The ECB's final decision to move towards a reduction in incentive measures, looking at the dynamics of the economies of the euro area, inflation, and the labor market, had a shocking effect on the foreign exchange markets, causing a collapse of the single European currency.

Previously, a significant number of investors expected that the regulator would be more aggressive in striving to eliminate the quantitative easing program, but this did not happen. The regulator played back in the face of its leader, who in late spring and summer encouraged the markets with the possibility of ending incentive measures next year. Thus, the bank made it clear that it does not want to throw out the "child". The growth of the region's economy from the "trough", a sharp change in the economic course.

Following the meeting, the ECB left the key interest rate at the previous zero level, and the deposit at the level of 0.4%. In accordance with the decision, the bank reduced the volume of purchases of assets under the incentive program to 30 billion euros, and at the same time he decided to extend the program of quantitative easing until September next year. Also, the regulator made it clear that he could continue to buy assets after September, and, perhaps, even again increase the volume of buying up securities.

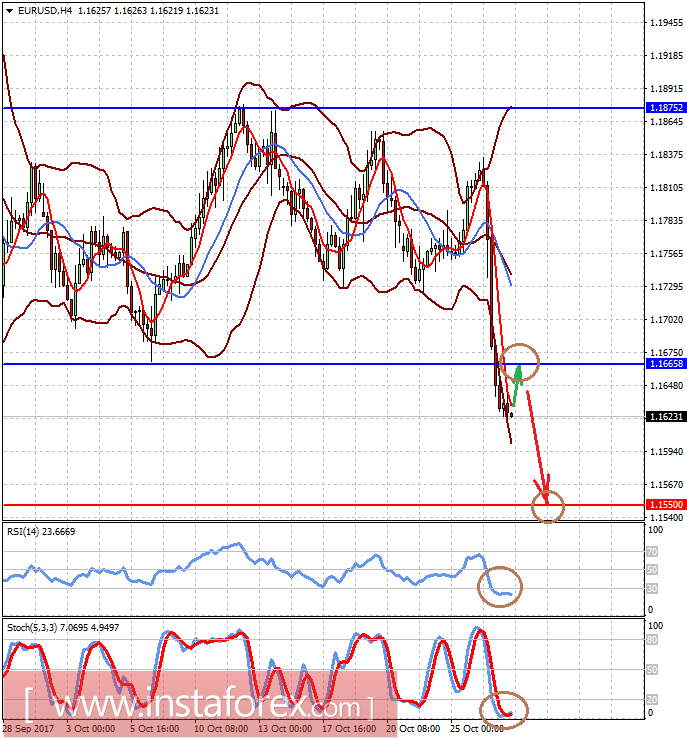

On this wave, the single European currency lost its foothold and collapsed against the US dollar below the support level of 1.1730-1.1880, in which it was in late September, pending the outcome of the elections in Germany, and then the ECB meeting on monetary policy.

Yesterday's outcome of the meeting of the European regulator coincided with our expectations. Based on the current state of affairs, we believe that the euro will continue to remain under strong pressure, as the market expectations did not coincide with the realities to which the ECB returned this Thursday.

Today, on Friday, the attention of players will already be drawn to the publication of preliminary data of US GDP for the third quarter. It is expected to drop to 2.6% against growth of 3.1% in the second quarter. It can be assumed that if the data prove to be better than the forecast, it will support the stock market in the States, as well as the US dollar rate.

Forecast of the day:

The pair EUR/USD, probably after the collapse of the day before and decline today in the Asian trading session will be adjusted upward on the wave of local oversold and partial profit-taking. But we still believe that the fall will continue to 1.1550.

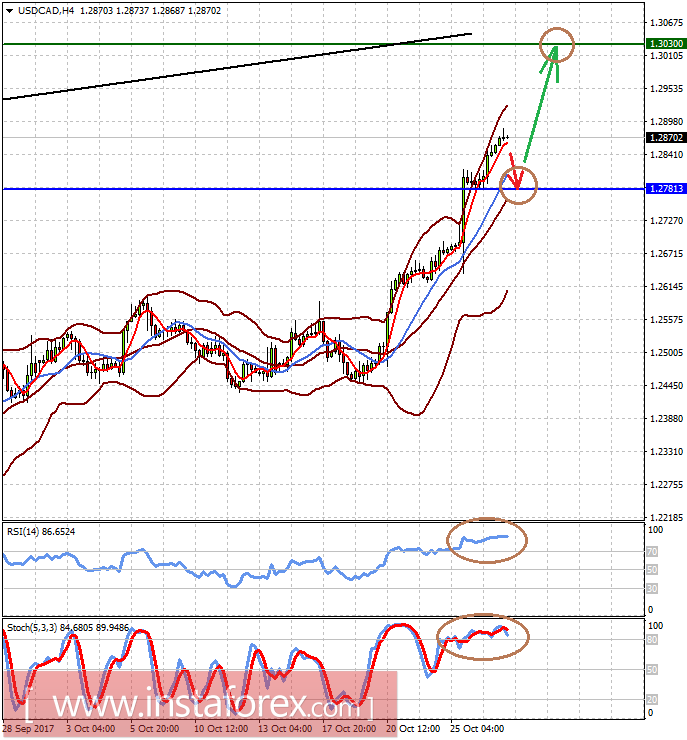

The USD/CAD pair may also adjust down to the level of 1.2780, but its growth will continue with a greater probability to 1.3030 than the decline.