EUR / USD, GBP / USD

The euro continued to actively grow yesterday and went into the range of 1.1830 / 75, helped by the eurozone's September trade balance which had a better than expected result at EUR 25.0 billion against expectations of 21.2 billion and 21.0 billion euros in August. However, the price also quickly returned to its starting position. As a result, the euro closed the day by a decrease of 6 points. This is the answer to our yesterday's question about the time of completion of the correction. The correction was completed yesterday.

In the UK, neutral employment indicators were published. Unemployment in September remained at the level of 4.3% while the average wage for the last three months increased by 2.2% against the forecast of 2.1%. The number of unemployed increased by 1.1 thousand against the expectation of 2.0 thousand. The overall picture was only spoiled by the general employment data which decreased by 14 thousand people.

In the US, retail sales for October added 0.2% against expectations of no change. Basic sales increased by 0.1% against the forecast of 0.1%. The consumer price index added 0.1% in October but fell year-on-year from 2.2% to 2.0%. The basic CPI added 0.2% and on an annual basis increased from 1.7% to 1.8%. The index of business activity in the manufacturing sector of New York fell from 30.2 to 19.4 for the month of November. Commodity stocks of companies in September showed zero change. In general, the Federal Reserve Bank of Atlanta lowered the forecast for GDP for the fourth quarter from 3.3% to 3.2%. Consumer spending was still insufficient to keep a high figure.

For the euro area, no significant indicators have been published today. The final CPI estimates for October will come out with the forecasts unchanged at 0.9% y / y for the basic CPI and 1.4% y / y for the general CPI. In the UK, there will be retail sales for October with a forecast of 0.1% after the September collapse by -0.8%. At 16:30 Moscow time, the head of the Bank of England, Mark Carney will speak at the Future Forum in Liverpool. It is possible that the monetary policy will be affected.

The US expects good data on industrial production for October. Growth is expected to be at 0.5% after the previous increase of 0.3%. Capacity utilization may increase from 76.0% to 76.3%. The number of applications for unemployment benefits is expected to be at 235 thousand, compared to 239 thousand a week earlier. The index of business activity in the manufacturing sector of Philadelphia in November may fall from 27.9 to 24.5 and the indicator of business activity in the housing market from NAHB for November will also drop from 68 to 67. However, this data is unlikely to overcome the emerging positive.

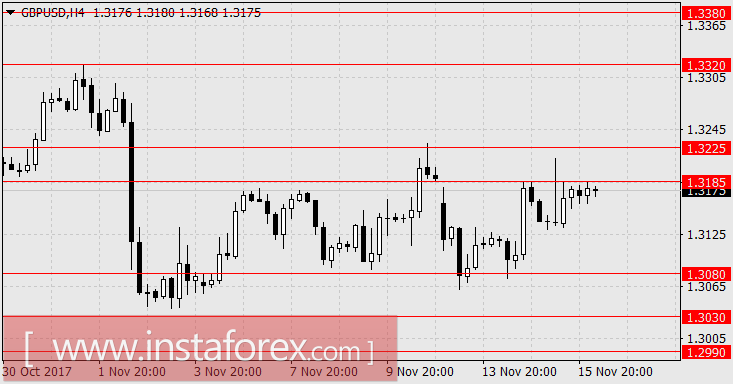

We are waiting for the euro at 1.1580 and the pound sterling in the range of 1.2990-1.3030.

AUD / USD

The Australian dollar continues to fall and fall, reacting weakly to the correction of European currencies. Nevertheless, the potential to reduce the "Aussie" in the event of a decline in the euro below parity with the dollar is not limited. If the euro, to the minimum of 2000 0.8225, is to be devalued by 30.15%, then the Australian dollar, to a minimum of that period, may move by 37.00%. At the same time, the current rate of EUR / AUD at 1.5500 corresponds to the price of October 2000. This means that the "Aussie" now looks stronger than the euro. Perhaps, that is why the RBA representatives are not afraid to play the game verbally. Yesterday's decline was an objective reason. Wages for the third quarter added only 0.5% against expectations of 0.7% with a year-on-year increase of just 2.0% while waiting for 2.2%. Today, the reports of the Ministry of Labor showed a deterioration in the structure of the workforce. Employment in October rose by 3.7 thousand with a forecast of 17.5 thousand. The proportion of economically active population dropped from 65.2% to 66.1% which led to a decrease in unemployment from 5.5% to 5.4%.

Prices for raw materials are falling in a wide range. Oil is down by 0.3%, iron ore declined by 2.1%, coal dropped by 0.1%, and gold lost 0.2%. Copper adds 0.2%. Tomorrow, the US dollar could receive an additional impetus to growth on construction data. The number of bookmarks of new homes could increase from 1.13 million to 1.19 million. We are waiting for the AUD / USD pair at 0.7495.