EUR / USD, GBP / USD

On Monday, the euro and the pound spent the day relatively calmly, while waiting for the ECB meeting on Thursday. The pound added 12 points to the optimistic statements from Theresa May in the issue of Northern Ireland and the deputy manager of the World War II John Cunliffe about the three-year perspective of the rate hike. The UK has lost 32 points due to talk about possible scenarios of QE reduction by the European Central Bank. Consumer confidence in the euro area remained at -1 in October.

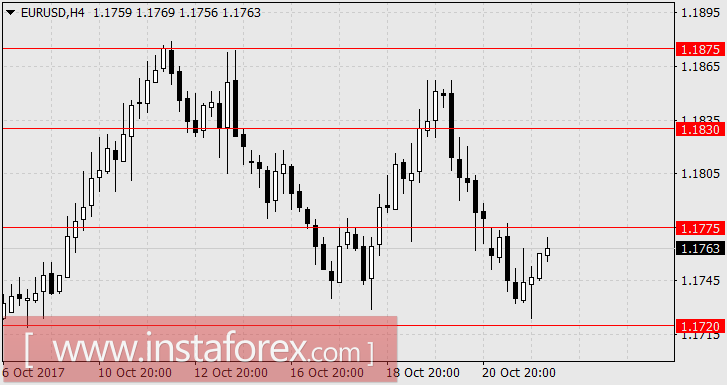

The euro is expected to move in the range of 1.1775-1.1830, but the strength of the single currency was not found. Today, this scenario has even lower chances since published business activity indices for October are expected with weakening. In the manufacturing sector, the euro zone's PMI is projected at 57.9 versus 58.1 in September, while German manufacturing PMI is expected to fall from 60.5 to 60.1. Services PMI eurozone is expected to gain 55.7 points against 55.8 previously.

The forecasts for PMI from Markit are expected to grow from 53.1 to 53.3, Services PMI may experience a more restrained decline with a forecast of 55.2 versus 55.3 in September. The business activity index in the manufacturing sector of Richmond is projected to decline from 19 to 17.

According to the UK, significant data will be released tomorrow, while the GDP will be published for the third quarter. The forecast assumes an increase of 0.3%, in the second quarter. On an annual basis, there could be a possible decline from 1.5% YoY to 1.4% YoY, but this is not a significant deviation, which could categorically hamper the growth of the currency without additional negative pressure.

As a result, we are expecting for the euro at the lower limit of the range 1.1720-1.1775, the pound sterling is expected in a wide range of 1.3230-1.3320. The technical breadth of the range allows investors to reach more convenient levels for both potential further growth and potential downgrade. Our main scenario assumes a subsequent decline.

USD / JPY

The first reaction of the Japanese yen to the victory of Shinzo Abe's party in the parliamentary elections was excessive, as the Japanese currency break 32 points during the opening, which subsequently led to its technical closure. This morning, the price further lies at one of the technical levels at 113.30. The business activity index in the manufacturing sector for October showed a decrease from 52.9 to 52.5 against expectations of growth to 53.1. The stock market shows growth despite the decline of US indices yesterday. The Japanese Nikkei 225 moved up to 0.16% and the Chinese Shanghai Composite rose to 0.08%. Later this week, the inflation is scheduled to come out generally, a slight increase in indices is expected, with the basic CPI gained 0.8% YoY against 0.7% YoY earlier. Taking into account the expected trend of strengthening the dollar, we expect the yen to rise to 114.40.