The Australian and New Zealand dollar declined at the beginning of the Asian session on Tuesday after weak data on industrial production in China. If the AUD / USD pair managed to recover its positions after a good report from NAB, the New Zealand dollar continues to remain under pressure.

According to the report of the National Bureau of Statistics of China, industrial production in China slowed this October, indicating a weakening momentum for growth.

So, industrial production in China in October grew by only 6.2% compared to the same period of the previous year after an increase of 6.6% in September. The data fully coincided with the forecasts of economists. Compared to the previous month, industrial production rose 0.5% in October after rising 0.56% in September.

According to the Ministry of Commerce of China, foreign direct investment in the economy for the month of October increased by 5% compared to the same period of the previous year, amounting to 60.12 billion yuan, or about 9.04 billion US dollars. In September, investments increased by 17.3% compared to September of the previous year.

As I noted above, Australian business activity data was supported by the Australian dollar.

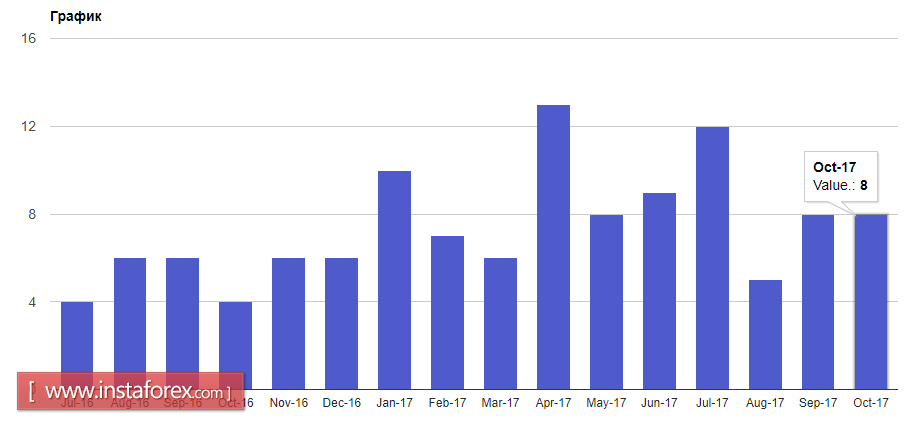

According to the NAB report, the index of conditions for business activity in Australia in October this year was at the same level as a month earlier. So, the index of business confidence in Australia in October was at 8 points, while the index of employment in business in Australia was at 7 points.

The index of business profitability in Australia for the month of October is +26 while the index of conditions for business activity in Australia in October is +21 points.

There are attempts to push the lower limit of the bears to 0.7620. While it fails, much will depend on where the trades will end today. Good data on the US can support the US dollar, which will lead to a new wave of the AUD / USD fall already in the second half of the day and the update of new monthly lows in the 0.7583 and 0.7560 areas.

Yesterday's data on the growth of the US budget deficit did not "please" the buyers of the US dollar.

According to the report of the US government, in October this year, a budget deficit of $ 63 billion was recorded. This happened due to the fact that the expenditures exceeded the incomes. The federal government spent $ 299 billion in October, while revenues were only $ 235 billion.

As for the technical picture of the EURUSD, it remained unchanged from the forecasts for yesterday.