Investors continue to follow the anticipated choosing of a new Fed head from the candidates. Now their circle has narrowed from five to three: J. Yellen, the current head of the Fed, D. Powell, a member of the board of directors of the Fed, and J. Taylor, a Stanford University professor. The president continues his show, gradually lighting up how things are going in this direction.

If the market earlier appreciated the visit of Yellen to the White House as some form of formality and as signs of decency when choosing a new head of the Fed, then after yesterday's statement that she is among the candidates, the alignment of forces has changed. Now, two of the three candidates are supporters of the current low-key policy of normalizing monetary policy. Taylor is considered a supporter of a more rigid approach.

We can assume that only the appointment of Taylor can give a strong impetus to the dollar, but the entry into the post of the head of the US Central Bank changes the game. Powell and the Yellen's possible second term is unlikely to change anything, since the factor of the current policy is already taken into account in the quotes of the US currency.

In addition to the theme of appointing a new head of the Fed, the markets are now ruled by increasing expectations of the implementation of the president's tax program. After the adoption of the budget by senators, this possibility really increased but not much else, since the budget should still be approved by the Congress. Here, there are many obstacles in the face of opponents and outspoken enemies of D. Trump.

Today, the market will focus on the publication of the indexes of business activity in the manufacturing and service sectors of the US and the euro area. It is assumed that the US figures will grow but the European ones will decrease. This can provide local support to the dollar paired with the euro. However, that's it. There is no more as the focus remains to be the result of the ECB meeting, which will determine the fate of the euro zone's stimulus program.

Forecast of the day:

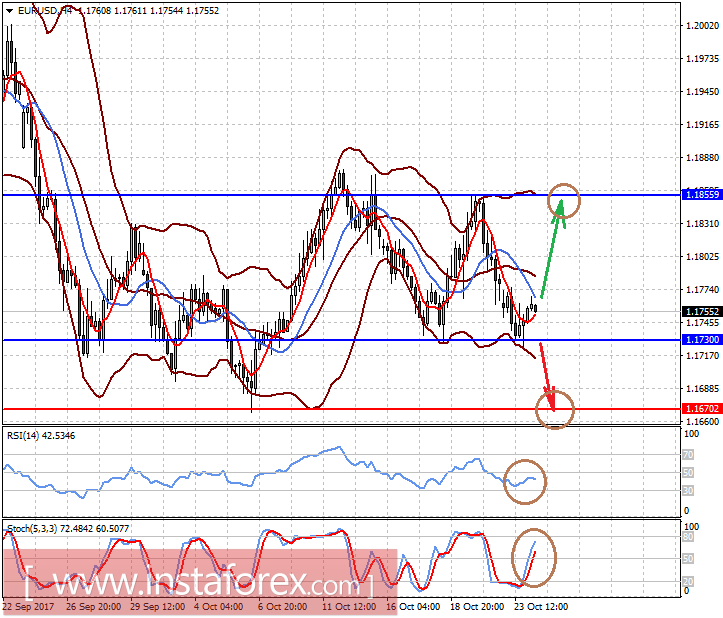

The EURUSD pair is trading in the range of 1.1730-1.1855. It is likely that it will remain in this area until the ECB meeting. It may grow to the upper limits but if it breaks its lower limit, then there is a probability of its local decrease to 1.1670.

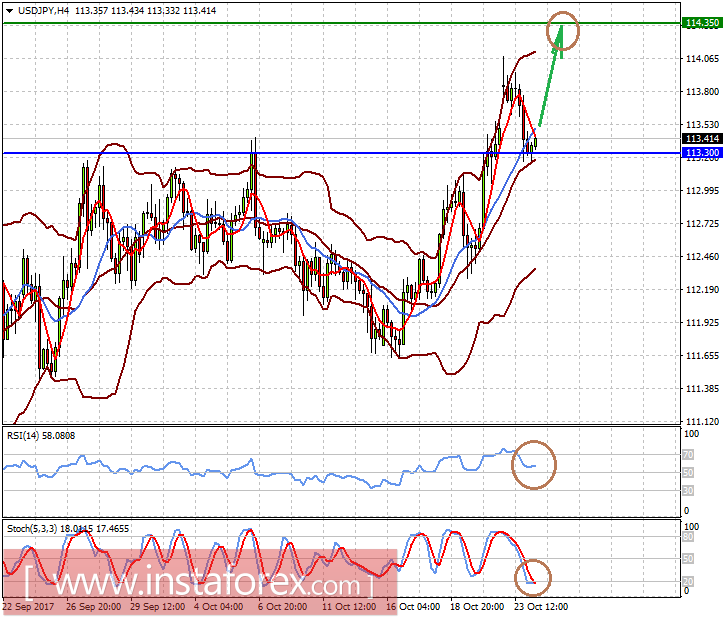

The USDJPY pair found support at 113.30 after a correction in the Asian trading session. It is likely that it will continue to rise to 114.35. If this mark stands, then statistics from the US will prove to be strong.