The US dollar finished Tuesday's trading session on a positive note. Investors believe that the Fed will raise interest rates at the December meeting, bolstering the dollar's exchange rate. However, with the new rumors around the proposed tax reform by D. Trump, market players are once again in doubt about whether it will be successfully adopted.

In October, on the wave of adoption by the US Parliament of the country's budget, there were hopes that the new tax code could be pulled to the Republicans. However, difficulties about resolving this issue still remains. In our opinion, the situation around the adoption of tax reform will be crucial for the markets this week in the wake of the lack of publication of new important data of economic statistics.

On Tuesday, comments were made by the leaders of the largest Central Banks - the Fed and the ECB. Investors were waiting for news about the details on the monetary rates of the US and the eurozone. However, neither J. Yellen nor M. Draghi touched this topic. This was reflected in the markets but it should be more correctly said that is did not affect the markets that much. Trades on Tuesday passed quietly.

However, what is important to consider for market players, is the restoration in recent weeks of a previously forgotten trend, which was a factor in supporting the US dollar. It is, of course, the assessment of exchange rates through the prism of the resumption of discrepancies in monetary policy between the Fed and other major securities - the ECB, the Central Bank of Japan, and the Bank of England. They were also joined by the Central Bank of Canada and Australia, who, like the first three, made it clear that they were not going to rush with the change in monetary rates on the wave of domestic economic reasons.

Among the turbulent events since the beginning of the week, the situation of the domestic political struggle in Saudi Arabia remains in the focus of the market. On Monday, this contributed to a sharp rise in the price of crude oil. On the foreign exchange market, these news had only a local effect. Commodity currencies first reacted to it with upward dynamics but then they played it down. This clearly indicates that this is only a short speculative reaction and nothing more.

Today, the market will again monitor the published data on oil and petroleum products from the US Department of Energy. The focus will be on the outcome of the RBNZ meeting on monetary policy.

Forecast of the day:

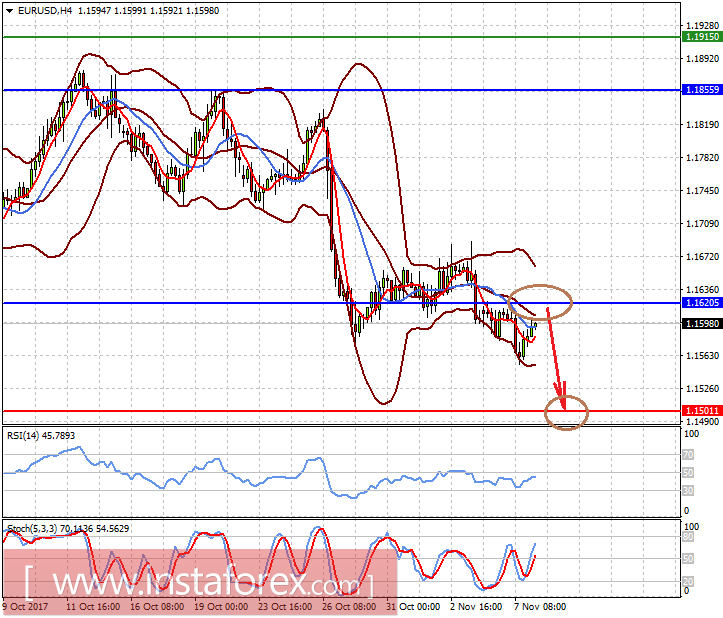

The EURUSD pair remains in the short-term downtrend but at the same time, it declines very reluctantly on the wave of market doubts that the tax reform in the States will be adopted. We believe that the pair should be on the upside, around the level of 1.1620, to sell with a probable target of 1.1500.

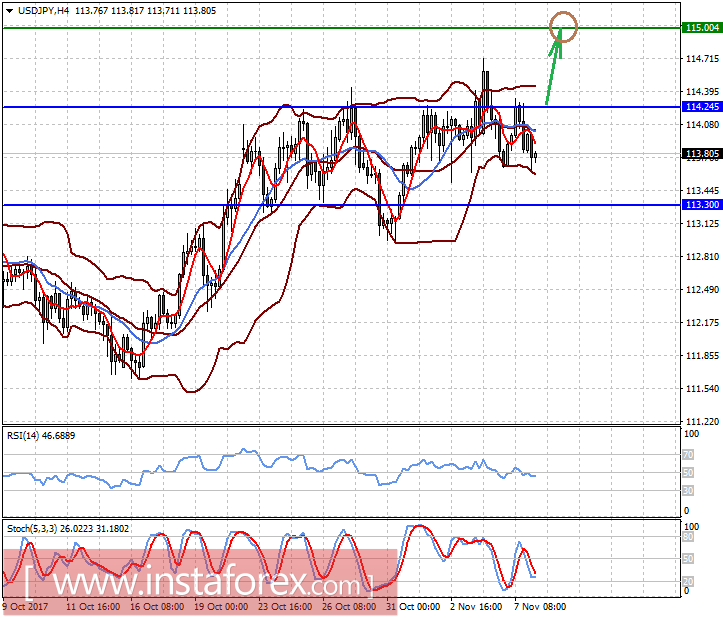

The USDJPY pair is trading in the range of 113.30-114.25 on the wave of demand for the yen as an asset of asylum and the signals from the Central Bank of Japan that monetary policy will remain soft. Overcoming the price of mark 114.25 and fastening above it will open a couple of way to 115.00.