TThe US dollar was supported by the release of data on consumer inflation on Wednesday, which showed an unexpected increase in its core value, which helped strengthen the expectation that the Fed will continue to raise interest rates not only next month but also in 2018.

The published data showed that in October consumer inflation, or rather, its base component, grew by 1.8% against the forecast of 1.7%. The monthly figures of the indicator added in October, in line with the forecast of 0.2% against 0.1% a month earlier. Another positive data was the retail sales figures, which grew above expectations by 0.1%, by 0.2%. Its September value was also revised upward to 1.9%. As for the general data of the consumer price index, its annual and monthly figures came in line with growth forecasts of 2.0% and 0.1%, respectively.

On the wave of the released data, the US dollar received support, and its index almost completely regained the losses it previously

suffered.

Today, the market will focus on the publication of data on consumer inflation in the eurozone. According to forecasts, it is expected in monthly terms show a slowdown from 0.4% in September to 0.1% in October. On an annual basis, the indicator should show a 1.4% rise in the rate of inflation. If the data comes out in line with the forecast or worse, then we should expect another drop in the hopes of some market players that the ECB will revise its plans for monetary policy in the near future.

Against this background, one should expect the single European currency to retreat against major currencies. When paired with the US dollar, it can again test the recently reached lows.

Forecast of the day:

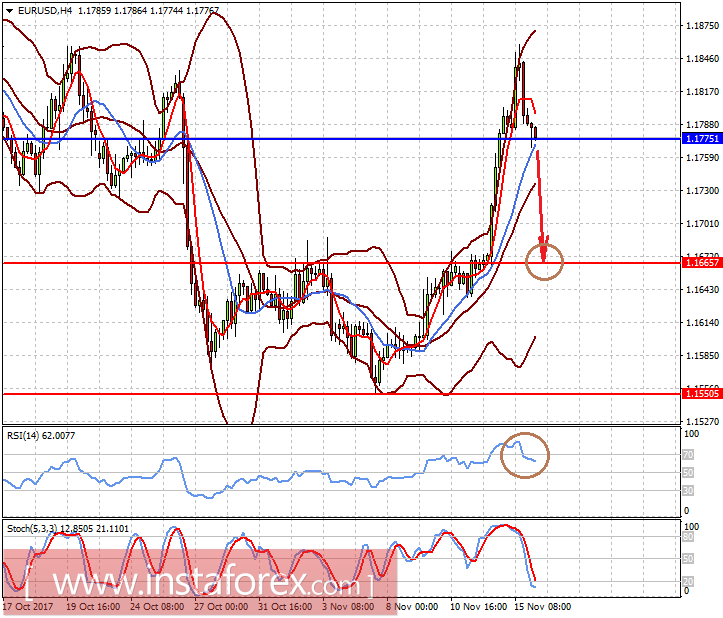

The EURUSD pair retreated from the local high on a wave of positive data from the US. The downward movement may continue if the data on consumer inflation in the eurozone is at the forecast level or worse. Against this background, the pair may fall to 1.1665 with the prospect of a decline to 1.1550 after the penetration of the level of 1.1775.

The USDCAD pair is consolidating above the level of 1.2750 on the wave of correction of crude oil prices. Its growth can continue to 1.2840 on the general wave of the positive sentiment of the market towards the US currency.