The pound began the trading week with a downward gap, returning to the 30th figure. The reason for the bearish sentiment was the events over the weekend: 40 MPs of the British parliament initiated an impeachment procedure against Prime Minister Theresa May. The headlines of the media were filled with loud phrases, after which talk about the possible resignation of the head of government broke out with a new force, putting considerable pressure on the pound. The market expectedly reacted to such affecting news, however, the GBPUSD pair failed to take the price below the 30th level to the bears. And this is quite understandable.

The fact is that all these "resonant" statements about impeachment in general have no practical perspective. For example, the last time the impeachment procedure in Britain was brought to its logical conclusion 211 years ago, that is, in 1806. And not even in relation to the prime minister, but about the minister, Lord Melville, who was accused of abusing the use of public funds. Actually, this is the only precedent of this kind in the entire long history of the British state.

But in this case deputy initiatives of the impeachment was quite sufficient. The last time it happened in 2004, when 11 deputies of the House of Representatives were asked to announce impeachment to Prime Minister Tony Blair. He was accused of providing unreliable information about the presence of weapons of mass destruction in Iraq. According to the deputies, Blair violated the country's constitution by concluding a secret agreement with US President George W. Bush. Despite the seriousness of the charges brought forward, the impeachment did not take place.

To begin this complex procedure, the lower house of the British Parliament, will appoint (form) a special committee, which is needed. Members of this committee study the reasoning of the charges and form a kind of indictment with a list and description of offenses. Further, the House of Commons will take this issue into consideration, but the final ruling is made by the House of Lords.All in all, the lords are here bestowed with the role of judges, who will decide whether this or that member of the government (or the prime minister) is guilty or is to be pardoned.

It is worth noting that these are general rules that have not been applied for centuries in the UK. Specificity of the Anglo-Saxon legal system (case law) is uncodified, so the actual impeachment procedure may differ from the algorithm described above 200 years ago.

Thus, the probability of leaving Theresa May due to impeachment is very unlikely. She can resign voluntarily if she loses the support of most of the party members (as Margaret Thatcher did in her time), but at the moment such a scenario is not relevant. Firstly, Theresa May publicly stated several times that she was not going to voluntarily resign. Secondly, there are 320 representatives of the Conservative Party in the House of Commons, therefore the opinion of 40 conservatives is not the majority. Moreover, in order to formally commence the impeachment procedure, 48 signatures are needed, which at the moment are also not present.

All this suggests that the market reacted too emotionally to the Saturday statement of a group of British MPs. In view of the futility of this political attack, the reaction of traders will quickly come to naught, and the attention of the market will focus on current macroeconomic statistics.

Moreover, this week, key data on the UK labor market (Wednesday, November 15) and data on the volume of retail sales (the next day, November 16) will be published. The dynamics of these indicators will determine the further direction of the GBPUSD movement, and the issue of May's resignation will go to the background - at least until December, when the next round of negotiations on Brexit will take place.

It should be noted that at the end of last week the EU representative Michel Barnier stated that London should determine the size of compensation payments before the end of November. According to him, only after Britain has decided on payments to the European Union for withdrawing from its membership, further negotiations will make sense.

In other words, the Brexit theme will again become relevant in the last month of this year, and until then the pound will follow the main macroeconomic indicators.

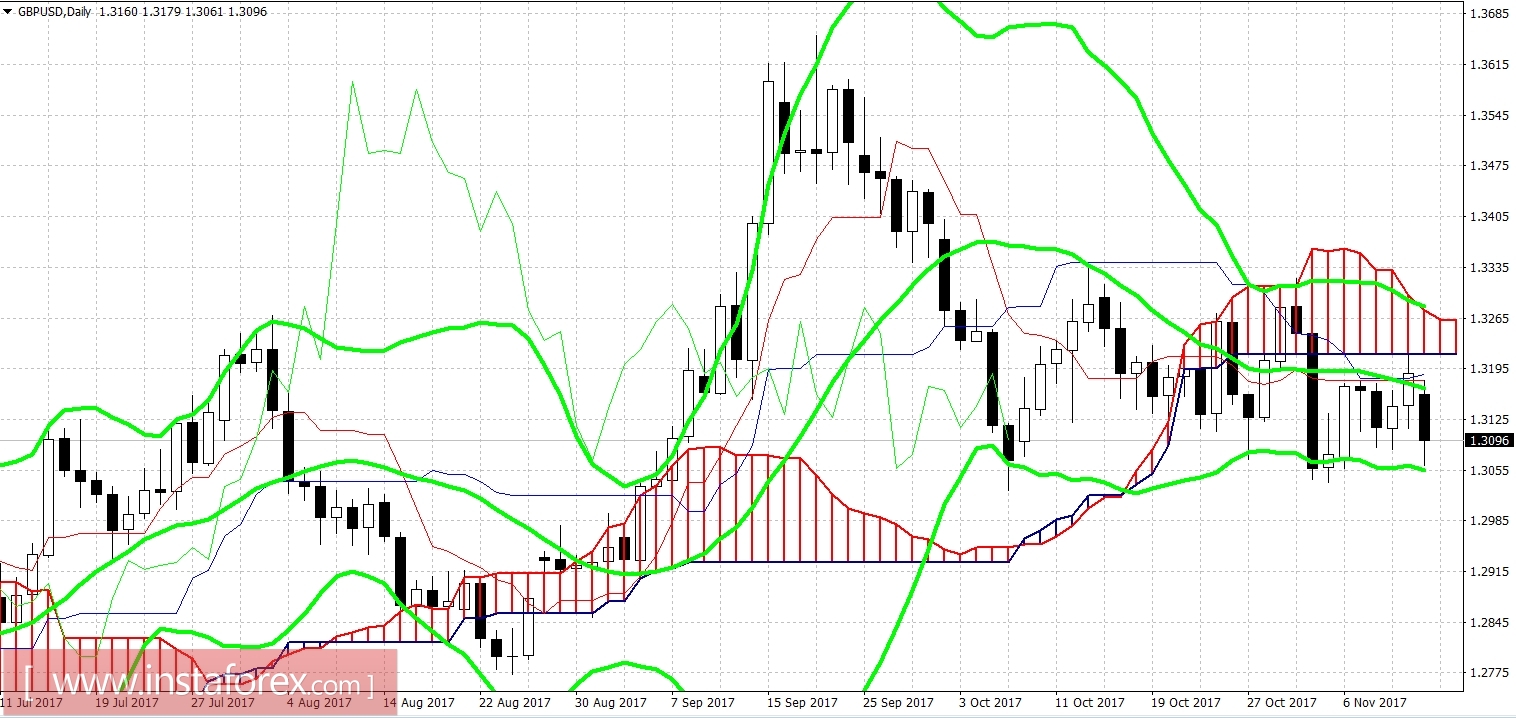

On the technical side, the pair shows a downward direction, being between the middle and bottom lines of the Bollinger Bands indicator. The indicator Ichimoku Kinko Hyo formed its strongest signal - "Parade Line", in which all the main lines of the indicator are above the price chart. Oscillators are in the sales area.

The resistance level is 1.3220 (the lower boundary of the Kumo cloud on D1). But the level of support is still the price of 1.3050 - this is the bottom line of the indicator Bollinger Bands on the daily chart. This level was not broken by talks about impeachment, so the pair's bulls are likely to test the upper limit of the price channel in the near future - the price area is 1.3200-1.3220.