Dear colleagues.

For the EUR / USD pair, the range of 1.1676 - 1.1701 is the key support for the downward structure. For the GBP / USD pair, the price canceled the formation of the upward structure from October 26. The continuation of the downward movement is expected after the breakdown of 1.2988. For the USD / CHF pair, the upward movement is expected after the breakdown of 1.0005, while the price is in correction. For the USD / JPY pair, the continuation of the upward movement is expected after the breakdown of 114.12. For the EUR / JPY pair, the situation has entered the equilibrium state. For the GBP / JPY pair, we follow the formation of the downward structure of November 1.

The forecast for November 3:

Analytical review of currency pairs in the scale of H1:

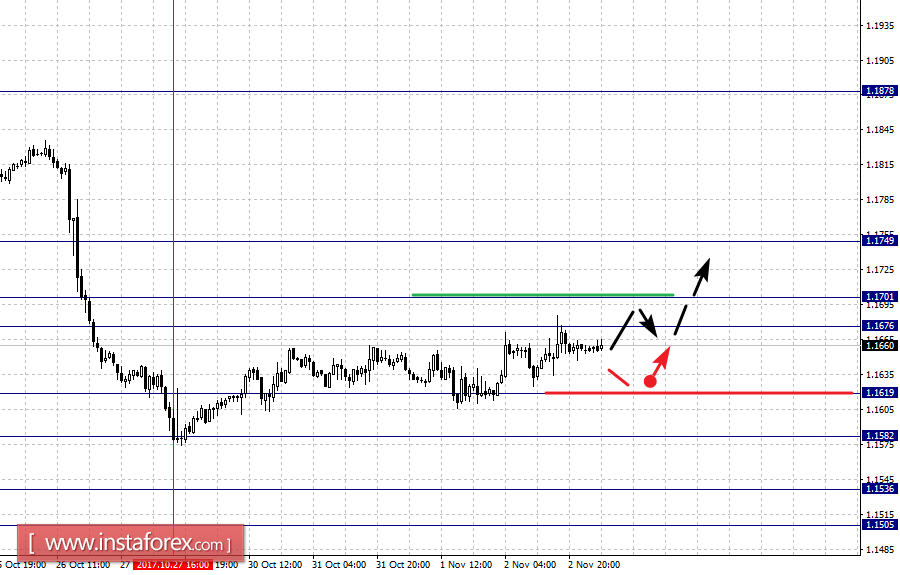

For the EUR / USD pair, the key levels on the scale of H1 are: 1.1749, 1.1701, 1.1676, 1.1619, 1.1582, 1.1536, 1.1505 and 1.1439. Here, we continue to follow the downward cycle from October 12. At the moment, the price is in correction and forms a small potential for the top of October 27. Continued downward movement is expected after the breakdown of 1.1619. In this case, the first target is 1.1582. The breakdown of this level will allow us to count on the movement towards 1.1536. In the area of 1.1536-1.1505 is the consolidation of the price. The potential value for the bottom is the level of 1.1439, upon reaching which we expect a pullback upward.

Short-term upward movement is possible in the area of 1.1676 - 1.1700. A breakout at the last reading will lead to the movement towards the level of 1.1749. Near this level we expect the consolidation of the price.

The main trend is the downward structure from October 12, the correction stage.

Trading recommendations:

