Today, it is important to pay attention to the data on the indexes of supply managers for the services sector of the euro area. At the end of last week, the US dollar managed to regain all its positions.

At the end of last week, the US dollar managed to regain all its positions and almost reached the lows of October after the release of a good report on the labor market in the US, which maintained investors and traders confidence that the US Federal Reserve will raise interest rates at the end this year.

According to the data, the number of jobs outside of US agriculture in October 2017 increased by 261,000, while economists expected that the there would be an increase of 315,000. The unemployment rate fell to 4.1%, while economists expected it to be without changes at 4.2%.

Positive indices of the supply managers' index for the non-manufacturing sphere of the USA also led to a wave of purchases of the US dollar.

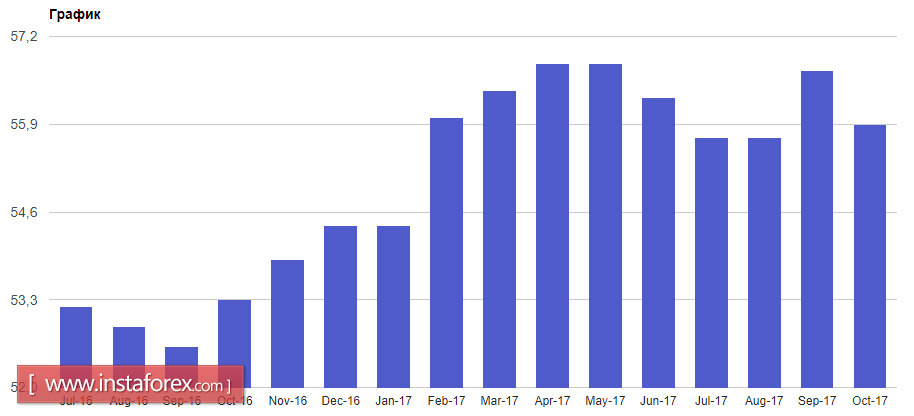

According to the report of the Institute of Supply Management, the index of supply managers for the non-manufacturing sector in the US in October this year rose to 60.1 points against 59.8 points in September. Take into consideration that the values above 50 indicate an increase in activity. Economists predicted that in October the index will be at 58.0 points. the growth was because of strong indicators of consumer spending and it is due to the increased capital investment of companies.

The PMI index for the US manufacturing sector fell to 58.7 points in October, while it positioned to be at the level of 60.8 points in September.

The speech of Fed President-Minneapolis Nill Kashkari began with a statement saying that it is not necessary to raise interest rates in conditions of slow inflation and low wage growth rates. He also drew attention to the fact that in the case of tax reform, the existing economic model will require renewal.

As for the new candidate for the post as the head of the Federal Reserve, Kashkari is confident that Powell will perfectly cope with the duties of the head of the Fed and his appointment will not lead to serious changes in the policy of the central bank.

Today, it is important to pay attention to the data on the indexes of supply managers for the services sector of the euro area. A slight slowdown in economic activity is expected.

As for the technical picture of EUR/USD pair, the pressure on the euro will continue this week. A break in the support range of 1.1600 could lead to the formation of a larger sale of risk assets which would update the new monthly lows around 1.1560 and 1.1520 towards the middle of the week. The key targets of the "bears" are still the levels in the area of 1.1400 and 1.1300. The growth of the euro today in the area of 1.1650 could lead to another sale of the euro after a test of major resistance levels.