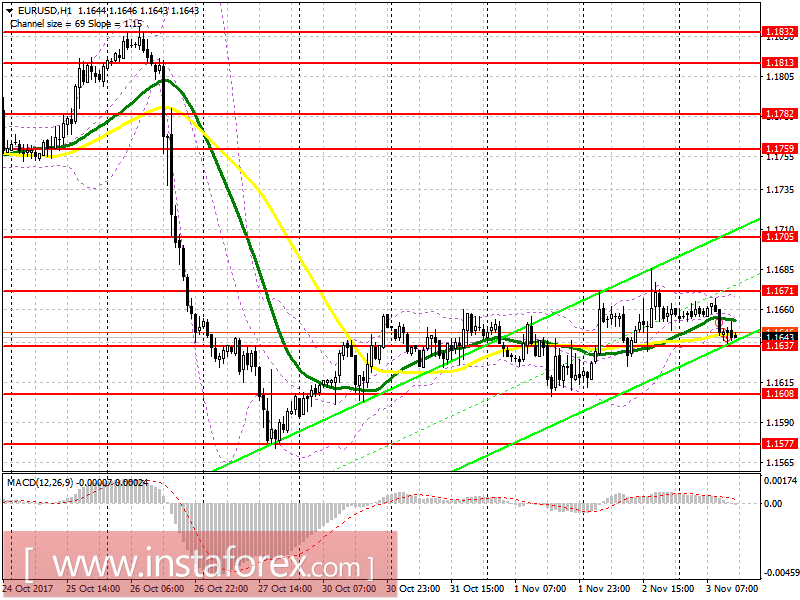

EUR/USD

To open long positions for EURUSD, it is required:

In order for the euro to grow, buyers need to form a false breakout and return to the level of 1.1637, which will serve as a good signal to increase long positions. In the event of a decline below the level of 1.1637, I recommend that you return to buying the EUR/USD pair only after updating 1.1608. A fastening above 1.1671 will also lead to a more powerful upward movement in the area of 1.1705.

To open short positions for EURUSD, it is required:

A break and consolidation below 1.1637 on good data on the US labor market will lead to a new wave of decline in the euro with an update of 1.1608 and an exit to the weekly low around 1.1577, where I recommend locking in profits. If the euro rises above 1.1671, it's best to return to a rebound from 1.1705.

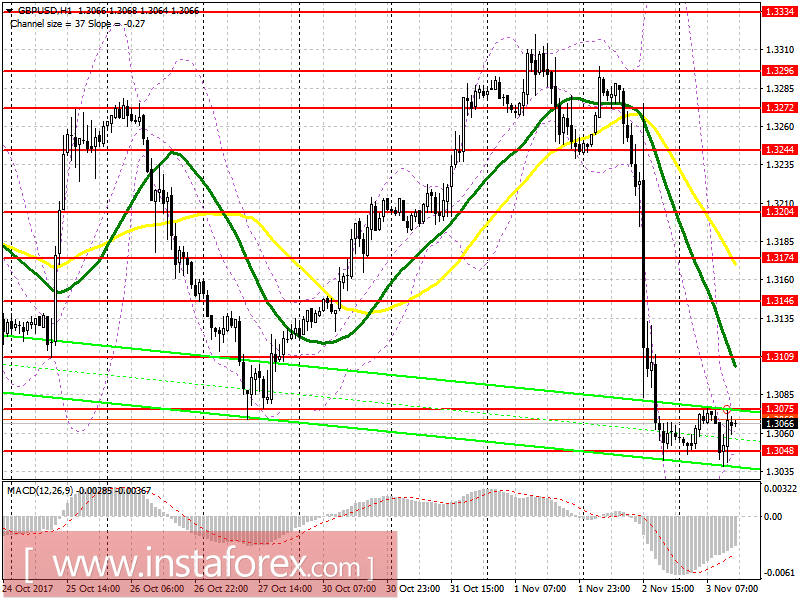

GBP/USD

To open long positions for GBP/USD, it is required:

A divergence for the pound occurred in the morning and now buyers expect a break and consolidation above 1.3075, which will lead to an increase to the area of 1.3109. However, the upward potential may also be limited and the 30-day moving average is at 1.3095. In case of an unsuccessful fastening to 1.3075, I recommend that you go back to buying in the support area of 1.3040.

To open short positions for GBP/USD, it is required:

Sellers will return to the market after updating the 30-day moving average or immediately after the test of a large resistance at 1.3109. Failure to consolidate and return to a support level of 1.3075 may lead to a new wave of selling in the pound and also a renewal of weekly lows around 1.3041 with an exit at 1.3022 and 1.2996.

Indicator description

- Moving Average (average sliding) 50 days - yellow

- Moving Average (average sliding) 30 days - green

- MACD: fast EMA 12, slow EMA 26, SMA

- Bollinger Bands 20