On Wednesday morning, the pound managed to reach new weekly highs against the US dollar after the release of good data on the PMI index for the manufacturing sector.

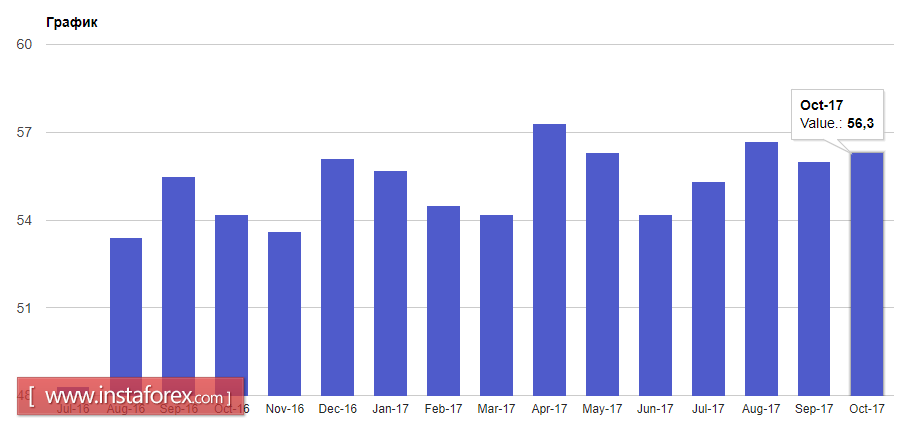

According to the IHS Markit report, the purchasing managers' index for the UK manufacturing sector increased to 56.3 in October from 56.0 points in September of this year. The data was stronger than the forecasts of economists, who expected the production sector to fall to 55.9 points.

IHS Markit stated that production and new orders continued to grow at a rapid pace, while price pressures remain high.

Such data will undoubtedly be reflected in the Bank of England's decision, as the central bank considers raising the interest rate for the first time since 2007. This decision will be published on Thursday.

UK house price growth increased in October of this year compared to the previous month. According to the Nationwide report, prices rose 0.2% after rising 0.4% in September. Compared to October 2016, prices increased by 2.5%, exceeding the forecast of economists.

The strengthening the US dollar ahead of the opening of the North American session contributed to good data on hiring in the private sector of the US, the pace of which has significantly accelerated in October of this year.

According to a report from Automatic Data Processing Inc. in partnership with Moody's Analytics, the number of new jobs in the private sector of the US in October 2017 turned out to be at the level of 235,000, whereas economists forecasted an increase of 190,000 jobs. The number of new jobs for August was revised downwards to 110,000.

On Wednesday evening, all the attention will be focused on the Fed meeting. Many experts and traders expect policymakers to unlikely change the key interest rate. Another question is whether the central bank will confirm its willingness to hike the cost of borrowing before the end of this year. The downside is also the fact that after the meeting of the central bank, Janet Yellen does not have a scheduled conference. Therefore, you will not be able to count on more open comments.

As for the technical picture of the EURUSD pair, a slight strengthening of the US dollar and a way out of the lateral channel at 1.1620-1.1660, which is observed throughout the week, indicates the likely continuation of the strengthening of the US dollar against the euro after the day's publication of the Fed decision.