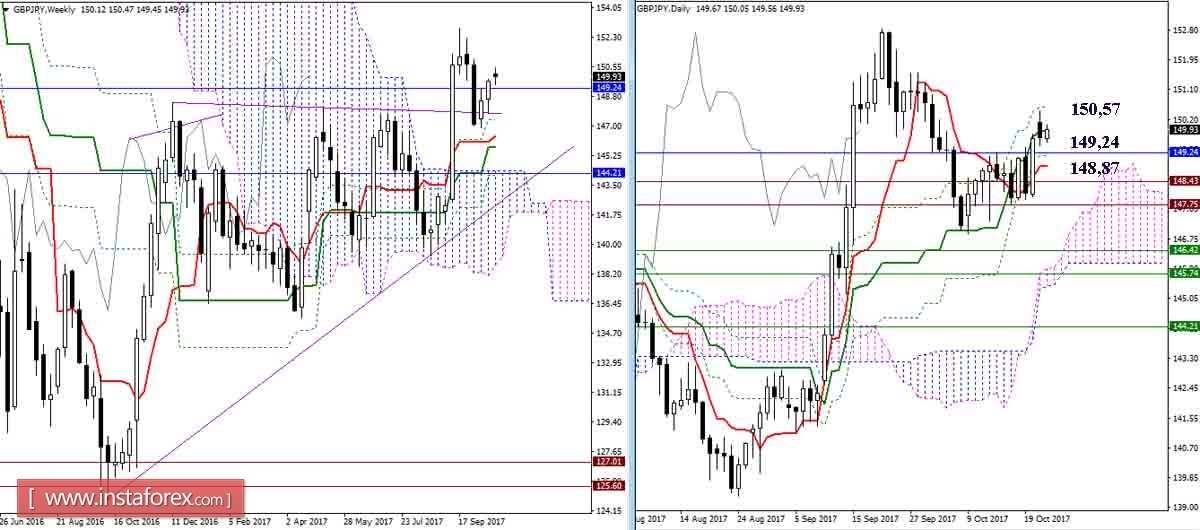

GBP / JPY

As noted earlier, the fastening above the monthly Fibo Kijun (149.24), as well as the liquidation of the daytime dead cross (Kijun 149.87 + Fibo Kijun 150.57), will open up new prospects for the players. The return for support 149.24 (monthly Fibo Kijun) and 148.87 (day Tenkan) can complete the next stage of recovery and create conditions for the resumption of the decline.

The pair uses as a support the spent H4 target (149,60-90) while maintaining the long-term (H4 and H1 - 149.24) and medium-term (N4 - 148.87) support of bullish sentiments. The decline under podderzhki can change the balance of power and create new downward benchmarks. The breakdown of the final resistance of the day cross (150,45-57) will allow to examine the testing of the maximum extremes (151.57 - 152.83).

EUR / JPY

The bears started the week with bright absorption. The descent under the support of the day cross (Kijun 133.04 - Tenkan 132.90) will confirm the intentions of the bears and will contribute to the development of the decline. The inconsistency of the candlestick absorption model will be a continuation of the uncertainty and instability that have been operating recently in the market.

After fulfilling the target for the breakdown of the H4 cloud (134.05), the pair went into a corrective decline but at the same time retained its location above the key supports currently concentrated in area 133 (the final crosses of the H4 + Senkou Span B N1 + cross the day). Fixing below changes the alignment of forces, forms a goal (the goal is to break the H4 cloud) and creates the conditions for continuing the decline. If the bulls retain their location over the key supports of this area and again test the resistance of the spent target H4, then we can expect the recovery of bullish positions and the trend.

Indicator parameters:

All time intervals 9 - 26 - 52

The color of the indicator lines:

Tenkan (short-term trend) - red,

Kijun (medium-term trend) - green,

Fibo Kijun - green dotted line,

Chinkou - gray,

Clouds: Senkou Span B (SSB, long-term trend) - blue,

Senkou Span A (SSA) - pink.

The color of additional lines:

Support and resistance MN - blue, W1 - green, D1 - red, H4 - pink, H1 - gray,

Horizontal levels (not Ichimoku) - brown,

Trend lines - purple.