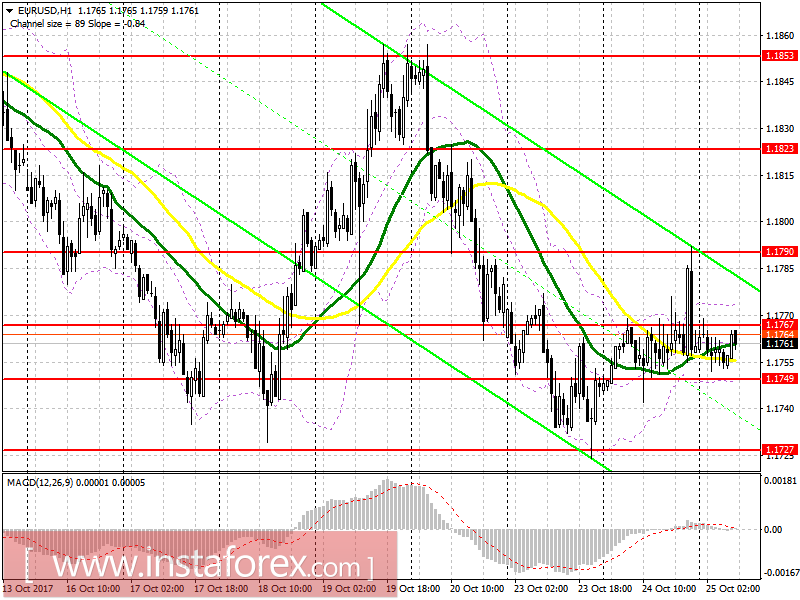

EUR / USD

To open long positions on EURUSD, it is required:

The level of 1.1767 remains to be an important goal for the buyers today. The fastening on this level will push the euro up to the resistance level of 1.1790. A breakthrough on this level will give a more powerful impetus to increase long positions for large players with the expectation of the test at the level of 1.1823, where it is recommended to lock in profits. In case of a decline below the level of 1.1749, it is recommended that to return to buying the euro only after updating to the level of 1.1727 or on a rebound from 1.1684.

To open short positions on EURUSD, it is required:

Sellers will try to form a false breakout and return to the level of 1.1767, which will be the first signal for opening of short positions. A consolidation below 1.1749 will lead to larger sales of the euro with the update at the level of 1.1727 and an exit to the level of 1.1684, where it is recommended to lock in profits. In case of growth above 1.1767, the best way to sell the euro is to return after the formation of a false breakdown on the level of 1.1790, or on a rebound from 1.1823.

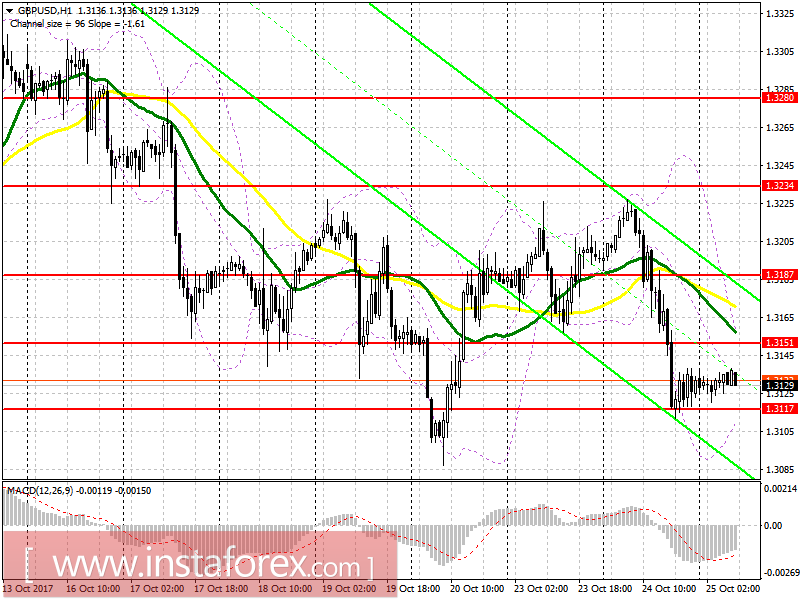

GBP / USD

To open long positions on GBP / USD, it is required:

The direction of the pound's movement will be given by the GDP. A growth to 1.3151 could lead to a quick pound sale but consolidation at this level could give a more powerful impetus to the further upward trend of GBP / USD pair, with an update at the level of 1.3187 and an exit to the level of 1.3234. The pound's decline to the area of 1.3117-07, with the formation of a divergence there on MACD, will also be a good signal to buy. Otherwise, opening long positions is best on a rebound from 1.3073

To open short positions on GBP / USD, it is required:

Sellers will try to form a false breakout of resistance at the level of 1.3151 with a 30-day moving average test. A return to this level will be a good signal to sell the GBP / USD pair for the purpose of breakdown and consolidation below 1.3117. This will collapse the pair to new lows in the area of 1.3073. If the pound is above 1.3151, it is best to return to selling after upgrading to 1.3187 or on a rebound from 1.3224.

Indicator description

MA (positions on) 50 days - yellow

MA (positions on) 30 days - green

MACD: fast EMA 12, slow EMA 26, SMA 9

Bollinger Bands 20