EUR / USD, GBP / USD

The US dollar has not yet started the large-scale offensive, but, on the other hand, the rapid movement can be played back no less aggressively. Due to lack of economic data yesterday, investors watched commodity prices and yields on government bonds. There were also consolidations of weekly ranges.

French trade balance for August was revised higher from -4.5 billion euros to -4.2 billion, and the month figure of -4.7 billion euros did not seem bad any more. This indicator was always negative with the whole of 2017. Speaking with the President of the Federal Reserve Bank of Philadelphia, Patrick Harker. Trump's Asia. He even stopped troubling the Chinese yuan (however, his quotes are now at the levels of July last year). His speech about North Korea was also delivered in a calm tone.

The Senate argument on tax reform infuriates the United States, which further restrains the dollar. There is a warning about the possible postponement of the 20% corporate tax reduction for a year. As Trump is currently in Asia, the main struggle will happen sooner or later. The British pound fell under the pressure of the political scandal which involves Minister of International Development Priti Patel of being accused of managing secret meetings with Israeli government members on the Golan and Syrian refugees.

Today, the Germany's trade balance for September will be released, with a forecast of 21.0 billion euros against 21.6 billion in August. In the afternoon (10:00 AM London time) the economic forecast of the European Commission will be published, and the UK GDP forecast from NIESR for October will be out at 1:00 PM London time. The United States will issue a number of applications for unemployment benefits with 231K forecast against 229K in the week earlier.

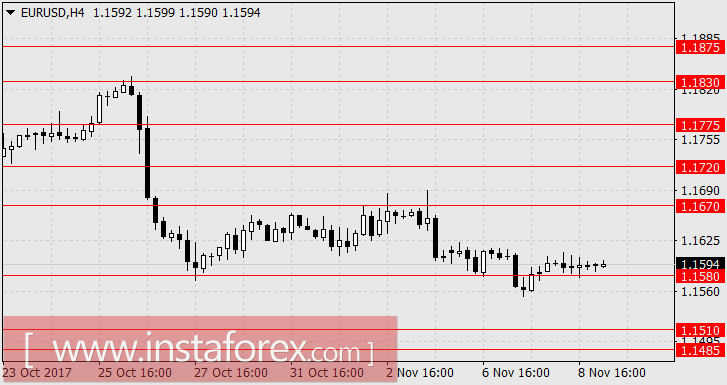

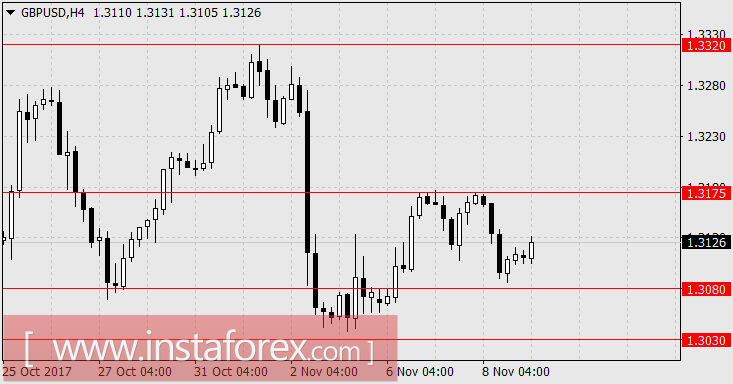

Tomorrow is a public holiday in the US and if investors tend to break through support for 1.1580 (for the euro). It is recommended to do it today within the 1.1485-1.1510 target. Otherwise, the price may still linger in the range of 1.1580-1.1670. According to the British pound, the 1.3030 / 80 range looks convincingly strong, and convincing reasons are needed to return to it, which are not yet visible. We are expecting for the trade in the range of 1.3080-1.3175.

USD / JPY

The Japanese yen market is consolidating in the range of 113.30-114.40 despite mixed data. The average wage in Japan increased by 0.9% in September against the expectation of 0.6%. While Chinese trade balance for October increased from $ 28.5 billion to 38.2 billion. But at the same time Japan's balance of payments for September fell from 2.27 trillion yen to 1.84 trillion yen. Bank lending declined from 2.9% YoY to 2.8% YoY, and base orders for engineering products fell by -8.1% in September against the forecast of -1.8%. Trump's meeting with the Japanese leaders ended up in vain. Trump did not succeed in turning the bilateral trade favorable to the side of the US and even failed to agree on increasing investment. The US stock market is now receiving additional risks which will immediately affect the yen. Yesterday, Dow Jones added only 0.03%, but today's growth of Nikkei 225 is up by 1.04%, showing the highest growth in the Asia-Pacific region and may die out due to lack of external support. The situation remains neutral, it is likely that the trade will continue in the range of 113.30-114.40.

* The presented market analysis is informative and does not constitute a guide to the transaction.