Among the entire significant events for this week that could affect the markets based on our opinion, is the importance to highlight the ECB meeting on monetary policy that will be held this Thursday.

Investors expect that the European Central Bank will undertake the prospects of stimulating the European economy, which is called as quantitative easing. Investors continue to speculate regarding the regulator's decision. It is assumed to reduce the volume of monthly assets purchases by 20 billion euros to 40 billion euros from 60 billion euros. It could further announce that the program will be extended for six months which is until mid-2018. While others believe that the volume purchases of government bonds will be further reduced, for example by 30 billion euros to 30 billion euros, with validity period extended by nine months. At the same time, most market participants agreed that the bank will be cautious after the meeting without a determined end date of the program, but, it would likely reserve the right to continue, if necessary, incentive measures.

Earlier, against the background of positive dynamics in the economy and the increasing inflationary pressures, ECB president Mario Draghi gave hints to the markets about the measures to support the economy might stop before the this year ends, the downward consumer inflation and its stabilization at current levels of 1.5% in the annual expression seems to forced ECB members and its leader to review their plans, which could led only in partial reduction of quantitative easing and program extension as early as next year.

In connection with this, the markets are interested in the possible dynamics of the single European currency, since the ECB's decision will not directly affect its prospects. In our opinion, the market already takes into account the probability of prolongation of incentive measures for next year, as well as the possible volume of reduction in monthly purchases of government bonds. But in case the decision is divergent from the market's opinion is approved, for example, the program will be extended not for six or nine months, but before the end of 2018, it will have a negative impact on the euro and will adjust significantly below the existing levels. At the same time, if there is a surprise and the ECB determines the end timeline of the economic support, then, it will noticeably support it otherwise.

Forecast of the day:

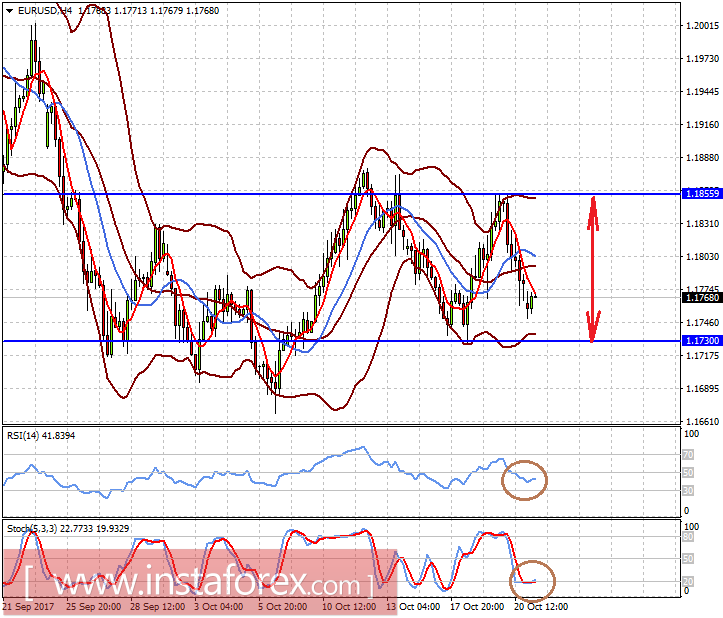

The EUR/USD pair is trading in the range of 1.1730-1.1855. It would likely to remain within that range until the ECB meeting.

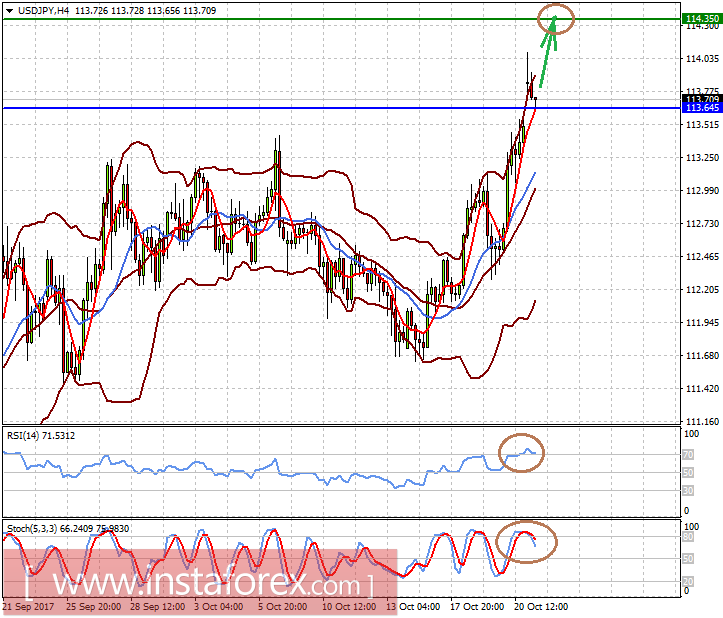

The USD/JPY pair markedly increase to the wave of the elections results in Japan, where Shinzo Abe won. The market believes in the expansion of incentive measures and averts to follow the example of the ECB and the Fed. On this wave, the pair has all chances to continue growing to 114.35, having fixed above the level of 113.65.