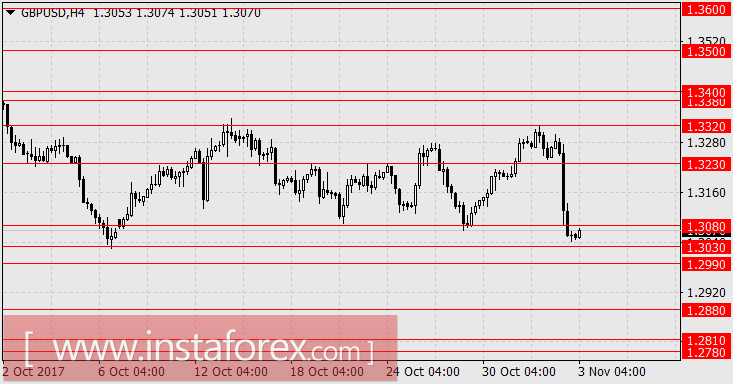

EUR / USD, GBP / USD

So on Thursday, the Bank of England raised the base rate from 0.25% to 0.50% by seven votes against two from the members of the Monetary Policy Committee with the expectations of six votes against three. Investors did not start to bring the pound up and immediately began to sell it. No one saw the optimism in the decision of the Bank of England. The Central Bank expects the inflation target of 2% to be possible only by 2020. Economic growth for the current year is estimated at 1.5% versus 1.75% two months ago. It is assumed that the next rate increase will be in only a year and a half. The pound fell by 184 points.

In the eurozone, the Manufacturing PMI with the final estimate for October was lowered to 58.5 from 58.6. In the United States, the weekly number of applications for unemployment benefits fell from 234 thousand to 229 thousand, which is already lower than the time before the hurricanes. Labor costs in the third quarter increased by 0.5% against 0.3% in the second quarter. The level of productivity in the non-agricultural sector during the same period increased by 3.0% against the forecast of 2.4%. All this gives grounds to look with optimism at today's data on work. The forecast for Non-Farm Employment Change for October is 310-312 thousand.

All day, the plan on tax reform, which "casually" got in the hands of the mass media, was discussed. There was nothing new in it and disputes were about the degree of probability of its adoption by Congress and in what final form will it be implemented. On these disputes, the euro added 40 points. In the evening, Donald Trump announced the name of the new Fed president, Jerome Powell. The Senate still has to approve this. Although Powell is similar to Yellen in their attitude towards monetary policy, Trump managed to make it about another thing. It seems that he emphasized a different aspect which is his approval on appointing a person to a key post from the camp of Republicans and still satisfying the Democrats. However, this is an illusory victory. The fact is that Powell worked in banks sponsored by Democrats such as Dillon, Salomon Brothers (bought by Morgan Stanley), Carlyle Group, and Read & Co. He then was enlisted in the team of Barack Obama. He also entered into the Federal Reserve under the pressure of the party top. At the same time, there is no information about Powell's actual belonging to any party. The control of the FRS over Trump was not received and this is the main news for investors. Now, we can expect a prompt review, adjustment, and adoption of the tax reform by the Congress, which again, will have a favorable effect on the dollar.

The US trade balance for September is expected to be at -43.3 billion dollars against -42.4 billion in August. The expectation is generally slightly worse than the average September values. However, the figure is easily attributed to hurricanes. The index of business activity in the US non-manufacturing sector for October is expected to decrease from 59.8 to 58.5 but the volume of factory orders for September is expected to increase by 1.3%.

In the UK, the October PMI Services is expected to fall from 53.6 to 53.3. We are waiting for a broad dollar offensive. The target for the euro is 1.1510. For the British pound, it is 1.2880 with the range at 1.2780-1.2810.

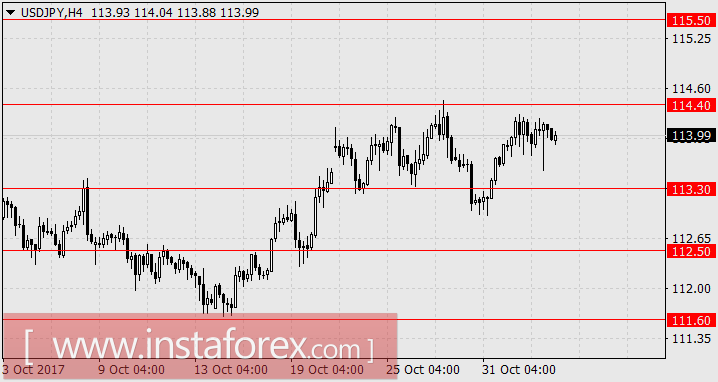

USD / JPY

Today, it is a day off in Japan. Yesterday, the Nikkei 225 stock index added 0.53%. The yen was down 10 points due to the weakening of the pound and the Canadian dollar while a number of other major currencies were strengthening. In particular, Australia's trade balance for September amounted to 1.75 billion dollars against the forecast of 1.42 billion while the "Aussie" increased by 37 points. The index of consumer confidence in Japan over the past month increased from 43.9 to 44.5. The stock indices of the APR are traded in different directions but this should not embarrass investors because the growth of the dollar will lead to an optimistic sentiment on the yen. At the moment, yields on US government bonds are falling. Although, they are in the range of Tuesday meaning it will not give full confidence.

We are waiting for the yen to rise to 115.50.