Given the lack of important fundamental data, the market traded fairly calmly. The euro is squeezed in a narrow channel paired with the US dollar. The British pound is trying to restore its position after updating to important support levels.

As noted in the morning review, the pressure on the British pound rose after news that 40 parliamentarians agreed to sign a letter of no confidence in Teresa May. It should be remembered that in the summer of this year, as a result of the elections, the Conservative Party headed by Teresa May lost a majority in the parliament. Recently, the party is surrounded by scandals which already led to the resignation of the two ministers this month.

Today, ECB Vice-President Vitor Constancio made a statement. In his opinion, the level of inflation in the eurozone is still low. This will affect the future decisions of the European Central Bank which should adhere to an extremely soft monetary policy. Vitor Constancio also noted the need to ensure favorable financing conditions in order to accelerate economic growth and wages.

It is important to note that at the end of October this year, the European Central Bank announced that it would cut the quantitative easing program by half. By January 2018, the monthly volume of purchases will be 30 billion.

The Deputy Finance Minister of Germany Thomas Steffen made a statement regarding the program of overdue loans from the European Central Bank today. This was presented earlier and was subjected to numerous harsh criticism. According to the Deputy Minister, complete freedom of action of the supervisory authority is necessary and criticism in the ECB approach is unacceptable.

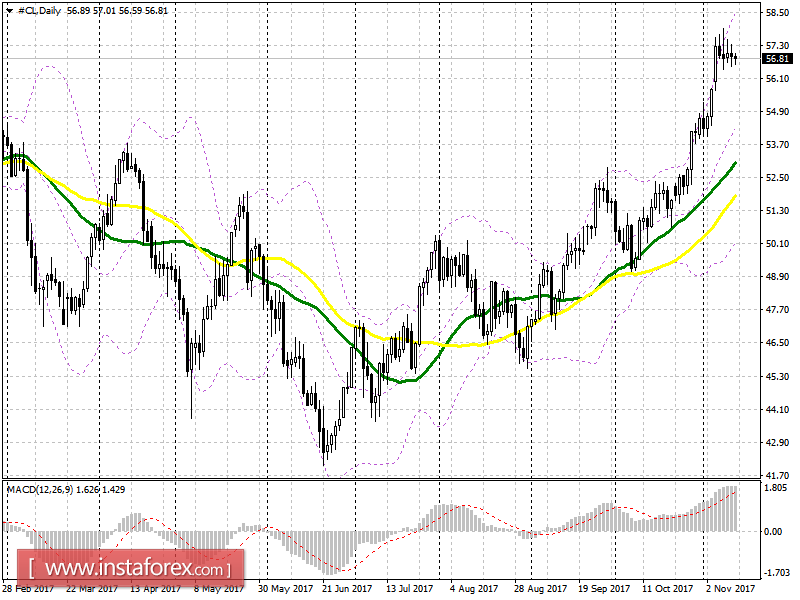

Today, the report made OPEC showed that production in October of this year fell. Forecasts for oil demand in 2017 and 2018 were also raised. OPEC said the decline in oil production in October this year was at 151,000 barrels per day, or 0.46%, to 32.59 million barrels per day.

The world demand for oil in 2017 is expected to grow by 1.53 million barrels per day while in 2018, the world demand for oil will grow by 1.51 million barrels per day.

The UAE oil minister said today that there is a potential in extending the deal to cut production in order to reduce the surplus in the market. Its new terms will be discussed in the near future.

Khalid Al-Falih also pointed out that the UAE is not satisfied with the price of oil, which for the year rose from only $ 40 to $ 64 per barrel.