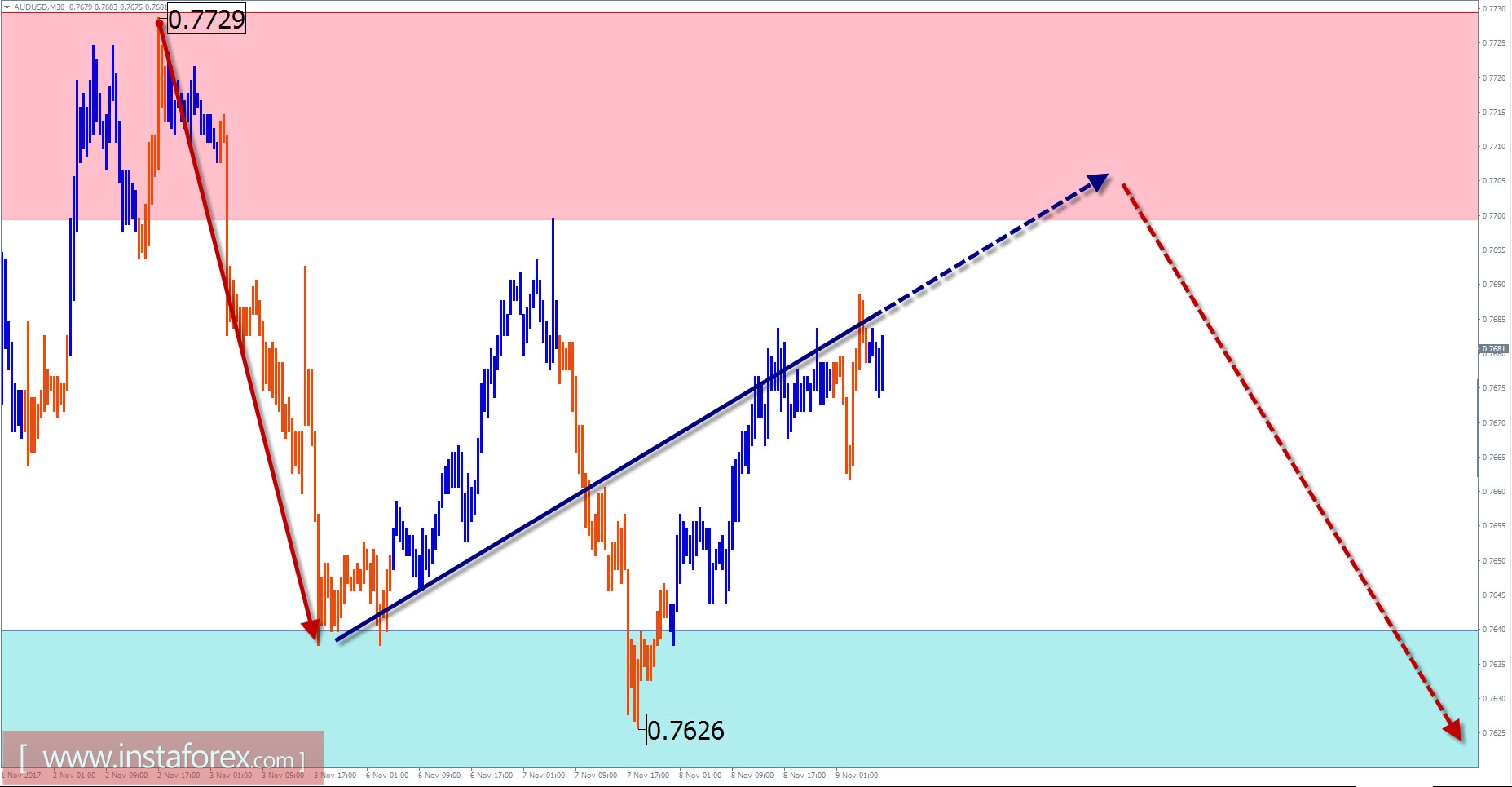

AUD / USD overview with current day forecast

Earlier last year, the ascending portion of the time chart for the major pair Australian dollar has been correcting a strong decline in the previous years. The potential for further growth is questionable, as the structure of the current bullish wave is formed and the price has reached the estimated target zone. Even if the wave level of the bullish wave is enlarged and the price moves upwards, the price should be balanced by the current rise in counter motion.

The price reduction that began in September formed the first part of the reversal wave, capable of giving rise to a more large-scale move of the pair downwards. During the beginning of this month, the price has reached the support section of the senior timeframe, which can trigger a downward rollback.

An upward mood is expected this morning. Completion is possible within the resistance zone. Towards the end of the day, there is a greater chance of changes in direction and a beginning of the decline.

