Dear colleagues.

For the EUR / USD pair, we follow the formation of the local downward structure of October 19. For the GBP / USD pair, the price is in the correction zone and forms a small potential for the top of October 20. For the USD / CHF pair, the development of the upward movement is expected after the breakdown of 0.9870. For the USD / JPY pair, we follow the development of the upward structure from October 16. At the current moment, the price is in correction. For the EUR / JPY pair, the resumption of the upward movement is expected after the breakdown of 133.82. For the GBP / JPY pair, we follow the development of the upward cycle from October 17. At the current moment, the price is in correction.

The forecast for October 24:

Analytical review of currency pairs in the scale of H1:

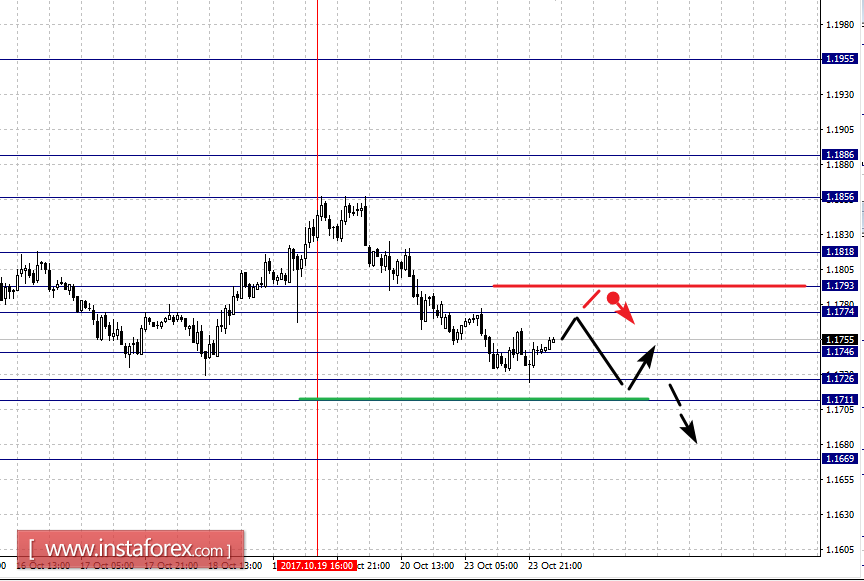

For the EUR / USD pair, the key levels on the scale of H1 are: 1.1856, 1.1818, 1.1793, 1.1774, 1.1746, 1.1726, 1.1711 and 1.1669. Here, we continue to monitor the formation of the local downward structure from October 19. At the moment, the price is in the zone of initial conditions. Continued downward movement is expected after the breakdown of 1.1746. In this case, the target is 1.1726. Near this level is is the consolidation of the price. Passing the price of the noise range at 1.1726 - 1.1711 should be accompanied by a pronounced downward movement. Here, the target is 1.1669. From this level, we expect a rollback upward.

The short-term upward movement is possible in the area of 1.1774-1.1793. The breakdown of the latter value will lead to an in-depth movement. Here, the target is 1.1818. The breakdown of this level will lead to the development of the upward structure on the scale of H1. In this case, the potential target is 1.1856.

The main trend is a local downward structure from October 19.

Trading recommendations:

