"Buy on the rumor, sell on the facts" - this principle of trade is now actively implemented by the pound/dollar traders. True, it is only going to buy British currency, but the question of short positions will be decided upon the results of tomorrow's meeting of the Bank of England.

The British currency is growing on expectations of an increase in the interest rate. The likelihood of such a decision was talked about for a long time, as soon as inflation in Britain overcame the target two-percent threshold. This was mentioned by Mark Carney himself, who hinted the rate hike. It would seem that this issue was already predetermined, but in October in Britain, very disappointing statistics were published - inflationary growth slowed, and key sectors of the economy showed a decline. Against the backdrop of failure talks on Brexit, such weak numbers provoked pessimism among traders. The pound, paired with the dollar, fell to the middle of the 30th figure, but the bears failed to break through the strong resistance level 1.3060 to take the price lower to the area of 20 figures.

Moreover, at the beginning of this week, the British pound received a strong enough momentum for its growth. The reason is very trivial: rumors of an increase in the rate at the November meeting returned to the market. According to various sources, 7 to 9 members of the regulator will vote for toughening of monetary policy tomorrow. The probability of an increase in the rate by 25 basis points is already 90%, but the dynamics of tomorrow's trading will affect not only the fact of the increase. The main intrigue lies in the further actions of the central bank. On this issue, the views of foreign policy analysts vary.

Supporters of the "hawkish" scenario are confident that the regulator will announce the start of a cycle of normalizing monetary policy tomorrow. The first signal to this will be the unanimous vote for the rate hike. Despite some slowdown in inflationary growth, this indicator is still at a sufficiently high level, which allows talking about further steps to tighten monetary conditions.

Another argument that may indirectly affect the "hawk" position of the regulator is the state of the real estate market. According to Nationwide, the October house price index in Britain fell to 0.2% (on a monthly basis), but in annual terms, the index rose by 2.5% after a similar growth in September. Also, the oil prices can influence the resolve of the Bank of England. The per-barrel price of Brent crude oil has risen and is above $60. This suggests that the British inflation will again increase in the coming months against the backdrop of rising producer costs for raw materials.

But supporters of a softer scenario doubt that the English regulator will decide on the beginning of a full-scale cycle of tightening monetary policy in the country. It should be noted the rate was lowered last summer after a historic referendum on the country's withdrawal from the EU (before that it was at the level of 0.5% for 7 years). Many economists and politicians called this step reckless and premature. Therefore, it is likely that the rate increase at tomorrow's meeting will be a kind of "correction of mistakes", without any further prospects. The regulator simply returns to the previous level and proceeds from the current situation.

In my view, this is the most realistic scenario. Although the UK GDP growth exceeded forecasts, it came out on a rather modest level (0.4% q/q), while the PMI index in the construction sector fell under the key 50 mark (for the first time since July last year). It is also worth recalling the recent comments of the Bank of England Deputy Chairman Jon Cunliffe, who stated that now there is no need to raise the rate "as quickly as before the crisis" (until 2008 there was a period when the rate was twice raised at intervals of one month). Of course, these words can be interpreted in different ways, however, supporters of the "dovish" scenario believe that the Bank of England will take a pause at least until the spring of next year after the first increase. And although Mark Carney will not voice any time frame, he can state that the regulator will not stick to the given trajectory and will proceed from the current economic situation. In the context of complex Brexit negotiations, such statement will look logical.

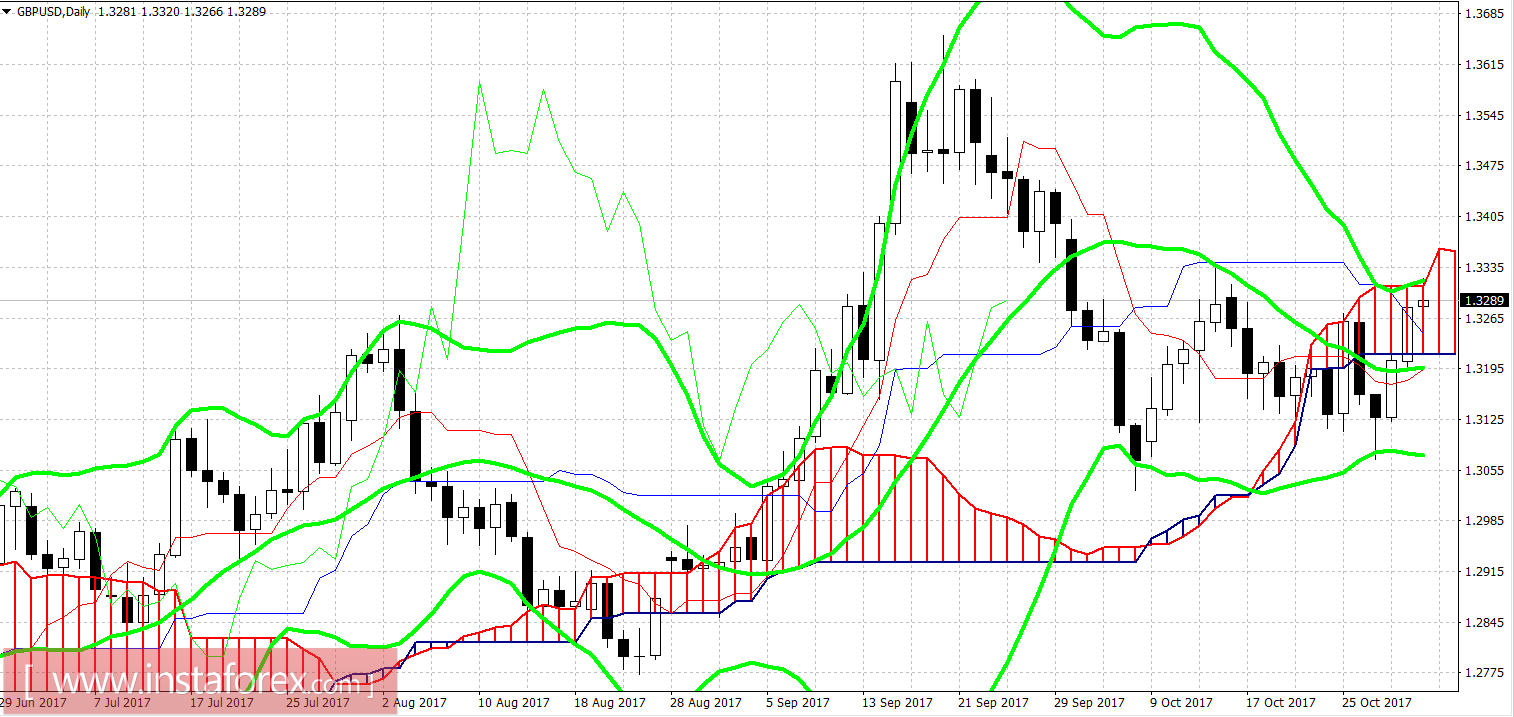

Thus, the vector motion of the GBPUSD pair will depend on how long the November meeting of the regulator will take place. At the moment, technical analysis suggests preconditions for further price growth: on the daily chart, the pair is between the middle and top lines of the Bollinger Bands indicator, and the nearest resistance level is at 1.3360 (the upper limit of the Kumo cloud on D1). But if Mark Carney's soft comments disappoints traders, the pair will plunge down to re-testing the level 1.3060 (the bottom line of the Bollinger Bands indicator). In case the most unlikely scenario is realized (the rate will not be increased), the pair will break through the above support level and stabilize it in the 29th figure.