EUR / USD, GBP / USD

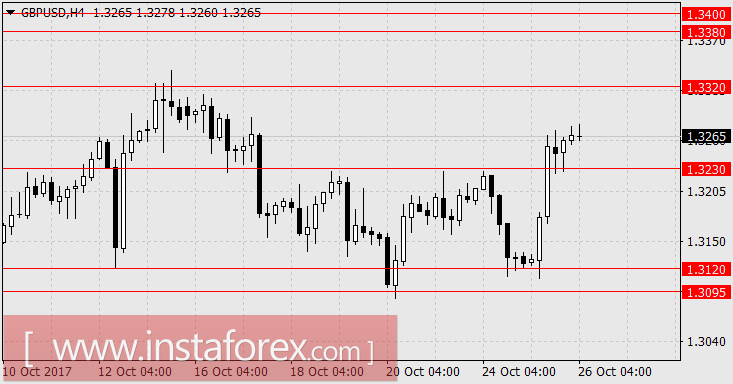

On Wednesday, the British pound once again became the star of the market. Data on GDP for the 3rd quarter surpassed the expectations of economists and the British currency jumped by 130 points. The quarterly growth of GDP was at 0.4% against expectations of 0.3%. The annual growth of the economy was at 1.5% against expectations of a weakening growth rate of 1.4% y / y. The average forecast for inflation for the next 12 months increased from 2.5% to 2.8%. Perhaps in another situation, the pound would have added less on similar data. However, investors view every positive indicator through the prism of a rate hike by the Bank of England this year and even at the next meeting.

In the euro area, the index of sentiment in German business circles Ifo for October increased from 115.3 to 116.7 against the forecast of a decline to 115.2. The index of current conditions showed a value of 124.8 against the forecast of 123.5. The index of expectations for medium-term investors was at 109.1 against the forecast of 107.3 (107.5 in September).

In the US, economic data showed enchanting optimism. It's as if there were no hurricanes or the Fed lowered the rate. The sales of new housing in September increased by 18.9%, from 561 thousand to 667 thousand, and this is the highest value since December 2007. Prices for housing have risen from 6.4% y / y to 6.6% y / y. The volume of orders for durable goods in September increased by 2.2%. The base orders index (excluding the transport component) added 0.7% against the forecast of 0.5%. Reserves of crude oil, instead of the expected decrease of 2.578 million barrels, increased by 0.856 million, which affected the decline in its cost by 0.86%. The stock market disappointed weak quarterly reports of companies (S&P 500 -0.47%) and it also affected the weakening of the dollar.

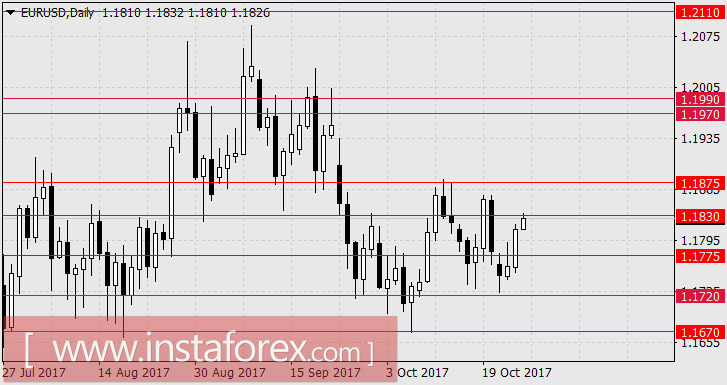

At such events, the markets approached the ECB's meeting on monetary policy in a disoriented state. In recent reviews, we have expressed concerns about the "wrong" perception of the market by the neutral and expected release of the ECB to start reducing QE. However, now these fears are increasing. The main uncertainties are: 1. Does the ECB hold a previously announced plan to cut back to 30 billion euros a month with an extension of the program for 9 months or reduce purchases to 25 billion euros? 2. Will the ECB fix the asset purchase completion date or leave the date "floating", tied to any economic factors? 3. Under what conditions or when the ECB will raise the rate? 4. Will these uncertainties be explained today, or is Draghi once again limited to general provisions, leaving the specifics for the next meeting?

The difficulty of the balance of quotations is that the EUR / USD pair is at the level of the first decade of August. This means that the markets have not yet invested these factors in prices. If we take the anti-fundamental growth of the euro from March to August by 1,300 points as the market takes into account "all factors", then the beginning of the ECB's reduction in the balance sheet can be considered fully accounted for in prices.

We are inclined to the scenario that at the meeting today, not the entire ECB's plan will be disclosed. This is in the hands of the Central Bank itself, since it will avoid higher market volatility. Under this scenario, the euro is likely to fall.

According to the UK, the publication of the balance of retail sales from the CBI for October has a forecast of 14 against 42 in September. However, after a sharp increase in this indicator, there is always a sharp drop. In the US, unfinished sales in the secondary real estate market in September may show an increase of 0.2% after the previous fall of 2.6%. The growth of warehouse stocks can grow by 0.4%.

So, for the main scenario, we assume a decrease in the euro and the pound after the ECB meeting and the commentary of Mario Draghi. Target levels are at 1.1720 and 1.1670 for the euro and a range of 1.3095-1.3120 for the pound. In case of the development of optimism, the euro is likely to grow in the range of 1.1970 / 90 and the pound's rise into the range of 1.3380-1.3400.

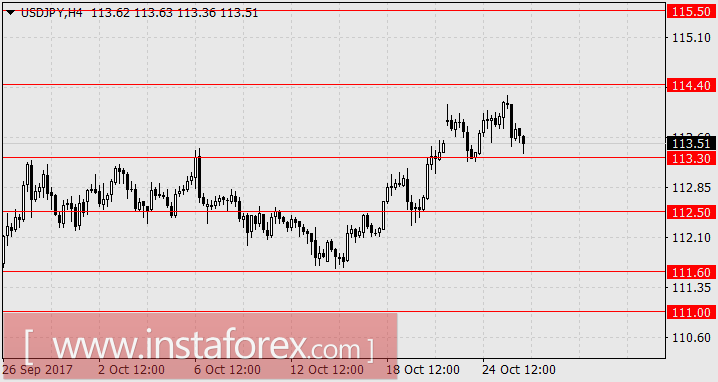

USD / JPY

According to pressure from the US stock market, the yen fell 16 points yesterday. Today, Asian markets are optimistic and the yen stopped declining. A number of Japanese corporations reported their profits and began to buy back their own shares from the market. The Nikkei 225 index added 0.19%, the Chinese Shanghai Composite grew by 0.46%, the Indonesian IDX Composite increased by 0.11. Yields on Japanese government bonds declined for the second day in a row, keeping the currency pair at the lower border of the range of 113.30-114.40.

The American market is focused on the preferences of Republican senators towards two candidates for the post of head of the Fed - John Taylor and Janet Yellen. Taylor is a traditional "hawk" (although his "hawk" manifests itself only as a correspondence of the situation). Despite his long-held view that a balanced rate of 3.75%, he is ready to extend the period of soft policy for the sake of ensuring a painless content of public debt.