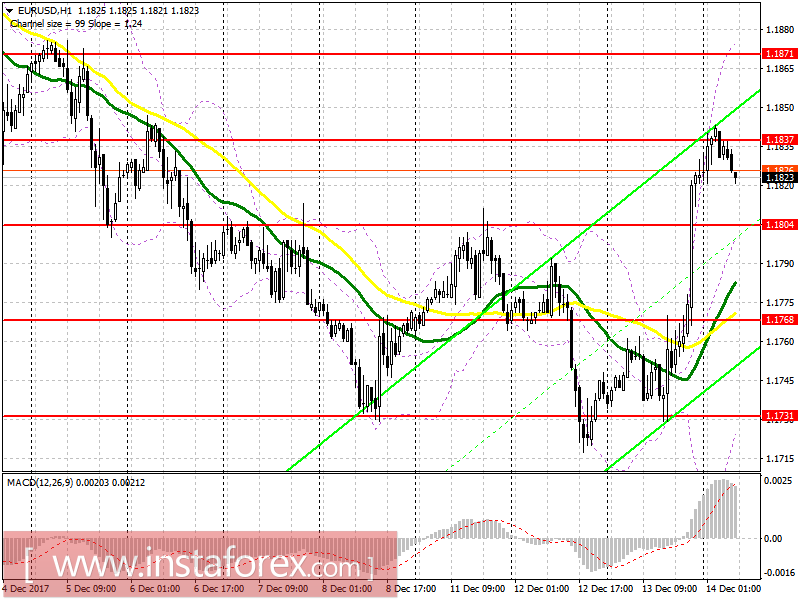

EUR / USD

To open long positions on EURUSD, it is required:

The euro was expected to rise after the decision of the Fed. A break with a consolidation above 1.1837 will allow us to continue the upward trend, which will lead to the renewal of new resistance levels at 1.1871 and 1.1900, where it is recommended to lock in profits. Buying can also be considered in case of a false breakdown at 1.1804 or immediately on a rebound from 1.1768.

To open short positions on EURUSD, it is required:

The unsuccessful consolidation and return to the level of 1.1837 could put pressure on buyers, which will lead to a downward correction of EUR / USD in the support area. A breakthrough on this level will provoke a sellout of the euro with an update of 1.1768, where it is recommended to lock in profits. In case of continued growth, short positions can be opened in the range of 1.1871 with a false breakdown here or at a rebound from 1.1900.

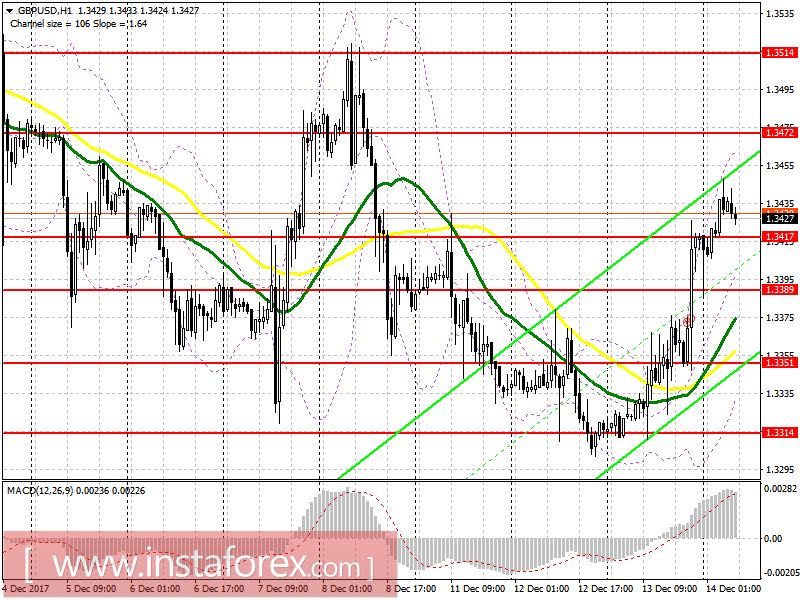

GBP / USD

To open long positions on GBPUSD, it is required:

While trading is higher than 1.3417, there is a possibility for the continuation of the upward trend for the pound with the update at the level of 1.3472 and a new high of 1.3514, where it is recommended to lock in profits. In case of a decline under 1.3417, it is recommended that you go back to buying after updating to 1.3389 or on a rebound from 1.3351.

To open short positions on GBPUSD, it is required:

Opening short positions on the pound is best after the update at the level of 1.3472 with the formation of a false breakdown there or on a rebound from 1.3514. If the support level of 1.3417 is lowered, the pressure on the GBP / USD pair may also increase, which will lead to an update to 1.3389 and a very likely exit to 1.3351, where it is recommended to lock in profits.

Indicator description

MA (moving average) 50 days - yellow

MA (moving average) 30 days - green

MACD: fast EMA 12, slow EMA 26, SMA 9

Bollinger Bands 20