The euro, the British pound, and the Australian dollar currencies declined at the beginning of the new week. The Labor data from U.S. for the month of October has come out positively.

EUR / USD and GBP / USD pairs

The Labor data from U.S. for the month of October has come out positively. The number of jobs outside the agricultural sector was 261,000 when revised for a September increase from -33 to 18,000. The consensus forecast was 311,000. The unemployment rate dropped from 4.2% to 4.1%, but at the expense of a decrease in the proportion of the economically active population. The average hourly wage against the 0.2% growth forecast showed a zero change. The ISM Non-Manufacturing PMI for October increased from 59.8 to 60.1 against expectations of deterioration to 58.5. Factory orders for September added 1.4% against the forecast of 1.3%. The data from the euro area was not available while the PMI services from the U.K. jumped from 53.6 to 55.6. This helped the pound to close the day by 17 points. The euro fell by 52 points.

In the euro area, the September volume of industrial orders from Germany is expected to be released today. There will also be the final evaluation of the PMI Services in the euro area for October and the forecast remains unchanged at 54.9. The producer price index of the eurozone can add 0.4%, and the index of investor confidence from Sentix from 29.7 to 31.2. However, I think that a weak set of data cannot neutralize the momentum set on Friday.

For today, there will be an important event as the Vice-President of the Federal Reserve Bank William Dudley will have his speech at 16.10 London time. He will discuss topics about the financial crisis. The investors are waiting for the main news whether he will resign. At the same time, if he will leave the Fed, he has to release the post of chairman of the Federal Reserve Bank of New York when he retires. In any case, this is not earlier than spring-summer next year.

Venezuela announced that paying external debt is not possible where there should have been a payment of $ 1.2 billion on Friday). President Maduro is trying to agree on a debt restructuring, but this was hampered by sanctions. In fact, this is bankruptcy and how it will be solved will only be known in the future. In another side, this is a strengthening factor for the dollar.

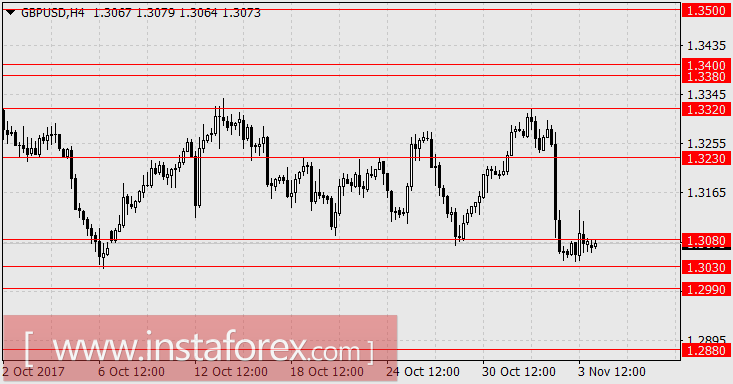

The euro is anticipated to range in the area of 1.1485-1.1510 and the sterling pound is expected to overcome the area of 1.2990-1.3030 which near the level of 1.2880.

AUD / USD pair

On Friday, U.S. President Donald Trump launched a 10-day tour of Asia with a plan to visit five countries namely Japan, China, the Philippines, South Korea and Vietnam. The first was Japan, where Trump persuaded Japanese manufacturers to organize production in the United States. He also said that the goals of the Pacific Partnership that he had put on hold could be achieved in other ways such as bilateral agreements. Apparently, the United Kingdom with European countries will also come to this form and the next stage of negotiations on Brexit will be held on November 9 to 10. Markets have not yet decided on the assessment of the visit of the US president, traded mixed: Nikkei225 0.07%, China A50 -0.46%, IDX Composite 0.08%, Kospi SEU -0.79%. The Australian S & P / ASX200 loses 0.17%. Commodities are mainly growing: aluminum 0.5%, iron ore 0.2%, gas 2.14%, copper -0.5%.

Investors were disappointed with data on September retail sales published on Friday as the estimate that turned out to be zero with the expectation of 0.4%. The quarterly growth showed only 0.1% against the forecast of 1.2%. Activity in the service sector fell from 52.1 to 51.4 points. The debate over whether the RBA will raise the bet tomorrow or not has resurfaced because of the data. Of course, this topic is controversial and can only discuss the topics such as the change in the Central Bank's inflation prospects and general economic growth being dependent primarily on commodity prices. Here, the forecasts are different and more convenient for the regulator to have a waiting attitude.

The AUD/USD pair is anticipated to be at 0.7580 and further move towards the level of 0.7540 under the pressure of the US dollar.