Buy: 1.1676 Take profit: 1.1700

Buy: 1.1705 Take profit: 1.1745

Sell: 1.1619 Take profit: 1.1585

Sell: 1.1578 Take profit: 1.1540

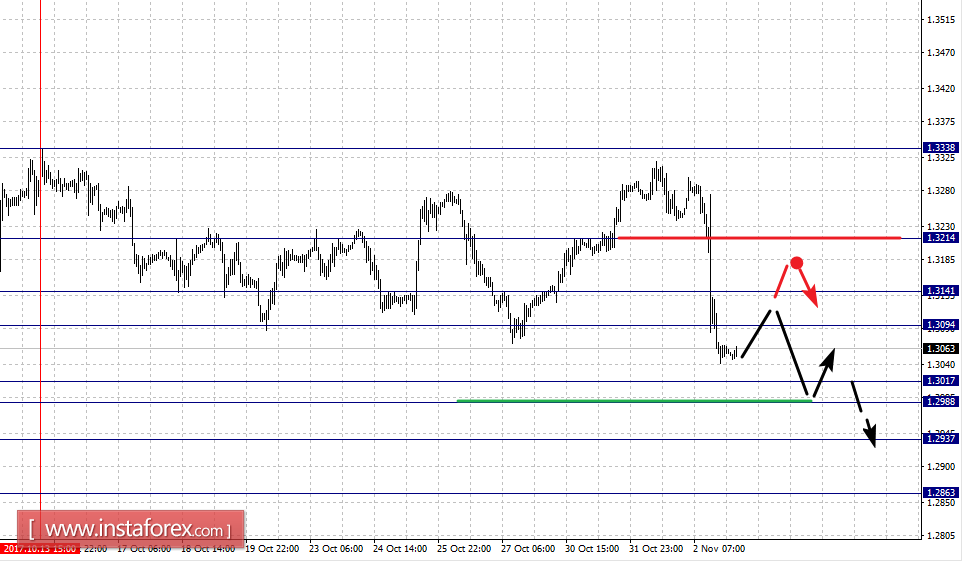

For the GBP / USD pair, the key levels on the scale of H1 are: 1.3214, 1.3141, 1.3094, 1.3017, 1.2988, 1.2937 and 1.2863. Here, the price lifted the formation of the upward structure and subsequent targets on the scale of H1 were determined from the downward structure on October 13. Continued downward movement is expected after passing the price of the noise range at 1.3017 - 1.2988. In this case, the target is 1.2937. Near this level is the consolidation of the price. The potential value for the downward movement is the level of 1.2863.

Short-term upward movement is possible in the area of 1.3094 - 1.3141. The breakdown of the last value will lead to an in-depth movement. Here, the target is 1.3214.

The main trend is the downward structure of October 13.

Trading recommendations:

Buy: 1.3095 Take profit: 1.3140

Buy: 1.3144 Take profit: 1.3212

Sell: 1.2987 Take profit: 1.2940

Sell: 1.2935 Take profit: 1.2865

For the USD / CHF pair, the key levels on the scale of H1 are: 1.0123, 1.0061, 1.0031, 0.9962, 0.9932 and 0.9890. Here, we continue to follow the development of the upward cycle of October 19. Short-term upward movement is possible in the area of 1.0031 - 1.0061. The breakdown of the last value will allow us to count on the movement towards the potential target of 1.0123, upon reaching which we expect a pullback downwards.

Short-term downward movement is possible in the area of 0.9962 - 0.9932. The breakdown of the last value will lead to in-depth correction. Here, the target is 0.9890. This level is the key support for the top.

The main trend is a local upward structure from October 19, the correction stage.

Trading recommendations:

