Traders ignore the data for the euro area. The composite PMI index of the eurozone has grown. The European currency remained to be traded in a narrow lateral channel.

The European currency remains to be traded at a narrow lateral channel paired with the US dollar after the release of a series of data from the company Markit, which were generally very positive.

Today, it became known that the volume of orders in the industrial sector of Germany in September rose by 1.0% compared to August this year, while economists expected a decrease of 1.3%.

Data for August were revised to 4.1% from 3.6%. The growth was due to an increase in export orders as it increased by 1.7%, while domestic growth declined by 0.1%. Export orders from the countries in the euro area grew by 6.3%.

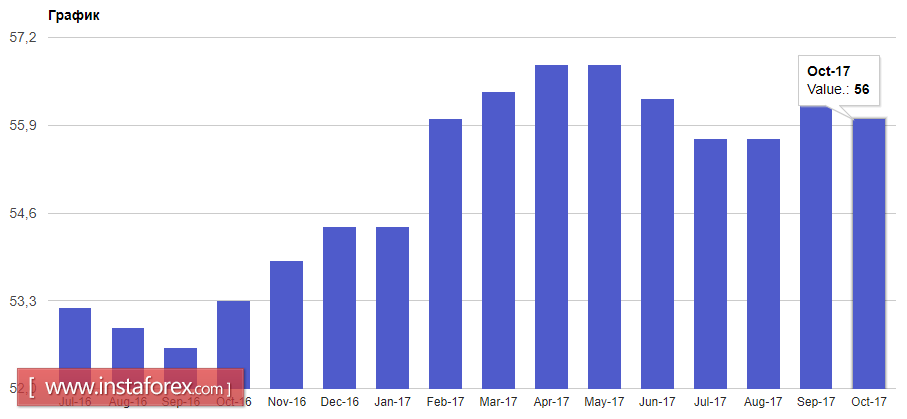

The composite index of supply managers of the eurozone rose in October this year due to a good increase in France. According to the IHS Markit company, the composite index of supply managers of the eurozone in October rose to 56.0 points from 55.9 points in September. Markit expects a good growth of the euro area economy in the 4th quarter of this year with the minimum score of 0.6%.

The index of supply managers for the services sector of France was 57.3 points in October, while this indicator from Germany was fixed at 54.7 points. In September 2017, the PMI for the service sector in France was 57.0 points, while economists predicted it to be at 57.4 points.

In Germany, a similar PMI index for the service sector at 55.6 points, while it was projected at 55.2 points.

A statement was given today by the representative of the European Central Bank Peter Praet. He drew attention to the improvement of economic prospects, which will increase confidence in the future as the gradual return of inflation to the target level of about 2.0%. Praet still believes that a significant monetary stimulus is necessary, but improving the prospects for the economy can reduce the pace of buying bonds until the incentive program has been fully completed.

As for the general technical picture, it remained unchanged compared with the morning forecast.

A break in the support range of 1.1600 could lead to the formation of a larger sale of risk assets which has already began and updates the new monthly lows around 1.1560 and 1.1520 towards the middle of the week. The key targets of the "bears" are still the levels in the area of 1.1400 and 1.1300. Today, the growth of the euro today in the area of 1.1650 could lead to another sale of the euro after a test of major resistance levels.