The euro rose slightly against the US dollar amid good fundamentals, but the total trading volume remains rather low before the ECB's tomorrow meeting and its decision on the asset buy-back program.

According to the report of the Institute of Ifo, the indicator of sentiment in the business sector in Germany in October this year rose again against the backdrop of a positive assessment of the companies' prospects for the next few months.

According to the data, the index of sentiment in business sector of Germany in October was at the level of 116.7 points against 115.3 points in September. Economists had expected the index to be at 115.1 points.

Some analysts once again talked about the next day's decision of the ECB. Many expect the regulator to extend the program of quantitative easing for nine months from January next year, but with this volume of purchases will be reduced by half, from 60 billion euros to 30 billion euro.

If so, then the European currency has good enough potential for further growth against the US dollar. However, one does not need to count on a long sharp jump up, as the above decision, which may be taken tomorrow, is already partially reflected in the quotations of the European currency. Only more significant changes and correction of the program will lead to a number of purchases of the European currency among major players.

As for the technical picture of the EURUSD pair, the situation is still on the side of euro buyers. A break and consolidation above 1.1800 will lead to another wave of opening long positions in risky assets and renewing the resistance in the region of 1.1825 and 1.1860 in the short term. However, today, expect a surge in trading volatility is not due to the caution of traders before tomorrow's meeting of the ECB.

The British pound rose sharply against the US dollar, as the probability of interest rate increases by the Bank of England increased significantly. This happened after the release of an excellent report on the growth of the UK economy in the third quarter of this year.

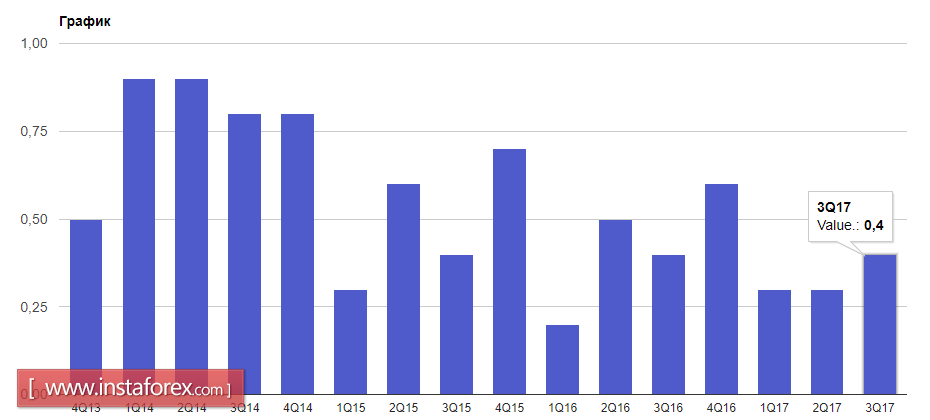

According to the National Bureau of Statistics, even preliminary, UK GDP growth in the third quarter of this year was 0.4% compared with the previous quarter and 1.6% compared with the same period last year. Economists projected growth of only 0.3%.

As for the technical picture of the GBPUSD, the break and consolidation on the daily chart above 1.3217 leaves a good potential for further growth of the pound to the highs of 1.3340 and 1.3410.