Prior +1.7%

- Market index 833.9 vs 838.2 prior

- Purchase index 293.5 vs 301.2 prior

- Refinancing index 3,973.1 vs 3,949.8 prior

- 30-year mortgage rate 2.98% vs 3.01% prior

The long-term mortgage rate falls to a record survey low in the past week, but purchases activity continues to lose steam and that is leading the drop in the headline reading.

Although the index is still relatively elevated even when compared to pre-virus levels, the recent drop in purchases could be hinting that housing market appetite is beginning to wane after a surge from April to early June.

Further Development

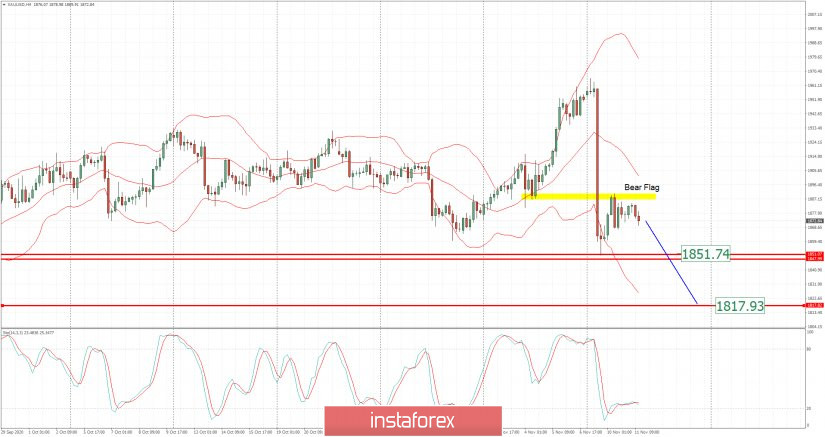

Analyzing the current trading chart of Gold, I found that there is potential for the the downside continuation due to strong impulsive downside movement in the background.

Imy advice is to watch for selling opportunities on the rallies using the intraday charts with the targets at $1,851 and $1,817

Resistance is set at the price of $1,887.

Additionally, there is the bear flag pattern on the 4H time-frame, which is another confirmation for the downside movement.

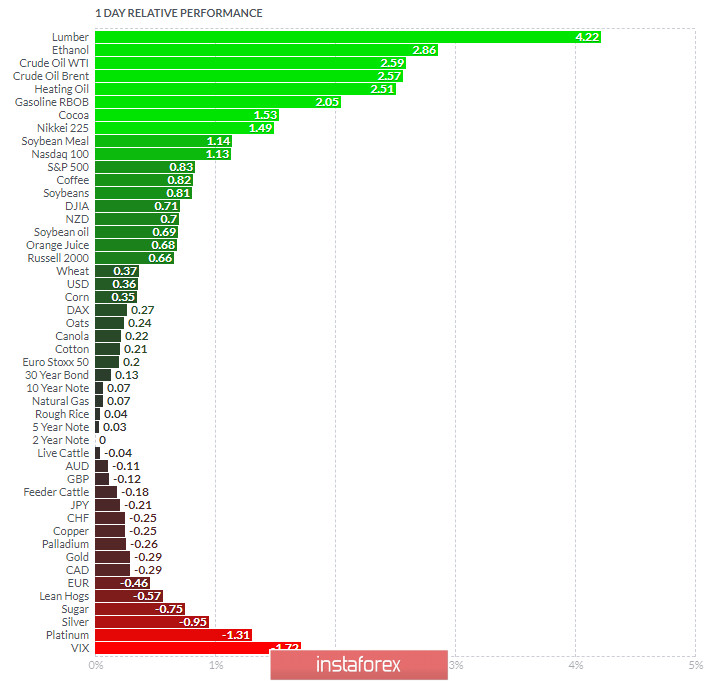

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Lumber and Ethanol today and on the bottom VIX and Platinum.

Key Levels:

Resistance: $1,887

Support levels: $1,851 and $1,817