The results of the October meeting of the Bank of Japan stalled the yen's growth - not only when it is paired with the US dollar, but throughout the market. In general, the regulator did not surprise markets, however, the comments of its head turned out to be so "hopelessly-soft" that the Japanese currency stopped being in demand. Although for some days, the yen is appreciated, reacting to speculations around the likely successor of Janet Yellen. However, first things first.

The main message of the day is that the money is spent on a long time. The Bank of Japan acknowledged that even with the current parameters, it would take "several years" to achieve a two-percent inflation. And though Kuroda set an approximate timeframe (the first quarter of 2020), he was clearly not sure that the regulator would reach its goal in this timeframe. Indirect confirmation of this. Thus, according to the Japanese central bank, consumer prices (excluding food products) will grow by 0.8% in the current financial year (which ends on April 1, 2018), whereas it was expected to reach 1.1%. Also, the key indicator of inflation was revised.

All this suggests that the current parameters of the monetary policy will not change in the direction of tightening for a long time. Here it is worth noting that the ruling party in Japan has recently won again in the parliamentary elections. And this, in turn, testifies to two facts: Shinzo Abe extended his mandate to the prime minister until 2022, and Haruhiko Kuroda secured himself as a second term as head of the Bank of Japan.

It is also worth noting that Abe plans to raise the sales tax rate, which will certainly lead to a slowdown in inflation in the country. Thus, Kuroda will have to stick to the soft policy and consider options for changing it only in the direction of further easing. Moreover, the first proposals on this matter have already been expressed. One of the members of the Governing Council of the Bank of Japan, Goshi Kataoka, said that the interest rate should be reduced in order to achieve the target rate. He also called for monitoring the profitability of not 10-year bonds, but 15-year bonds. Kataoka recently joined the board of governors, and so far his position was not supported by his colleagues. But if the consumer price index continues to show weak dynamics, such proposals will be heard more often.

Thus, the continuation of the "Abenomics" course, low inflation rates and "dovish" views of the majority of the Central Bank's Board of Governors (primarily Kuroda). Of course, this does not mean that the Japanese currency will only become cheaper: as a "safe haven" currency, the yen will react primarily to an external fundamental background. However, without supporting external influence, the USDJPY will return to the previous levels.

The US events will also have a significant impact on the pair. First of all is the discussion about choosing a candidate for the post of head of the Fed. As expected, a decisive announcement Donald Trump will be made this this Thursday. Several influential publications (among them Bloomberg and WSJ) reported that the new head of the Fed will be Jerome Powell. Among all the options, this is the most unacceptable scenario for dollar bulls. In general, he will continue Yellen's route, that is, pursue a liquid, cautious and prudent policy of normalizing monetary policy. Other possible candidates (John Taylor or Kevin Warsh) would have significantly stepped up this process-they are declaring a more "hawkish" stance.

Given this factor, now the dollar-yen pair is at a crossroads. On one hand, the soft rhetoric of the Japanese regulator. On the other hand, is the prospect of weakening the greenback in the light of Trump's decision. In such circumstances, it is recommended to take a wait-and-see attitude, at least until Thursday. Despite the high probability of Powell's appointment, the US president can make another decision. The stakes are too high, so volatility in all the dollar pairs will be strong enough. If it will be, the favor of the dollar.

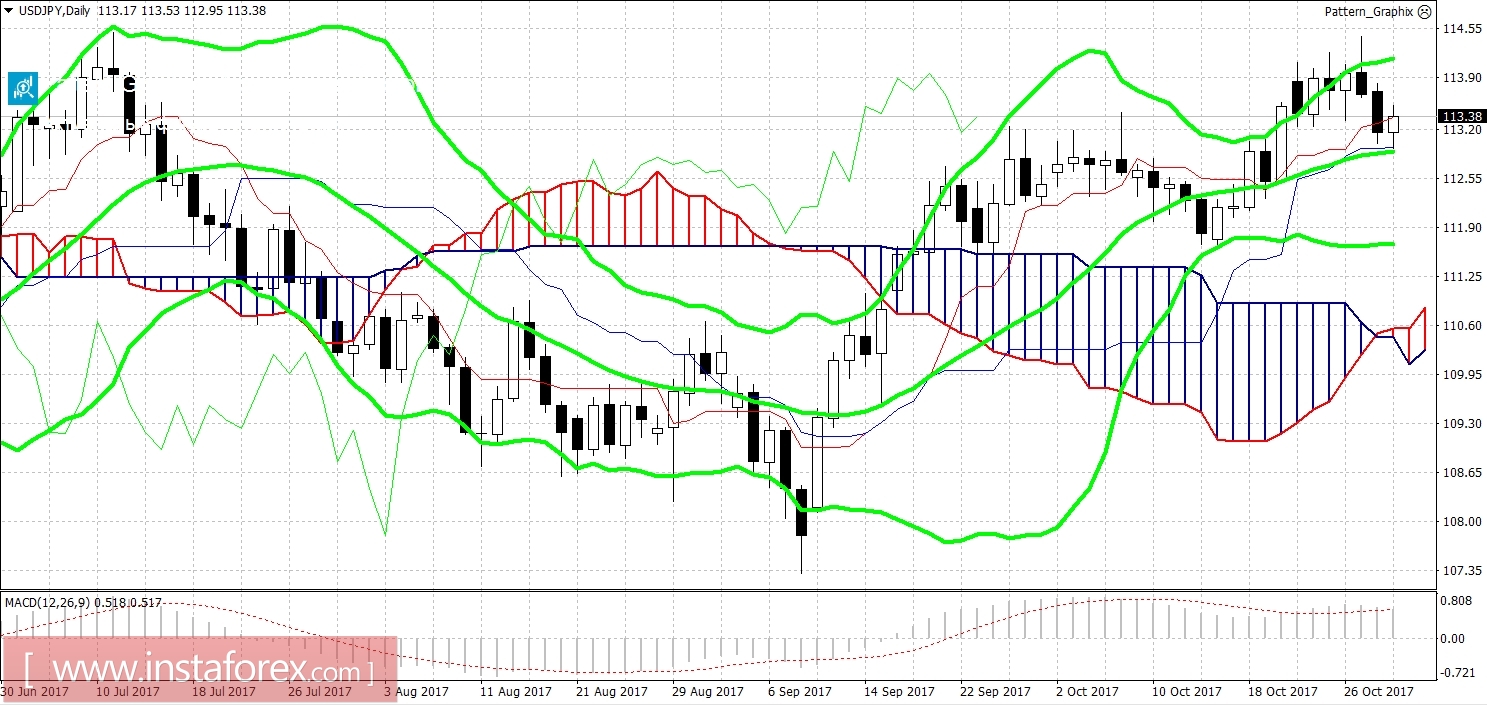

Technically, the USDJPY pair is also at a crossroads. At the moment the price is located between the middle and top lines of the Bollinger Bands indicator (on D1), which indicates the priority of the northern movement. But the other indicators do not confirm the bullish momentum. Moreover, if the pair drops below the middle line of the above indicator (that is, under the 112.95 mark), the indicator Ichimoku Kinko Hyo will generate a signal "Dead Cross", which warns of a trend change. In this case, the price will continue its fall to a strong resistance level of 111.70 (the bottom line of Bollinger Bands).