Buy: 1.1774 Take profit: 1.1790

Buy: 1.1795 Take profit: 1.1816

Sell: 1.1744 Take profit: 1.1726

Sell: 1.1710 Take profit: 1.1680

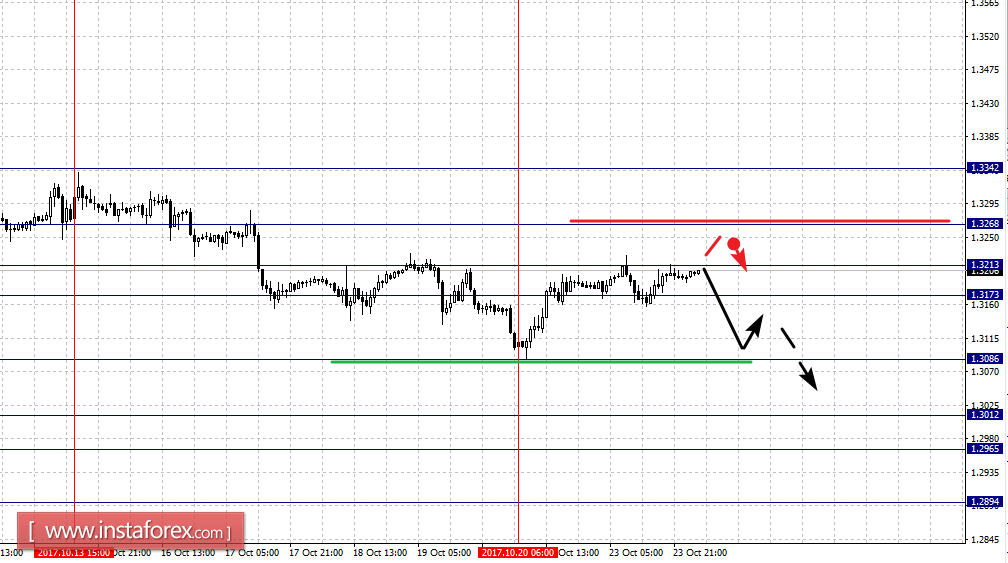

For the GBP / USD pair, the key levels on the scale of H1 are: 1.3268, 1.3213, 1.3173, 1.3086, 1.3012, 1.2965 and 1.2894. Here, we continue to follow the downward structure from October 13. At the moment, the price is in correction and forms a small potential for the top. Continued downward movement is expected after the breakdown of 1.3086. In this case, the target is 1.3012. In the area of 1.3012 - 1.2965, we expect short-term downward movement as well as the consolidation of the price. The potential value for the downward structure is the level of 1.2894, from which we expect a rollback to the top.

Consolidated movement is possible in the area of 1.3173 - 1.3213. The breakdown of the last value will lead to in-depth correction. Here, the target is 1.3268. The breakdown of this level will lead to an upward movement on the scale of H1. In this case, the target is 1.3342.

The main trend is the downward structure of October 13, the correction stage.

Trading recommendations:

Buy: 1.3215 Take profit: 1.3265

Buy: 1.3270 Take profit: 1.3340

Sell: 1.3084 Take profit: 1.3015

Sell: 1.3010 Take profit: 1.2970

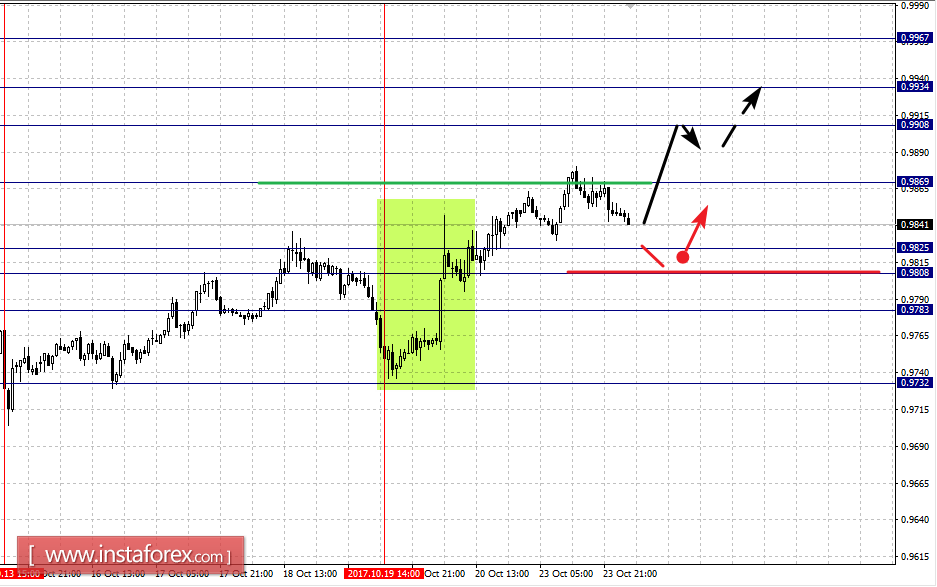

For the USD / CHF pair, the key levels on the scale of H1 are: 0.9967, 0.9934, 0.9908, 0.9869, 0.9825, 0.9808 and 0.9783. Here, we continue to monitor the formation of the local structure for the top of October 19. Continued upward movement is expected after the breakdown of 0.9870. In this case, the target is 0.9908. Near this level is the consolidation of the price. Its breakdown will allow us to count on the movement towards 0.9934. For the potential value for the top, consider the level of 0.9967. From this level, we expect a pullback downwards.

