The October meeting of the European Central Bank will undoubtedly stir up markets, and the euro-dollar pair will awaken from suspended animation, the state of which it has been for several days. Regardless of what decision will be taken by Mario Draghi tomorrow, this will provoke a strong volatility: the only question is whether it will be in favor of the European currency or vice versa.

On the eve of such a significant event, the market is flooded with suggestions of analysts who often contradict each other. But they all agree that tomorrow will be determined by the turning point: the ECB should announce the tapering of its QE, and this fact will mark the beginning of a long way to tighten monetary policy in the euro area. This question has been exaggerated for a long time and seems to have already been foreseen. But, as we know, "the devil is in the details": traders will be interested in the timing, pace and other details of the completion of the stimulus program. All this indicates that the main focus of attention will be shifted to the press conference of Mario Draghi, where he must answer the key questions of journalists.

According to the general forecast, the European Central Bank tomorrow will announce the extension of QE for another few months (from five to nine months), while reducing the volume of purchases to 20-30 billion euros (from the current 60 billion euros). According to some analysts, the volume of assets for repurchase is almost exhausted, according to various estimates, it is just over 300 billion euros. In other words, these funds will last for five months of the stimulus program in its present form.

However, there is no consensus on this: according to other experts, if Mario Draghi decides to reduce QE at a slower pace - roughly, this figure will be reduced to 40 billion euros. This scenario will disappoint traders: the very fact of exiting the QE is already largely taken into account in current prices, so the dynamics of the EURUSD pair will depend on the degree of aggressiveness of the rate of its completion.

In general, the head of the ECB faces a difficult task: on the one hand, it should declare a reduction in QE, but on the other hand - it should keep the euro within the existing price range. Therefore it is likely that Draghi will use the verbal method of "carrot and stick". Having voiced the expected solution, he will traditionally list a number of arguments in favor of maintaining a soft monetary policy. Low inflation growth rates, political uncertainty in Spain, complex and ineffective negotiations on Brexit, the unstable growth of the European economy - that's an incomplete list of such arguments. And, naturally, he will repeat the traditional language that interest rates will remain at low levels for a long time, and after the completion of QE.

It is difficult to predict the reaction of the market to the comments of Mario Draghi. Most likely, traders will proceed primarily from the volume of reduction in the stimulus program. In general, the market has got used to the "dovish" stance of Draghi, therefore they will be of secondary nature. But if the head of the ECB even hints at the probability of a rate hike (even without a time frame), the EURUSD pair will grow at least to the 20th figure, testing local highs. In my opinion, the market has laid the most "soft" outcome of tomorrow's meeting in prices: any "hawkish" phrases will provide strong support for the European currency. the market has laid the most "soft" outcome of tomorrow's meeting in prices: any "hawkish" phrases will provide strong support for the European currency.

As for the fate of interest rates, it is worth recalling the recent speech by a member of the ECB Governing Council, Sabina Lautenschleger. She repeated the words of Draghi that the soft policy will continue to exist, but first of all in order to return inflation to the target two percent. The head of the ECB is unlikely to tie the growth of inflation to a rate hike tomorrow, but we will need to carefully study the minutes of tomorrow's meeting (published after 1.5 weeks). If the regulator's members do not really rule out such cause-effect algorithm, the euro-dollar pair will get an additional reason for its recovery.

Thus, the main issue of the October meeting is how much the European Central Bank will reduce the volume of redemption of bonds. The higher this number is, the more active the euro-dollar will strengthen its positions. Subsequent comments by Mario Draghi can reverse the initial reaction - but only if he announces unexpected intentions for the market.

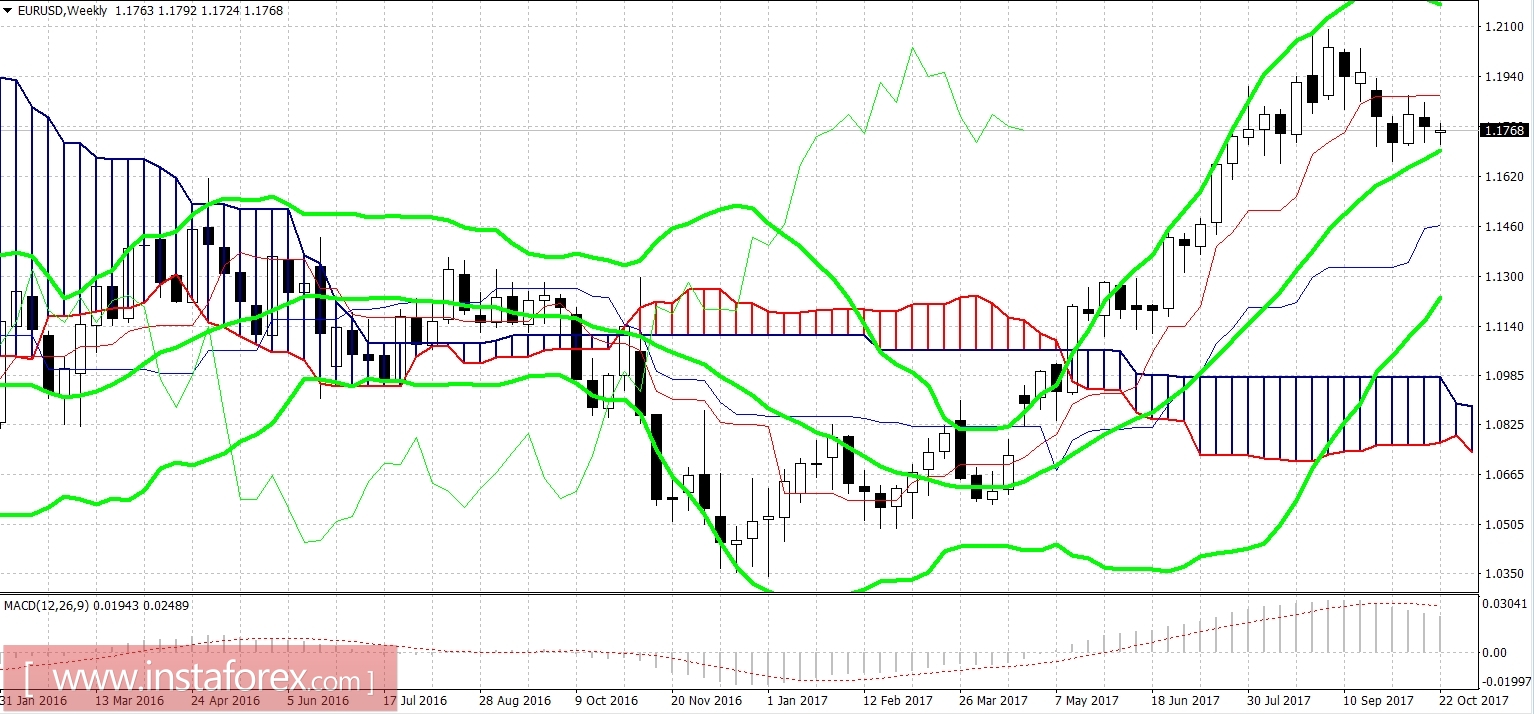

Technically, the pair is in the flat, and the main indicators do not signal the direction of the subsequent movement. On the daily chart, the EURUSD pair is located on the midline of the Bollinger Bands indicator, while in the Kumo cloud. On the weekly chart there are also no warning signals. Only the price arrangement between the middle and top lines of the Bollinger Bands indicator (on W1) indicates the indirect priority of the northern movement. The support level is 1.1695 (the bottom line of the Bollinger Bands indicator on D1). But the target level of the upward movement is 1.2091 (the highest price this year).