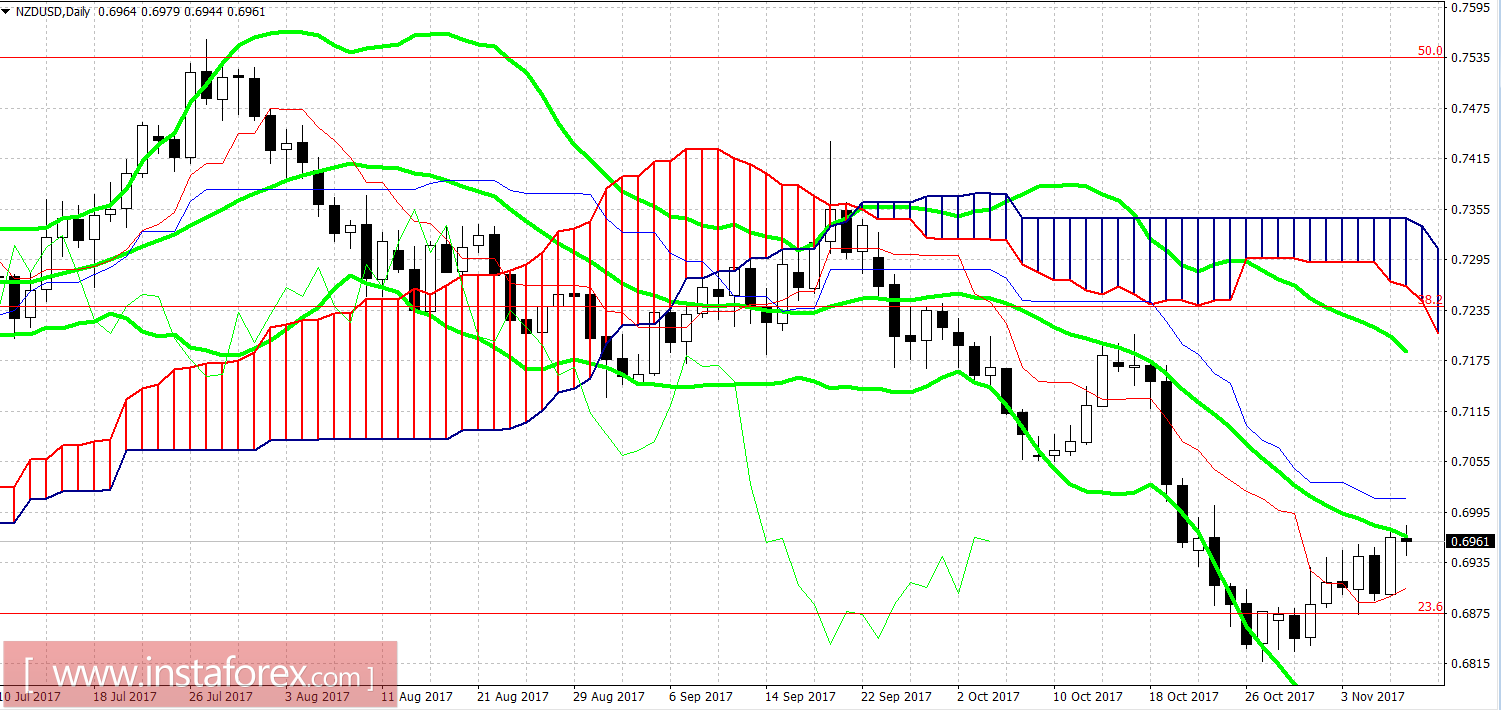

The New Zealand dollar rose in price across the market after the announcement of the results of the November meeting of the central bank of the country. The statement of the New Zealand regulator unexpectedly became tougher, which surprised traders who are used to the pessimistic and cautious forecasts of the RBNZ. The NZDUSD pair jumped nearly 100 points overnight, but the growth halted near the resistance level of 0.6970 (the middle line of the Bollinger Bands indicator on D1). Prospects for further price growth look unsure, as the overall fundamental background for the New Zealander remains subdued, and the positive promises of the RBNZ are too distant.

A week ago in New Zealand published key data on the labor market. They were significantly better than expected: the unemployment rate dropped to 4.6%, and the number of employed increased to 2.2% (with a forecast of 0.8%). The share of economically active population also increased. Thus, the labor market returned to "pre-crisis" levels due to the growth in the number of able-bodied population and a record increase in "clean" migration.

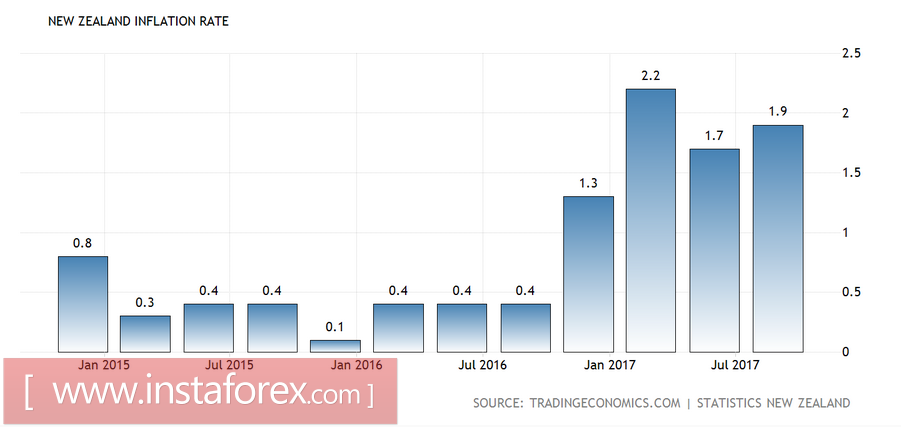

Inflation also slightly increased: in the third quarter, the CPI was 1.9% in annual terms. In monthly terms, the inflation index also increased - from zero to 0.5%.

