EUR/USD, GBP/USD

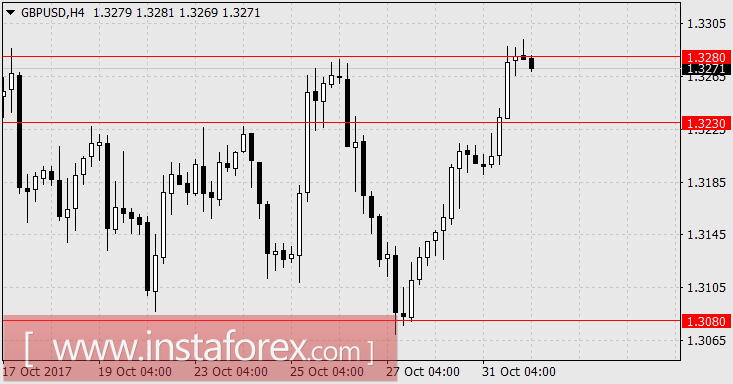

Ahead of the Bank of England's decision on the rate that is set to be announced on Thursday, the pound jumped by 74 points, due to the statements of Brexit negotiators - from the EU Michel Barnier and from the UK David Davis about the readiness to accelerate the negotiation process. The eurozone showed good results. Consumer spending in France increased in September by 0.9%, the unemployment rate in the eurozone for September was 8.9% against the forecast of 9.0% and the indicator for August was revised downward from 9.1% to 9.0%. Eurozone GDP for the third quarter in the preliminary estimate was 0.6% against the forecast of 0.5%. However, the euro could not develop an offensive stance due to weakened inflation indicators and no less good data from the US. The basic CPI of the euro area for October fell from 1.1% y/y to 0.9% y/y, the total CPI fell from 1.5% y/y to 1.4% y/y, with expectations for both indicators left unchanged . In the US, the index of business activity in the manufacturing sector of the Chicago region for October increased from 65.2 to 66.2, against the expectation of a decline to 60.2. The index of consumer confidence from the Conference Board for the same period increased from 120.6 to 125.9. The S&P/Case-Shiller home price index in the country's 20 largest cities in August increased from 5.8% y/y to 5.9% y/y.

The development of the main events will depend on the US session, since no news is planned for the euro zone. At 11:15 London time, the number of jobs in the private sector from ADP in October is set to be released, with a forecast of 202,000 against 135,000 in September. The index of business activity in the manufacturing sector (Manufacturing PMI) from the company Markit for October in its final estimate is forecasted to be unchanged at 54.5 points, according to the Institute of ISM, the indicator may fall from 60.8 to 59.5. Construction costs for September are expected to decrease by 0.1% after rising 0.5% earlier. At 17:00, the Fed will publish the release of its report following a two-day meeting of the FOMC. Changes are not expected, but investors are waiting for the Central Bank to confirm its intention to raise the rate in December. The expectation of such an increase is at 96.2% in December.

We are waiting for the euro to return to the lower limit of the 1.1580-1.1670 range, pound sterling is expected to trade in the range of 1.3230/80.

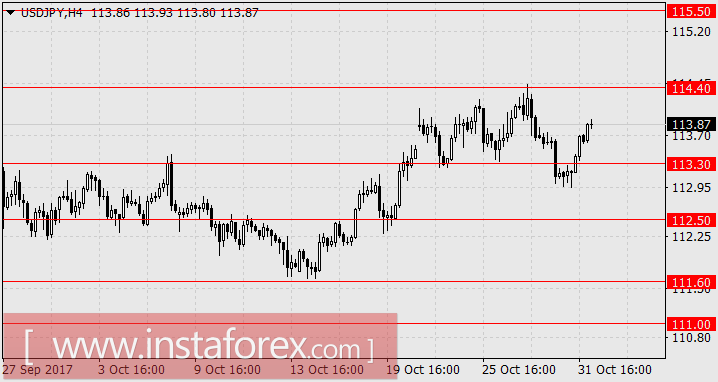

USD/JPY

On Tuesday, the Bank of Japan's meeting was held, at which the current soft policy was confirmed without hints of limiting it. The central bank lowered inflation forecasts, which was a confirmation of such plans. The subsequent speech of the head of the Central Bank, Haruhiko Kuroda, once again reiterated the policy of continuing a powerful softening. Verbal events proved to be so strong that they did not pay attention to a decline of industrial production in September by 1.1%. Household expenses decreased by 0.3% against expectations of an increase of 0.7%. The number of bookings of new houses in September decreased by 2.9% after -2.0% in August. Unemployment remained at 2.8%. As for the forecasts of the Bank of Japan, inflation for 2018/19 is expected to be 1.4% against 1.5% earlier. For the current fiscal year, it decreased from 1.1% to 0.8%.

Recent economic indicators were pleasing: the final estimate of Manufacturing PMI for October had increased from 52.5 to 52.8. In general, Japanese investors will focus on developments in the US, since even Kuroda recent speech attributed the weakening of the yen to the growth of the US economy and the growth of rates in the US.

Prime Minister Shinzo Abe is forming a new government. This is a favorable sentiment for investors, who are optimistic about the future - the Nikkei 225 had increased by 1.36%. We are waiting for the yen at 115.50.