GBP / JPY pair

The strength of the supports did not allow players to lower in confirmation of the daytime breakdown of the most important level at 150.16 (day Kijun + week Tenkan). Nevertheless, the main task for players on the decline remains the same - overcoming the encountered support zone (150.16 - 149.24). The resistance is now the levels of the day cross Fibo Kijun (150.92) and Tenkan (151.38).

The support levels (150.16 - 149.78 - 149.40-24) and resistance (150.93 - 151.38 - 151.98) have retained their position today, as a result of which the balance of forces practically did not change since the previous analysis. Overcoming the supports will open the way for the continuation of the reduction and fulfillment of the target at the breakdown of the H4 cloud. Reliable consolidation above the supports can change the existing balance of forces and will require a new assessment of the situation.

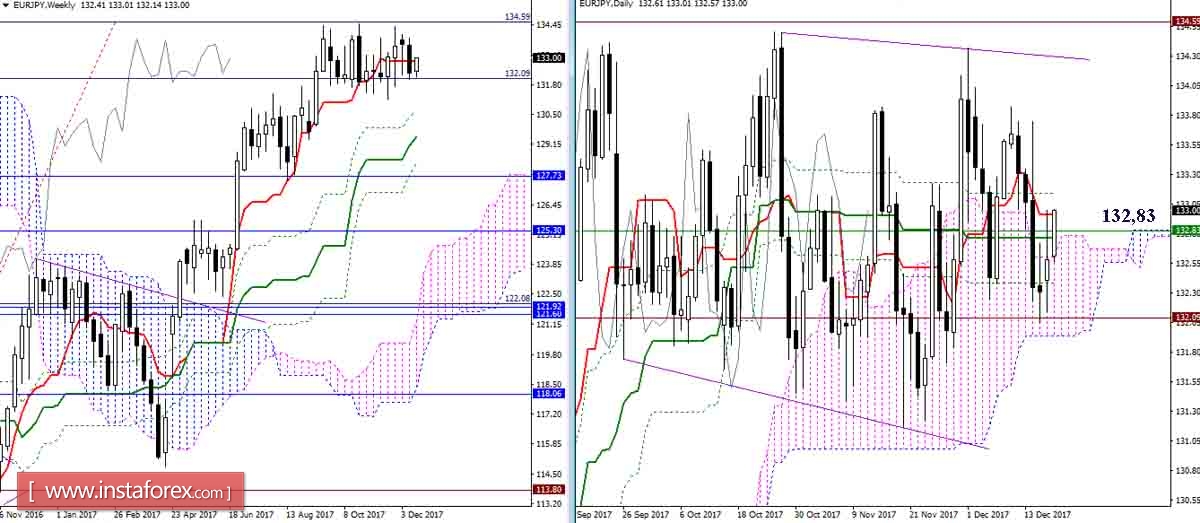

EUR / JPY pair

Interaction in the key levels of this area (day cross 132.76-96 + weekly Tenkan 132.83) continues. The pair is working in the zone of a long weekly consolidation and the initiative at the beginning of this week so far belongs to the players on the rise, despite the bearish mood of the last week's candle and the closing of the week under the center of attraction.

Overcoming the resistance zone (133,14-31) will change the existing balance of forces and create new prospects for recovery with upward goals for the breakdown of clouds of lower dimes. But, if the bears will be able to complete the climb, their key reference point will not be changed with testing for the strength of the lower boundary of the daytime cloud (131.94) and target testing for H4 cloud breakdown (131.97-70).

Indicator parameters:

all time intervals 9 - 26 - 52

Color of indicator lines:

Tenkan (short-term trend) - red,

Kijun (medium-term trend) - green,

Fibo Kijun is a green dotted line,

Chikou is gray,

clouds: Senkou Span B (SSB, long-term trend) - blue,

Senkou Span A (SSA) - pink.

Color of additional lines:

support and resistance MN - blue, W1 - green, D1 - red, H4 - pink, H1 - gray,

horizontal levels (not Ichimoku) - brown,

trend lines - purple.