The British pound remains a hostage of political problems in the UK. Scandals in the government that have recently emerged has undermined the authority of its Prime Minister, Theresa May. We can assume that as long as this hype does not settle, the sterling will remain extremely volatile.

At the same time, the US dollar, despite the uncertain timing of the adoption of the new tax code, is supported. On Monday, US Treasury Secretary S. Mnuchin again expressed his confidence that the differences over the tax reform between the House of Representatives and the Senate are "insignificant". In addition, an important supporting factor is still the expectation of an increase in interest rates at the December meeting of the Fed.

Today, the market will focus on the publication of a number of important statistics from Germany and the eurozone. It is assumed that the GDP of Germany will grow at an annualized rate in the third quarter by 2.3% against the previous period's increase of 0.8%. The monthly value of the indicator in growth should remain at the previous level of 0.6%. As for the value of the GDP for the euro area, it is assumed that the current growth rate in annual terms will be 2.5% and in the quarterly, it will be 0.6%. If the data does not disappoint, we can talk about maintaining a good post-crisis growth rate of the European economy. This will be a supporting factor for the euro but it will not affect its growth.

Data on industrial inflation in the United States will also be released today. It is expected that the annualized figure will decrease in growth from 2.6% to 2.4%. In monthly terms, growth will be 0.1% in October against a 0.4% rise in September. The market is unlikely to react to this data, since its focus is primarily on the values of consumer inflation and its important component, the basic consumer price index, which will be published this Friday. This data is guided by the Fed with its the decision on the rates.

Assessing the general market expectations and sentiments, we believe that by the end of the week, the overall lateral trend in the currency market will continue.

Forecast of the day:

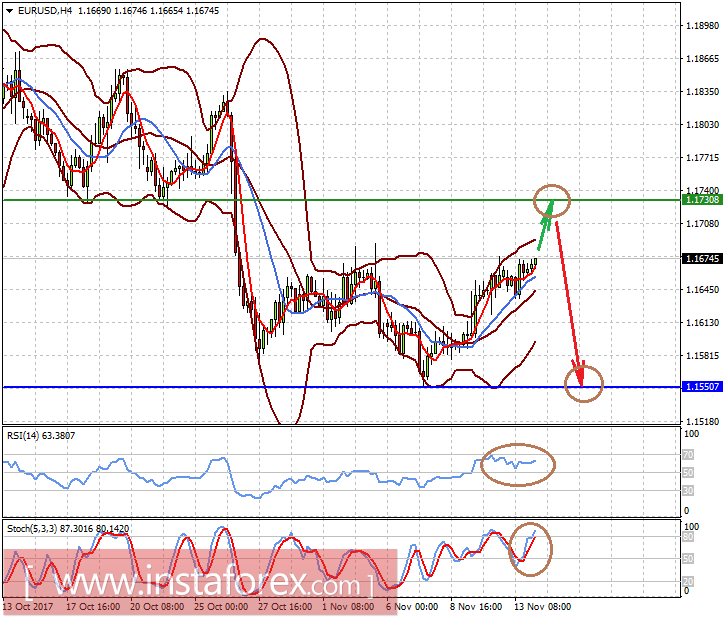

The EURUSD pair remains in the range of 1.1550-1.1665. However, today, it can receive local support on the positive news from Germany and the eurozone. Despite this, we believe that the pair should be sold on growth with a probable local target of 1.1550.

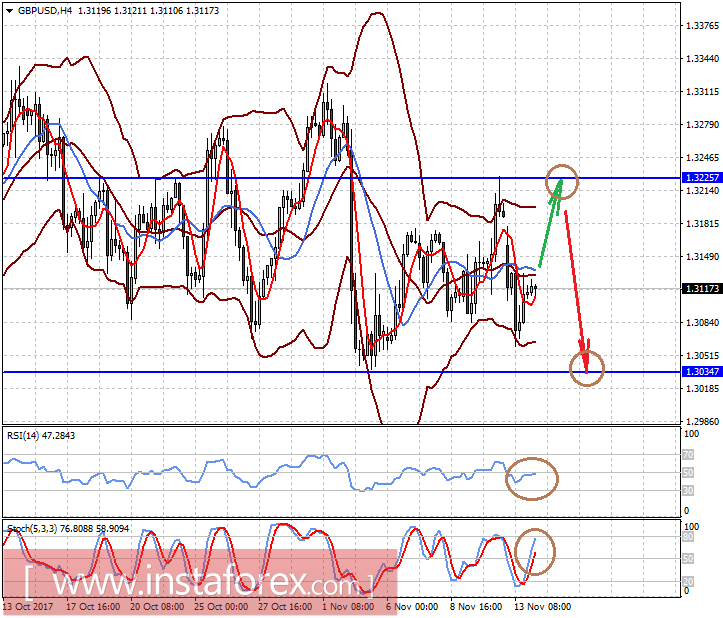

The GBPUSD pair is also consolidating in the range of 1.3060-1.3225. The pair may receive limited support on the wave of data on inflation growth to 3.1% from 3.0%, which will be published today. If the forecast is confirmed, the pair may jump to 1.3225. However, in our view, it should be sold with a probable decline to 1.3035, as the Bank of England is unlikely to decide to raise rates in the foreseeable future.