Short-term downward movement is possible in the area of 0.9825 - 0.9808. The breakdown of the last value will lead to in-depth correction. Here, the target is 0.9783. This level is the key support for the top. Its breakdown will lead to a downward movement. In this case, the target is 0.9732.

The main trend is the formation of a local upward structure from October 19.

Trading recommendations:

Buy: 0.9870 Take profit: 0.9906

Buy: 0.9909 Take profit: 0.9932

Sell: 0.9825 Take profit: 0.9810

Sell: 0.9806 Take profit: 0.9785

For the USD / JPY pair, the key levels on a scale are: 115.25, 114.97, 114.48, 114.12, 113.54, 113.24, 112.90 and 112.52. Here, we continue to follow the upward cycle from October 16. At the moment, the price is in correction. Continued upward movement is expected after the breakdown of 114.12. In this case, the target is 114.48. Near this level is is the consolidation of the price. Breaking the level of 114.50 should be accompanied by a pronounced upward movement. Here, the target is 114.97. The potential value for the top is the level of 115.25, from which we expect a pullback downwards.

Consolidated traffic is possible in the area of 113.54 - 113.24. The breakdown of the last value will lead to in-depth traffic. Here, the target is 112.90. This level is the key support for the top. Its breakdown will allow us to count on the movement towards the level of 112.52.

The main trend is the upward cycle from October 16, the correction stage.

Trading recommendations:

Buy: 114.12 Take profit: 114.46

Buy: 114.50 Take profit: 114.95

Sell: 113.22 Take profit: 112.90

Sell: 112.88 Take profit: 112.55

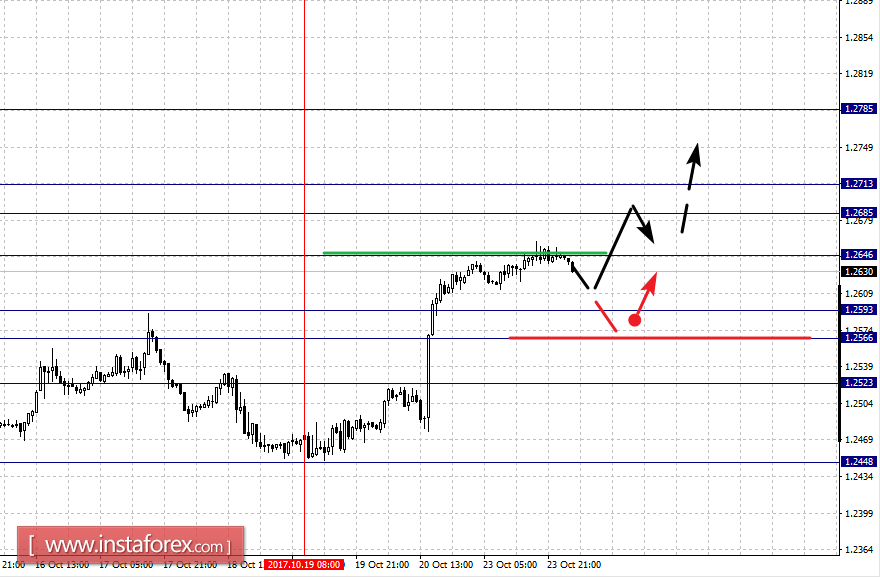

For the CAD / USD pair, the key levels on the H1 scale are: 1.2785, 1.2713, 1.2685, 1.2646, 1.2593, 1.2566 and 1.2523. Here, we continue to monitor the formation of the upward structure of October 19. Continued upward movement is expected after the breakdown of 1.2646. In this case, the target is 1.2685. Near this level is the consolidation of the price. Passing the price of the noise range at 1.2685 - 1.2713 should be accompanied by a pronounced upward movement towards the potential target of 1.2785, from which we expect a pullback downwards.

Short-term downward movement is possible in the area of 1.2593 - 1.2566. The breakdown of the last value will lead to in-depth correction. Here, the target is 1.2525. This level is the key support for the upward structure.

The main trend is the formation of the upward structure of October 19.

