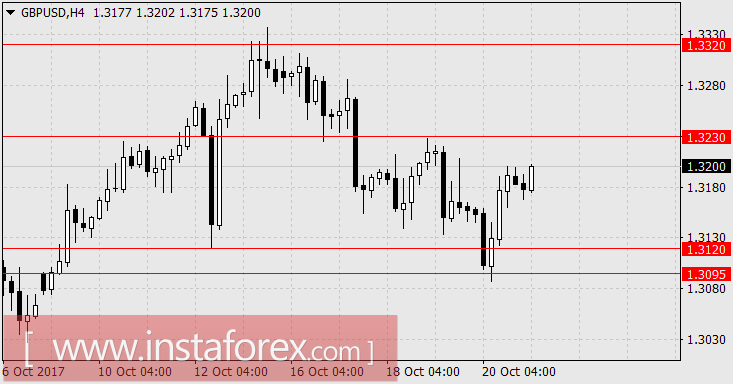

The British pound managed to gain 25 points due to the statement made by EU President Donald Tusk regarding the active preparation of the European Union for the so-called second phase of Brexit negotiations scheduled in December. The net borrowing of the UK public sector for September came in lower than forecasted with 5.3 billion versus 5.7 billion pounds.

As the new week begins, the dollar began to strengthen due to highly expected news of victory for the political coalition of the Liberal Party and Komeito in Japanese elections (233 and 25 seats). The optimism was the main opposition, the "Party of Hope", that received fewer seats in the parliament (36) than it was supposed to have. But, after the initial reaction, the markets began to adjust for technical reasons and they pushed themselves away from market orders in the purchase. The ECB's meeting on monetary policy scheduled on Thursday considered also a deterrent. Today, the United Kingdom CBI balance of production orders for October showed a forecast of 9 against 7 in September. The consumer confidence index in the euro area for the current month is expected to remain unchanged at -1.

In the current situation, we are expecting the EUR correction until Thursday within the range of 1.1775-1.1830. The first reaction of the market towards the ECB's decision to start QE reduction (with the extension of the term itself), could continue the rise of the euro if the situation of increased uncertainty occurred in the near term. On Friday, the Senate of Spain will vote for the rejection of Catalonia independence, limiting the powers of the regional parliament, banks and the media for six months. On the other hand, US President Donald Trump will announce this week the nominated candidate for the post head of the Fed. If the appointed candidate is Yellen, then the growth of the euro will be suppressed.

Generally, the British pound can strongly continue to grow due to private positive or neutral news regarding the Brexit negotiations, and it is equally possible that the pound will fall after Trump's nomination of the new Fed head, it's either Janet Yellen or Jerome Powell. The third candidate, John Taylor, is a "hawk", a nominee who can stop the strengthening of the dollar as the stock market may fall. We are expecting for the prices to enter the range of 1.3230-1.3320.

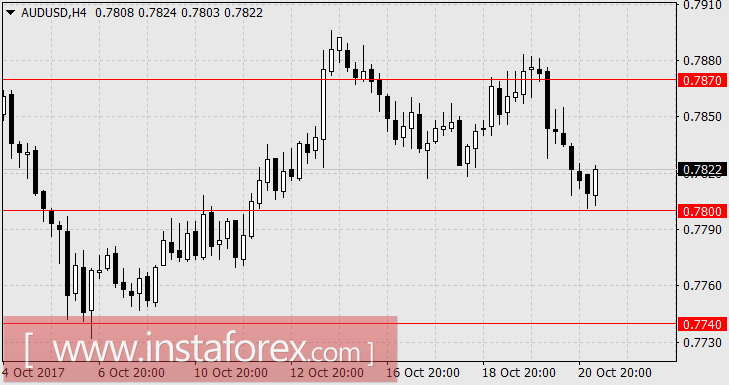

AUD / USD

The head of the People's Bank of China, Zhou Xiaochuan, said on Friday that there are dangerous credit risks in the country, threatening bankruptcy not only for corporations but for municipal institutions that use various loopholes for on-lending. This could partially affect the decline of the "Australian" on Friday by 60 points. But on the same day, the conditions for today's growth were also prepared, particularly in iron ore which could rose from 0.7% to 2.6% depending on the trading platform, while the oil may increase from 0.4% to 1.2%. Today, the special optimism in the ATP shows the Nikkei 225 is growing by 1.18% which is followed by other indices. The main "bearish" factor for the Australian currency remains in the discrepancy in Central Banks' monetary policies. This week, the Australian investors will tend to hold the candidacy for the post of Fed chair. As mentioned previously, there is a proposal for Yellen's nomination for a second term. As a deterrent and a counterweight, John Taylor can be nominated as the vice chairman. After the current correction was completed, a decrease of the "Australian" to 0.7740 is expected.