On Thursday, the most important event for the world financial markets will happen and it is the result of the ECB meeting on monetary policy.

The market came to a consensus that the outcome of the ECB meeting would be to reduce the monthly volume of asset purchases from 60 billion euros to 30 billion euros. Meanwhile, it is assumed that the bank will extend these measures next year until September. The ECB will also signal that they reserve the right to change the parameters of asset purchase and the term for the curtailment of the program. It is assumed as well that the rates on the results of the meeting will be left at the previous levels. The key interest rate is at the zero mark and the deposit rate is at the level of -0.40%.

Currency traders are interested in the possible market reaction to the decision of the ECB on monetary policy. In our opinion, any hint of M. Draghi on a possible increase in the level of interest rates next year or an earlier end of the incentive program will lead to a sharp increase in the euro. This will locally add against all major currencies. At the same time, if the comment of the ECB President is showing "dovish" tones, (for example expressing high dependence of the future quantitative easing program on the dynamics of consumer prices that were stuck at 1.5% year on year in the last few months which is noticeably below the target level 2.0% set by the ECB) it will put downward pressure on the euro.

We follow the second option, where the outcome of the ECB meeting as well as M. Draghi's speech at the press conference after the announcement of the bank's resolution, will be the presentation of a balanced and cautious approach that will undoubtedly become a signal for euro sales. This is still supported by a high level of hope that the European regulator will behave more aggressively towards stopping the stimulus measures of the euro area economy.

Again, this caution can still be supported by a factor of political problems that exist in the euro area. There is the Catalan crisis, the strengthening of the positions of Eurosceptics, and the still unclear ending of the divorce of the UK with the EU.

In addition, it seems that because of this epoch-making event, the attention of investors will be drawn to the publication of the index of unfinished sales in the real estate market for September in the States. It is assumed that the indicator will show an increase of 0.2% against the August fall of 2.6%.

Forecast of the day:

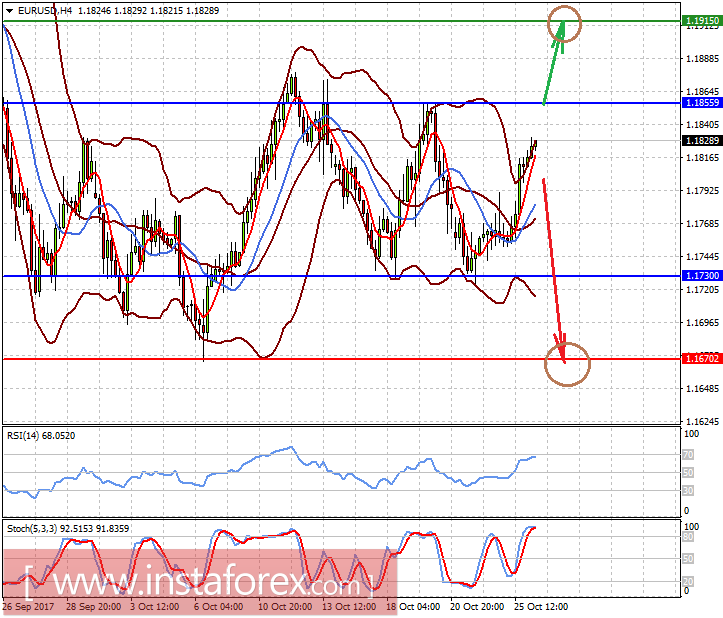

The EURUSD pair is growing before the ECB meeting on monetary policy. If the bank's statement is "tough" with respect to the prospects for incentive measures, the pair may, by breaking through level 1.1855, rise to 1.1900-15. However, it is most likely that the statement will be more restrained, which may put pressure on the pair and lead to its fall first to 1.1730 and then to 1.1670.

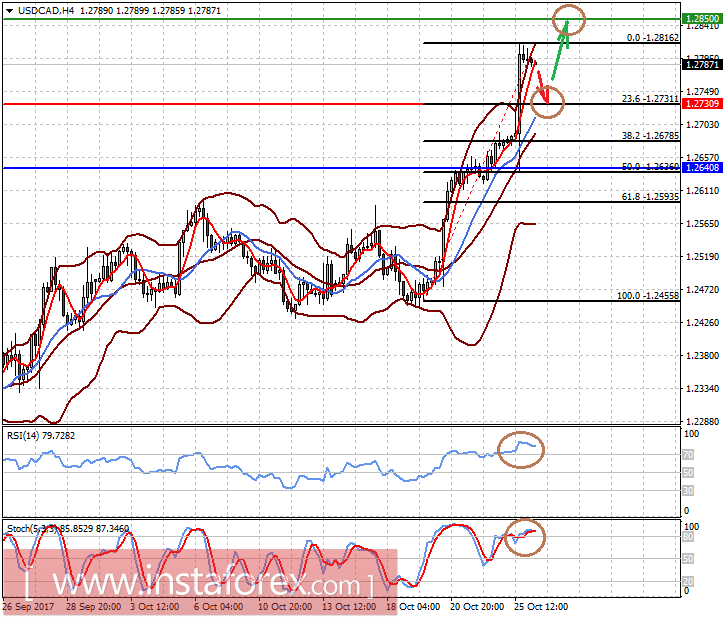

The USDCAD pair may adjust after strong growth on the eve to 1.2730. If this mark stands, then the pair will resume growth to 1.2850.