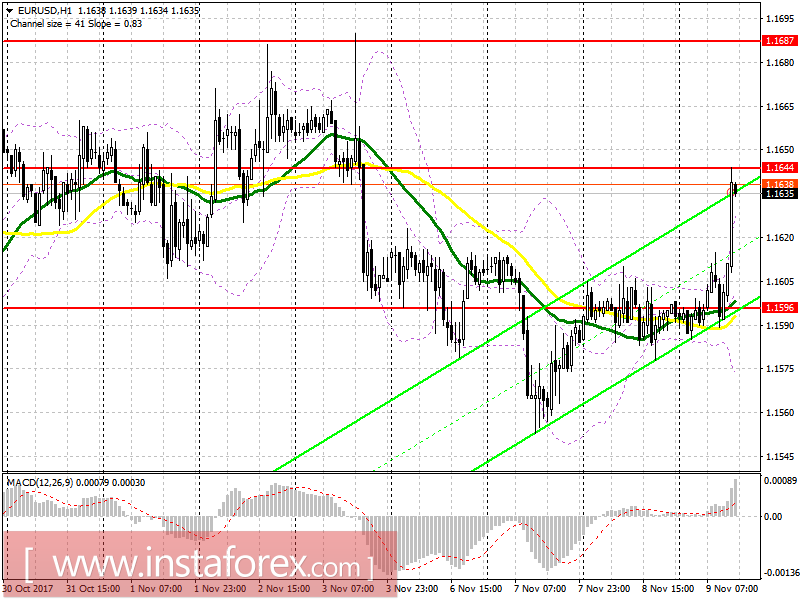

EUR/USD

To open long positions for EURUSD, it is required:

The euro went beyond the upper limit of the weekly channel. Stopping at 1.1644 was quite expected. A break in the afternoon above 1.1644 will lead to an increase in long positions with an update of 1.1687, where I recommend locking in profits. In the event of a decline in the euro, a return to buying would be best done for a rebound from 1.1596.

To open short positions for EURUSD, it is required:

The formation of a false breakout and an unsuccessful attempt to gain a foothold above 1.1644 can return new sellers to the market, which will lead to a decline in the EUR/USD pair towards the support area of 1.1596. I recommend locking in profits on short positions in that particular area. With a growth option above 1.1644, selling the European currency can immediately be rebounded from 1.1687.

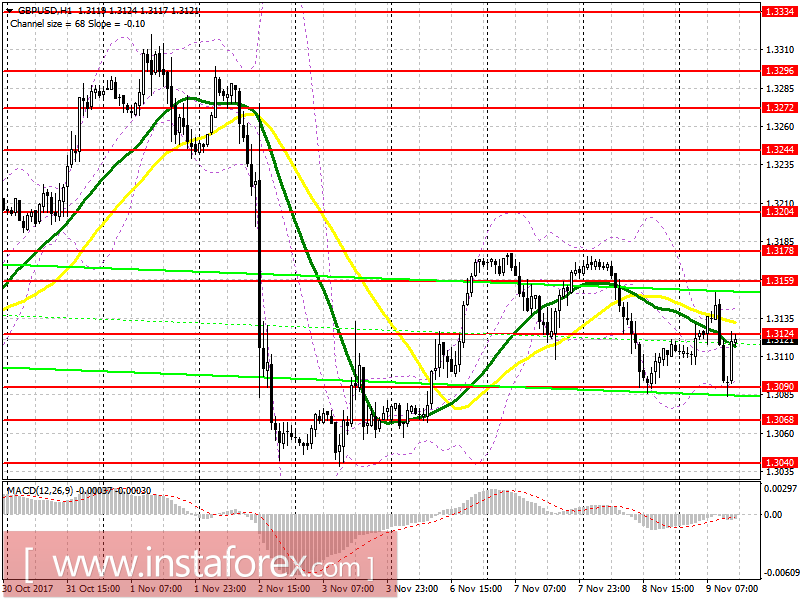

GBP/USD

To open long positions for GBP/USD, it is required:

Buyers excellently worked on a false breakdown support of 1.3090 and returned to the level of 1.3124. A steadying on it will provide a good momentum to the upward trend in the pound and a return to the upper channel boundary area of 1.3159 and 1.3178, where I recommend locking in the profit. In the event of a re-decline of the pound towards 1.3090, I recommend that buying be postponed until an upgrade of 1.3068.

To open short positions for GBP/USD, it is required:

Selling can be expected after an unsuccessful attempt to consolidate and a return to the level of 1.3124. The main goal will be to descend to 1.3090 with a breakdown and update at 1.3068, where it is advised to close some of the short positions. In the event of growth above 1.3124, you can count on selling the pound for a rebound from 1.3159.

Indicator description

- Moving Average (average sliding) 50 days - yellow

- Moving Average (average sliding) 30 days - green

- MACD: fast EMA 12, slow EMA 26, SMA

- Bollinger Bands 20