After the data on inflation in the US came out, it became clear that the Fed, with a 100% guarantee, will go to another increase in interest rates at the end of this year.

According to the report of the US Department of Labor, consumer prices in the US for the month of November 2017 increased. The increase was due to higher energy prices. As for core inflation, there were some signs of weakening there.

Thus, the consumer price index in November rose by 0.4% compared to the previous month while energy prices increased by 3.9%.

The basic CPI index, which does not take into account volatile prices, grew by only 0.1%. Economists had expected the growth of the overall CPI index by 0.4% and the base CPI by 0.2%. Compared to the same period in 2016, consumer prices rose by 2.2% while the base consumer price index increased by 1.7%.

The US tax reform remains under close attention of investors and traders. Yesterday, it became known that an agreement was reached on the final version of the tax bill in the US but its details will be published by the end of this week and voting will take place next week.

As it became known under the new agreement, it was decided that the maximum tax rate for private individuals will be reduced to 37% from the current 39.6%, whereas it was decided to reduce the tax for companies to 21% from the current 35%.

US President Donald Trump also supported this initiative.

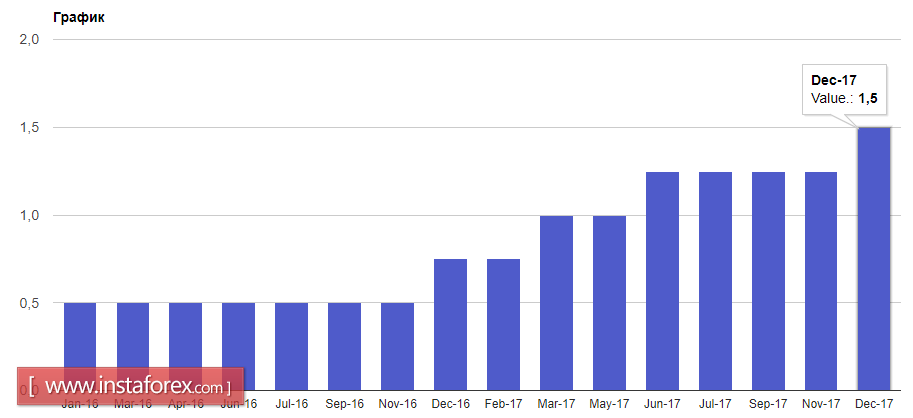

The key event of yesterday was the decision of the Federal Reserve to set a range of interest rates for federal funds between 1.25% and 1.50%. The Fed also raised the discount rate by 0.25 percentage points up to 2.00%. This decision by the committee on operations in the open market had the number of votes at 7 vs. 2.

The Fed said it expects further interest rate increases in 2018 as economic activity grows at a strong pace and the labor market is showing very good performance.

The Fed predicts that the key interest rate will average 2.1% at the end of 2018 and 2.7% at the end of 2019. By 2020, the key interest rate will reach the level of 3.1%.

As for the forecast of GDP growth, according to the experts of the FRS, short-term risks appear to be fairly balanced as the consequences of hurricanes did not lead to significant changes in the economic prospects of the United States.

The upward dynamics of the European currency may continue today. A breakthrough at the level of 1.1840 will lead to new highs in the EURUSD pair with a test at 1.1870 and 1.1900.