Boundaries of resistance zones:

- 0.7700 / 0.7730

Boundaries of support zones:

- 0.7640 / 10

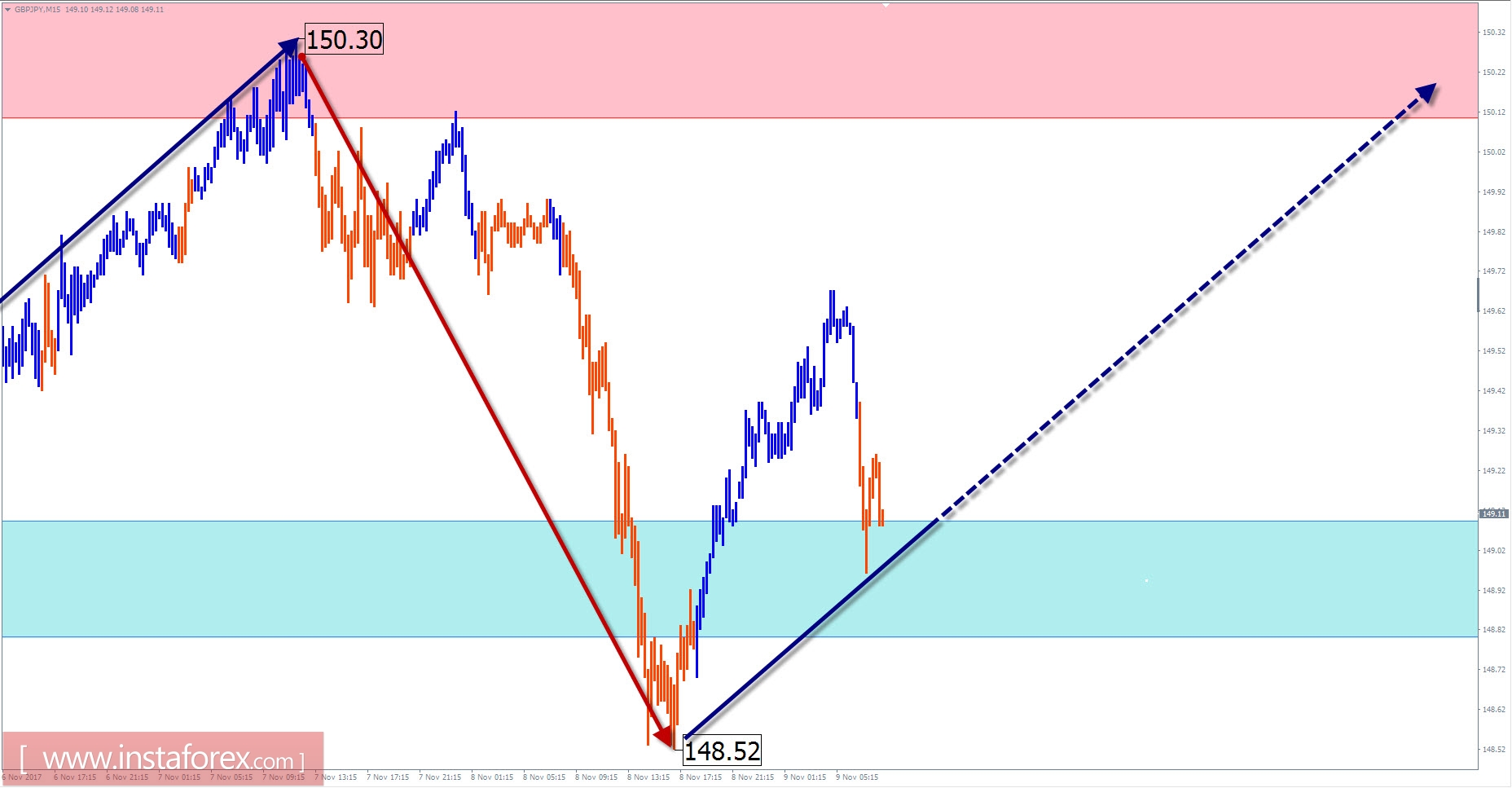

GBP / JPY outlook for the current day

Since October last year, the direction of the short-term trend on the chart of the cross pair pound-yen is set by an upward wave. Price extremes formed a graphic figure "ascending tone". The wave structure indicates completeness. Preliminary goals of recovery are achieved.

At the end of the uptrend, a bearish wave is developing since September 21, in which the middle part (B) is close to completion. The appearance of its structure allows expecting the developmental process to update the high levels in the beginning of the wave. The wave level of the entire structure allows us to classify it as a potential reversal model.

Today, the general upward trend of cross-movement can be considered. In the first half of the day, short-term pressure on the support zone is not ruled out. The upper daily level of the pair limits the resistance zone.

Boundaries of resistance zones:

- 150.10 / 40

Boundaries of support zones:

- 149.10 / 148.80

Explanations to the figures: For simplified wave analysis, a simple waveform is used that combines 3 parts (A; B; C). Of these waves, all kinds of correction are composed and most of the impulses. On each considered time frame the last and incomplete wave is analyzed.

The areas marked on the graphs are indicated by the calculation areas in which the probability of a change in the direction of motion is significantly increased. Arrows indicate the wave counting according to the technique used by the author. The solid background of the arrows indicates the structure formed, the dotted one indicates the expected wave motion.

Attention: The wave algorithm does not take into account the duration of the tool movements in time. The forecast is not a trading signal! To conduct a trade transaction, you need to confirm the signals of your trading systems.

* The presented market analysis is informative and does not constitute a guide to the transaction.