Such positive data reflected on the general mood of members of the New Zealand regulator. True, their optimism concerns a too distant period. In response to the reduction in unemployment and rising inflation, RBNZ changed a possible increase in the interest rate from the third quarter of 2019 to the second quarter of the same year.

In my opinion, this is a rather weak argument for the resumption of the upward trend of NZDUSD in the short and medium term. First, the hypothetical prospect of tightening monetary policy looks too distant. Secondly, the growth of inflation is unstable. In the first quarter of this year, the consumer price index reached 2.2% (in annual terms), but then fell to 1.7%. Secondly, it should be noted that former oppositionists came to power in New Zealand, who declared very radical changes, including in the economic sector.

But the problem lies in the fragility of the coalition created. After all, in addition to the "base" Labor Party, the coalition included the "Green" and representatives of the political force "New Zealand First", who are known for their anti-immigration positions and populist statements. Relations between "junior partners" in the coalition were very strained even before the elections. "Green" has repeatedly publicly criticized political populism, and their opponents, in turn, rather disparagingly spoke about environmental bills. Undoubtedly, the forced union within the coalition has reduced the intensity of political confrontation, but the strength of their relations has yet to be tested in practice, during parliamentary elections.

In other words, the new government will have to prove its effectiveness, and intra-coalition disputes will certainly prevent it. Another open question is how New Zealand's economy will react to tightening immigration and environmental legislation, as well as imposing restrictions on foreigners (in the sector of real estate and enterprises acquisition).

It is also worth noting that there are plans to reform the Reserved Bank of New Zealand by expanding the mandate by analogy with the Fed. At yesterday's press conference, acting head of the RBNZ Grant Spencer said that the planned changes "are unlikely to significantly affect the policy of the regulator." However, this issue is still under discussion, so the final version of the reform can increase concerns about this.

In general, after a series of "dovish" meetings of the RBNZ, yesterday's meeting was somewhat optimistic. But all this optimism is addressed to distant prospects, whereas at the moment the regulator peremptorily maintains the "dovish" position. "The soft monetary policy will remain for a long time," - in such words the head of the New Zealand regulator summarized his speech.

Despite such a clearly ambiguous nature of the November meeting, the NZDUSD pair still adjusted to the middle of the 69th figure. If the bulls manage to overcome the 0.6970 mark and gain a foothold over it, then the technical side of the pair will open the way to two resistance levels - 0.7010 (Kijun-sen line to D1) and then 0.7185 (Bollinger Bands top line on the same timeframe).

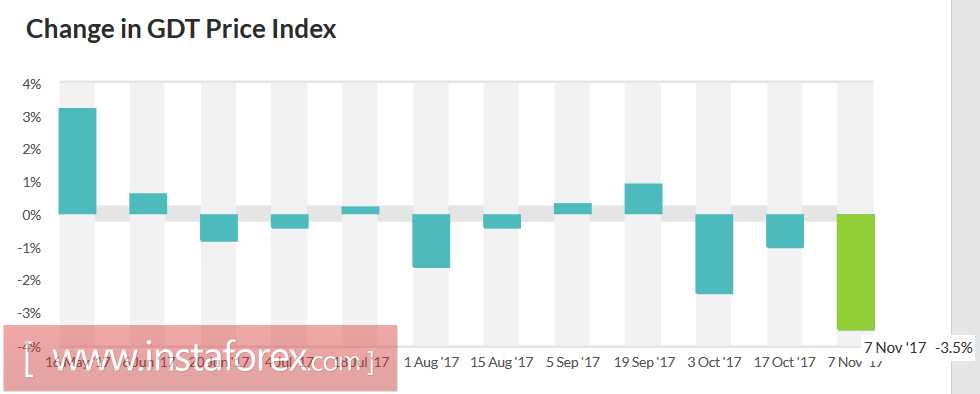

But taking into account the general fundamental background and the "sleeping" US dollar, one can consider the option of short positions from the above resistance levels. Here it is worth recalling that the price index for dairy products (Global Dairy Trade) since the end of September is in the negative area, and the last auction showed a record decrease this year (-3.5%). In total, the auction was sold for 1.7% of the production less than at the auction on October 17. Almost all dairy products have fallen in price on the background of continuing decline in demand.

On the wave of long-term optimism of the RBNZ, traders practically ignored this fact, but next week the recent macroeconomic statistics will be a priority, as well as the understanding that in the next 18 months the New Zealand regulator will maintain the current positions of monetary policy.