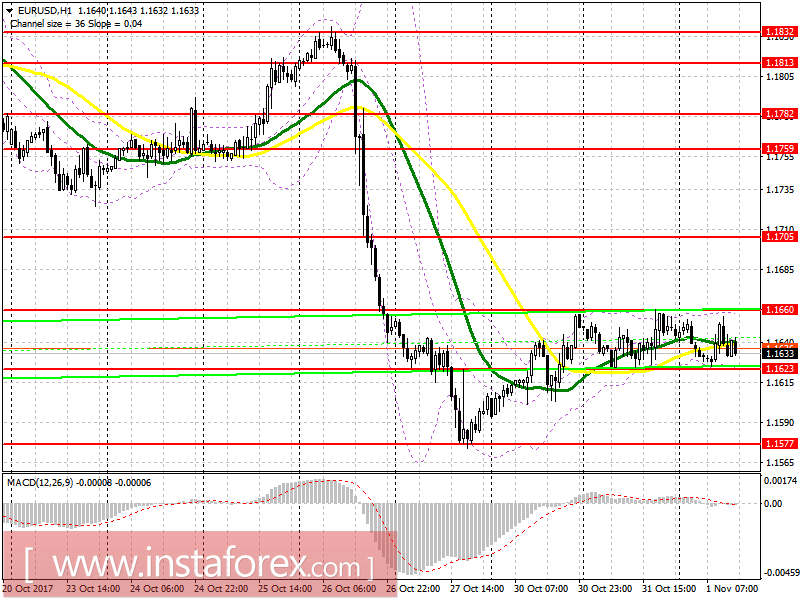

EUR/USD

To open long positions for EURUSD, it is required:

Everything will depend on the US data and the Fed statements. The consolidation above 1.1660 will provoke a higher growth of the euro towards 1.1705, where I recommend locking in profit on long positions. A breakthrough at 1.1705 could lead to a larger upward wave in the area of 1.1759. In case of a decline under 1.1623, I recommend a return to buying the euro after the formation of a false breakout at 1.1577 or on a rebound from the larger support of 1.1521.

To open short positions for EURUSD, it is required:

The breakdown and consolidation below 1.1623 will indicate the return of new sellers to the market with the first goal of the test at 1.1577 and an exit to 1.1521 by the end of the day. If the euro rises above 1.1660, I recommend selling only after updating at 1.1705 or on a rebound from 1.1759.

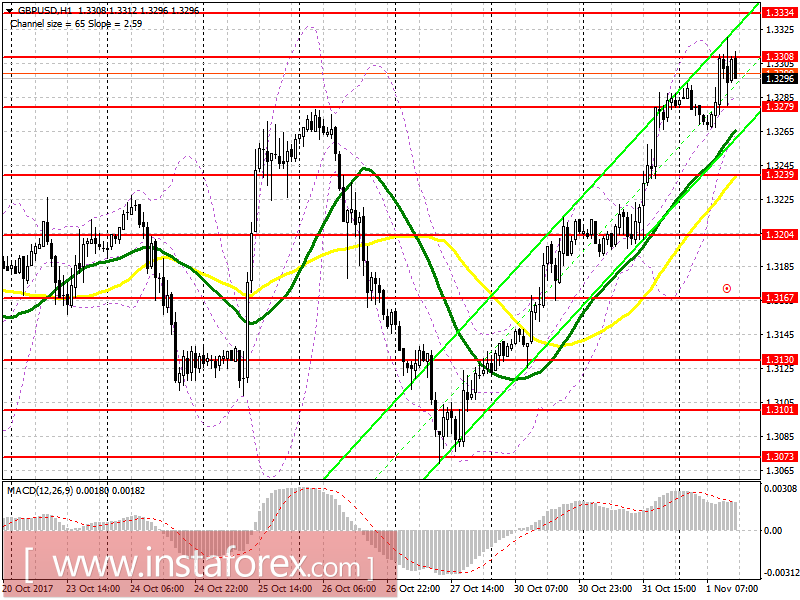

GBP/USD

To open long positions for GBP/USD, it is required:

Buyers made it to 1.3308, and currently, only at a consolidation above this level will lead to a further wave of growth with an update of 1.3334 and an exit at 1.3371, where I recommend locking in profits. In the event of a decline under the support of 1.3279, it is best to pay attention to buying only after a test at 1.3239 or on the rebound from 1.3204.

To open short positions for GBP/USD, it is required:

The sellers formed a false breakout of 1.3308, and while the trade is below this area, it is possible that the GBP/USD pair will return to the support area of 1.3279. Only a consolidation below 1.3279 could lead to a sharp selling of the pound with a return to 1.3239 and an update of 1.3204.

Indicator description

- Moving Average (average sliding) 50 days - yellow

- Moving Average (average sliding) 30 days - green

- MACD: fast EMA 12, slow EMA 26, SMA

- Bollinger Bands 20