Buy: 1.0031 Take profit: 1.0060

Buy: 1.0065 Take profit: 1.0120

Sell: 0.9960 Take profit: 0.9934

Sell: 0.9925 Take profit: 0.9900

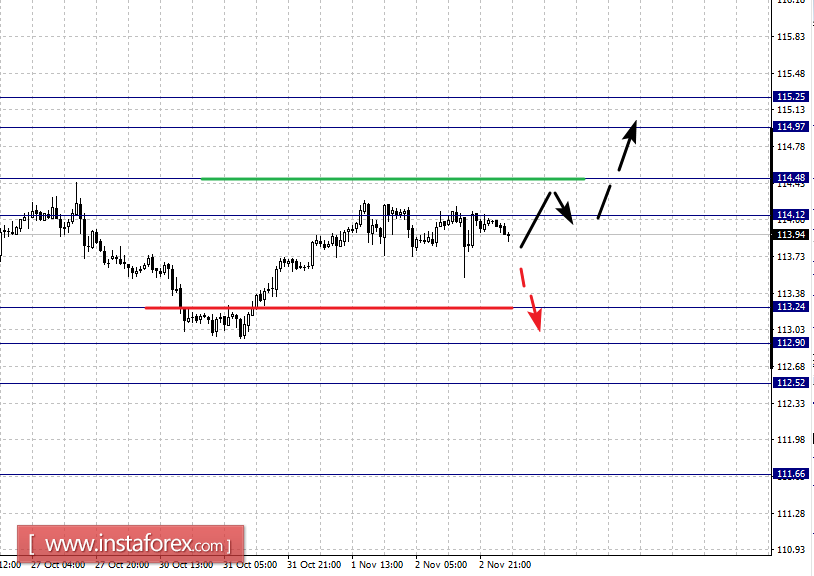

For the USD / JPY pair, the key levels on a scale are: 115.25, 114.97, 114.48, 114.12, 113.24, 112.90 and 112.52. Here, we continue to follow the upward cycle of October 16. Short-term upward movement is expected in the range of 114.12 - 114.48. A breakthrough in the level of 114.50 should be accompanied by a pronounced upward movement. Here, the target is 114.97. The potential value for the top is the level of 115.25, from which we expect a pullback downwards.

Short-term downward movement is possible in the area of 113.24 - 112.90. The breakdown of the last value will lead to the development of a downward structure. Here, the target is 112.52.

The main trend is the upward cycle of October 16.

Trading recommendations:

Buy: 114.12 Take profit: 114.44

Buy: 114.50 Take profit: 114.95

Sell: 113.22 Take profit: 112.95

Sell: 112.88 Take profit: 112.55

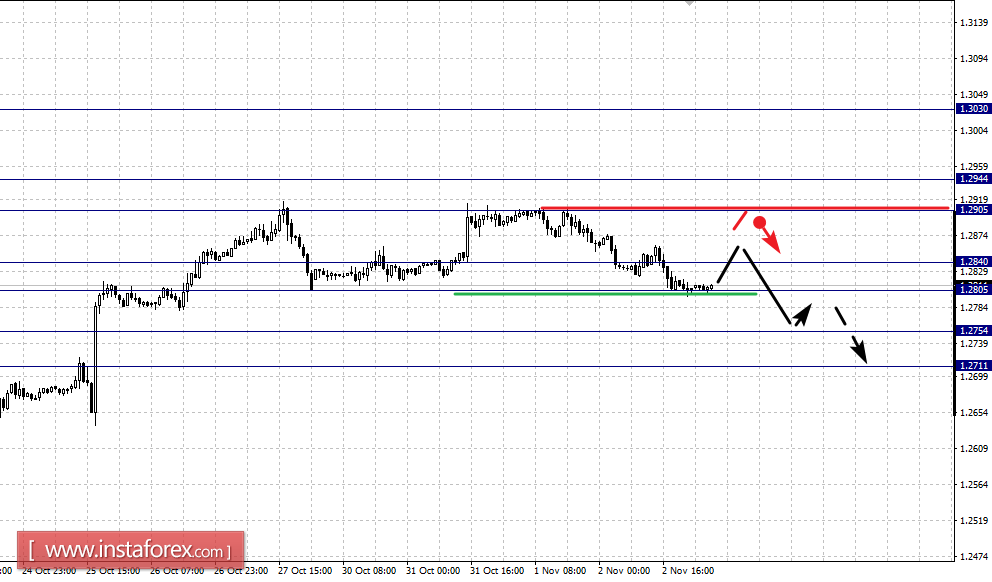

For the CAD / USD pair, the key levels on the H1 scale are: 1.3030, 1.2944, 1.2905, 1.2840, 1.2805, 1.2755 and 1.2711. Here, we continue to follow the development of the upward structure of October 19. Continued upward movement is expected after the breakdown of 1.2905. In this case, the target is 1.2944. In this range is the consolidation of the price. A breakthrough of the level of 1.2945 will allow us to count on the movement towards the potential target of 1.3030.

Short-term downward movement is possible in the area of 1.2840 - 1.2805. The breakdown of the last value will lead to in-depth movement. Here, the target is 1.2755. This level is the key support for the top. Its breakdown will lead to the formation of the initial conditions for the downward cycle.

The main trend is the upward structure of October 19.