Trading recommendations:

Buy: 1.2646 Take profit: 1.2685

Buy: 1.2715 Take profit: 1.2780

Sell: 1.2590 Take profit: 1.2568

Sell: 1.2562 Take profit: 1.2530

For the AUD / USD pair, the key levels on the scale of H1 are: 0.7865, 0.7841, 0.7828, 0.705, 0.7794, 0.7767 and 0.7747. Here, we follow the downward structure of October 13. Continued downward movement is expected after passing through the noise range of 0.7805 - 0.7794. In this case, the target is 0.7767. The potential value for the bottom is the level of 0.7747, from which we expect the movement towards correction.

Short-term upward movement is possible in the area of 0.7828 - 0.7841. The breakdown of the last value will lead to in-depth correction. Here, the target is 0.7865.

The main trend is the downward structure of October 13.

Trading recommendations:

Buy: 0.7828 Take profit: 0.7840

Buy: 0.7845 Take profit: 0.7865

Sell: 0.7794 Take profit: 0.7770

Sell: 0.7765 Take profit: 0.7750

For the of EUR / JPY, the key levels on the scale of H1 are: 135.69, 135.15, 134.37, 133.82, 133.00, 132.72, 132.33 and 131.66. Here, we continue to follow the development of the upward structure of October 16. Short-term upward movement is expected in the range of 133.82 - 134.37. The breakdown of the last value should be accompanied by a pronounced upward movement. Here, the target is 135.15. The potential value for the top is the level of 135.69, from which we expect a pullback downwards.

Short-term downward movement is possible in the area of 133.00 - 132.72. The breakdown of the last value will lead to in-depth movement. Here, the target is 132.33. This level is the key support for the bottom.

The main trend is the formation of the upward structure of October 16.

Trading recommendations:

Buy: 133.85 Take profit: 134.30

Buy: 134.40 Take profit: 135.15

Sell: 133.00 Take profit: 132.74

Sell: 132.68 Take profit: 132.36

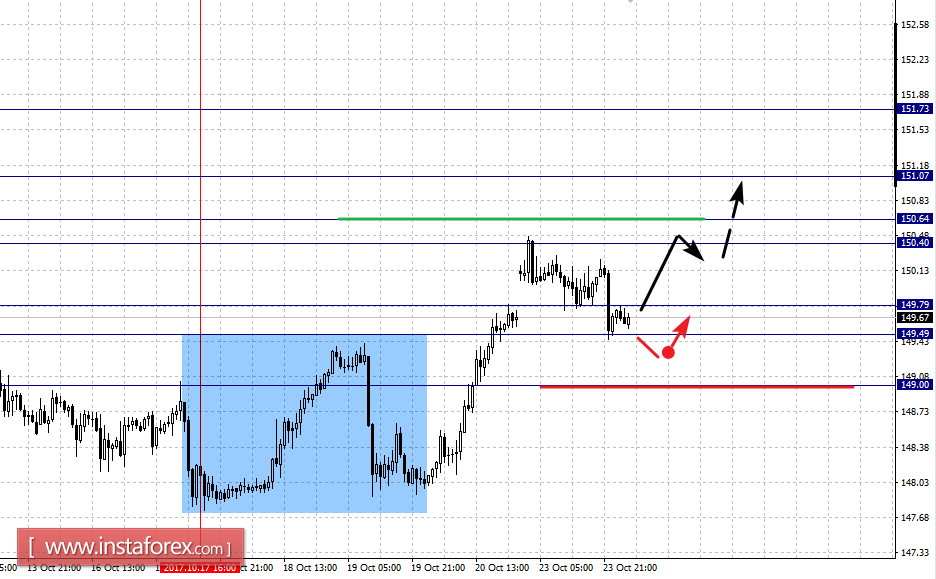

For the GBP / JPY pair, the key levels on the scale of H1 are: 151.73, 151.07, 150.64, 150.40, 149.79, 149.49 and 149.00. Here, we follow the development of the upward structure of October 17. At the moment, the price is in the correction zone. The continuation of the upward movement is expected after passing the price of the noise range at 150.40 - 150.64. In this case, the target is 151.07. Near this level is the consolidation of the price. The potential value for the top is the level 151.73, from which we expect a rollback.

Consolidated movement is possible in the range of 149.79 - 149.49. The breakdown of the last value will lead to in-depth correction. Here, the target is 149.00. This level is the key support.

The main trend is the upward structure from October 17, the correction stage.

Trading recommendations:

Buy: 150.66 Take profit: 151.05

Buy: 151.10 Take profit: 151.70

Sell: Take profit:

Sell: 149.45 Take profit: 149.05