To open long positions on EURUSD, you need:

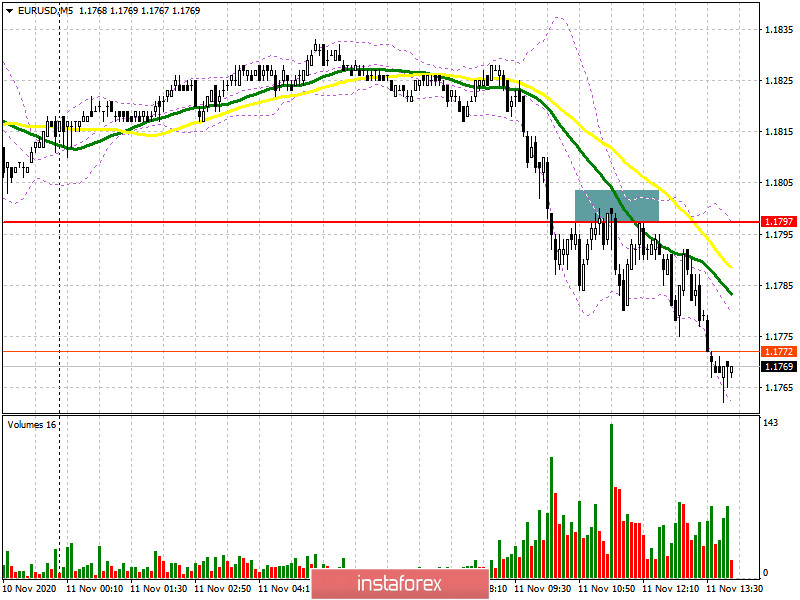

The absence of important fundamental statistics played into the hands of the sellers of the European currency, which albeit for the third time, coped with the level of 1.1797, which I paid attention to in the morning and where I recommended selling the euro. If you look at the 5-minute chart, you will see how the breakout and consolidation below the support of 1.1797 led to the formation of a sell signal for the European currency. A test of this level from the bottom up clearly confirmed the presence of those who want to sell the euro further, which led to a new wave of decline in the pair, which is now aimed at a minimum of 1.1743.

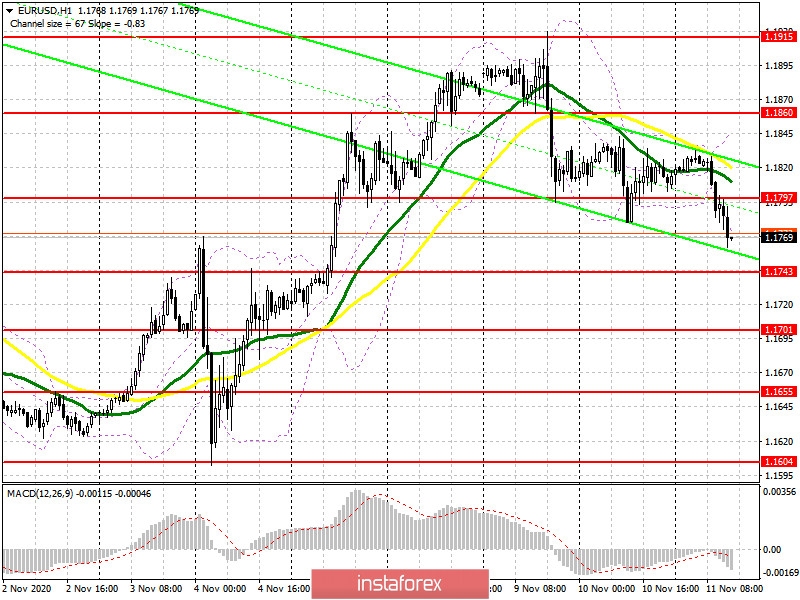

In the second half of the day, buyers are likely to focus on protecting the support of 1.1743. However, it is only possible to open long positions on the first test based on a correction of 15-20 points within the day. A larger reversal in favor of buyers will occur if they manage to form a false breakout at 1.1743. In the scenario of a lack of activity on the part of the bulls, I recommend that you postpone long positions until the test of the minimum of 1.1701. Given that the release of important fundamental statistics is not scheduled for the second half of the day, the pressure on the euro is likely to remain. An equally important task for the bulls will be to return to the level of 1.1797. Only a confident top-down test of this area forms a convenient entry point into long positions, counting on the resumption of euro growth and a return to major resistance. The longer-term goal will be a maximum of 1.1915, where I recommend fixing the profits. A test of this range will also indicate a resumption of the bull market.

To open short positions on EURUSD, you need to:

The initial task of sellers is to protect the resistance of 1.1797, which they managed to win today on the third attempt during the European session. As long as trading is below this range, you can expect the downward trend to continue. The nearest target of the bears in this case will be at least 1.1743. A test of this level will indicate the actual formation of a new bear market for EUR/USD. However, only a break in this area will increase the pressure on the pair and quickly push it to a minimum of 1.1701, where I recommend fixing the profits. If the bulls are stronger and manage to regain the area of 1.1797 in the second half of the day, then it is best to exit the morning sales and postpone new short positions until the resistance of 1.1860 is updated. I recommend selling EUR/USD immediately for a rebound from the maximum of 1.1915, based on a correction of 15-20 points within the day.

Let me remind you that the COT report (Commitment of Traders) for November 3 recorded a reduction in long positions and an increase in short positions. But despite this, buyers of risky assets believe in the continuation of the bull market, although they prefer to act cautiously. Thus, long non-profit positions decreased from 217,443 to 208,237, while short non-profit positions rose to 67,888 from 61,888. The total non-commercial net position fell to 140,349 from 155,555 a week earlier. It is worth noting that bullish sentiment on the euro in the medium term remains quite high, especially after the victory of Joe Biden, who intends to give the American economy the next largest monetary aid package in the amount of more than 2 trillion US dollars.

Signals of indicators:

Moving averages

Trading is below 30 and 50 daily moving averages, which indicates a further decline in the euro.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

If the pair grows in the second half of the day, the upper limit of the indicator in the area of 1.1845 will act as a resistance.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.