Trading recommendations:

Buy: 1.2905 Take profit: 1.2940

Buy: 1.2946 Take profit: 1.3030

Sell: 1.2800 Take profit: 1.2755

Sell: 1.2750 Take profit: 1.2715

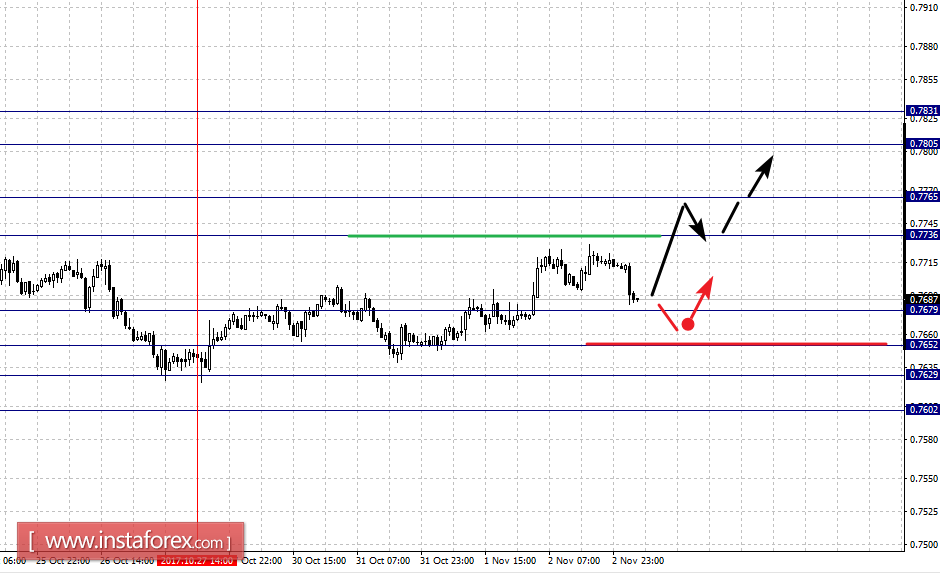

For the AUD / USD pair, the key levels on the scale of H1 are: 0.7831, 0.7805, 0.7765, 0.7736, 0.7679, 0.7652, 0.7629 and 0.7602. Here, we continue to follow the downward structure from October 19. At the moment, the price is in correction. Continued upward movement is expected after the breakdown of 0.7736. In this case, the target is 0.7765. The breakdown of this level should be accompanied by a pronounced movement to the level of 0.7805. The potential value for the top is the level of 0.7831, from which we expect a pullback downwards.

Short-term downward movement is possible in the area of 0.7679 - 0.7652. The breakdown of the last value will lead to the development of the downward structure. In this case, the target is 0.7629. The potential value for the bottom is still the level of 0.7602 where we expect the initial conditions to be formalized.

The main trend is a downward local structure from October 19, the correction stage.

Trading recommendations:

Buy: 0.7736 Take profit: 0.7762

Buy: 0.7767 Take profit: 0.7805

Sell: 0.7675 Take profit: 0.7655

Sell: 0.7650 Take profit: 0.7630

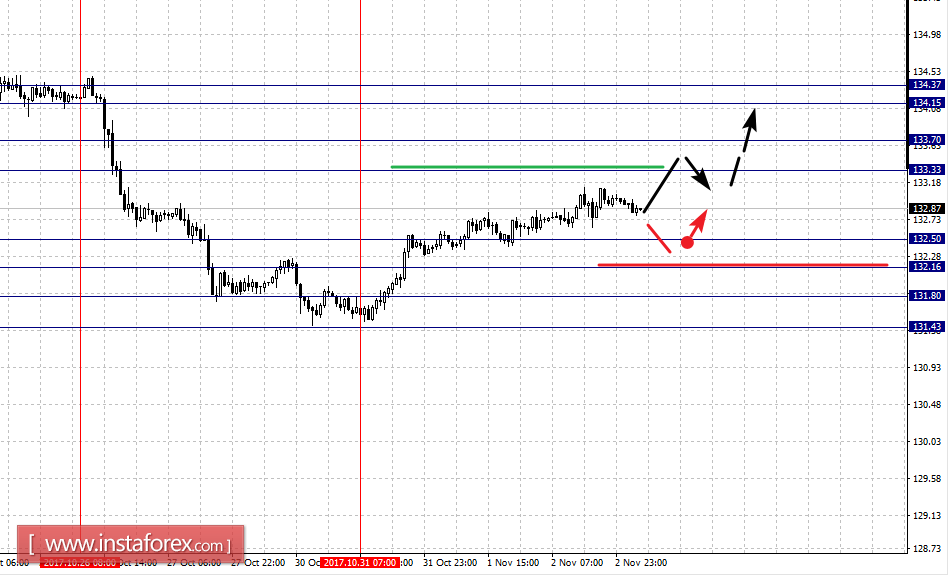

For the EUR / JPY pair, the key levels on the scale of H1 are: 134.37, 134.15, 133.70, 133.33, 132.50, 132.16, 131.80 and 131.43. Here, the continuation of the development of the upward structure of October 31 is possible after the breakdown of 133.33. In this case, the target is 133.70. In this area is the consolidation of the price. The breakthrough of the level of 133.70, will allow us to count on the movement towards the potential target of 134.37, upon reaching which we expect consolidated movement and also a pullback downwards.

Short-term downward movement is possible in the area of 132.50 - 132.16. The breakdown of the last value will lead to in-depth correction. Here, the target is 131.80. This level is the key resistance for the development of the downward structure. Its breakdown will allow us to count on the movement towards 131.43.

The main trend is the equilibrium situation: a downward structure from October 26 and the formation of an upward potential from October 31.

Trading recommendations:

Buy: 133.35 Take profit: 133.70

Buy: 133.75 Take profit: 134.15

Sell: 132.50 Take profit: 132.25

Sell: 132.14 Take profit: 131.83

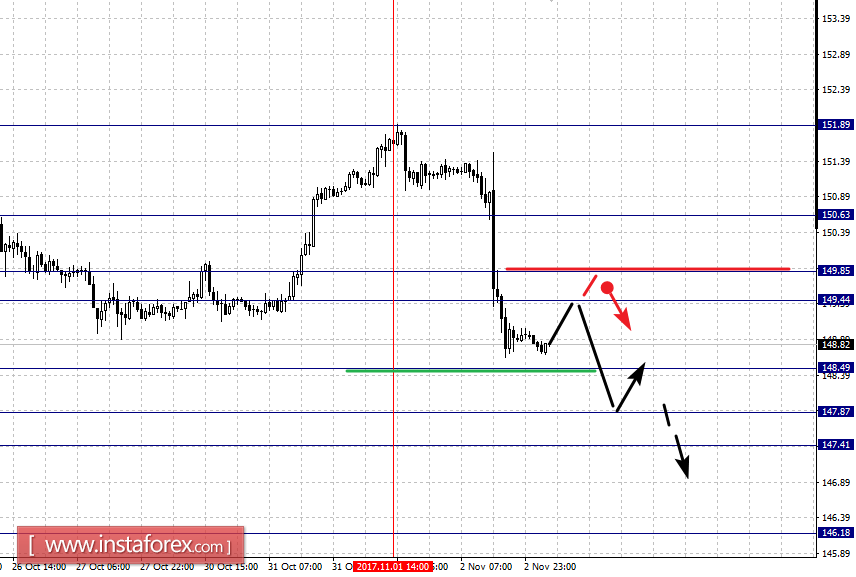

For the GBP / JPY pair, the key levels on the scale of H1 are: 150.63, 149.85, 149.44, 148.49, 147.87, 147.41 and 146.18. Here, we follow the formation of a downward structure from November 1. Continued downward movement is expected after the breakdown of 148.49. In this case, the target is 147.87. In the area of 147.87 - 147.41 is the consolidation of the price. A breakthrough at the level of 147.40 should be accompanied by a pronounced downward movement. Here, the target is 146.18. From this level we expect a pullback upward.

Short-term upward movement is possible in the area of 149.45 - 149.83. The breakdown of the last value will lead to in-depth movement. Here, the target is 150.63. This level is the key support for the bottom.

The main trend is the formation of a downward structure from November 1.

Trading recommendations:

Buy: 149.45 Take profit: 149.80

Buy: 149.80 Take profit: 150.45

Sell: 148.49 Take profit: 147.95

Sell: 147.40 Take profit: 146.40